Paper Boat Creative

While ChatGPT’s introduction in late 2022 kicked off an investment trend in artificial intelligence, more than half of S&P 500 (SP500) companies did not mention the technology in recent earnings calls, suggesting there’s room for AI growth in Corporate America and on Wall Street, according to DataTrek.

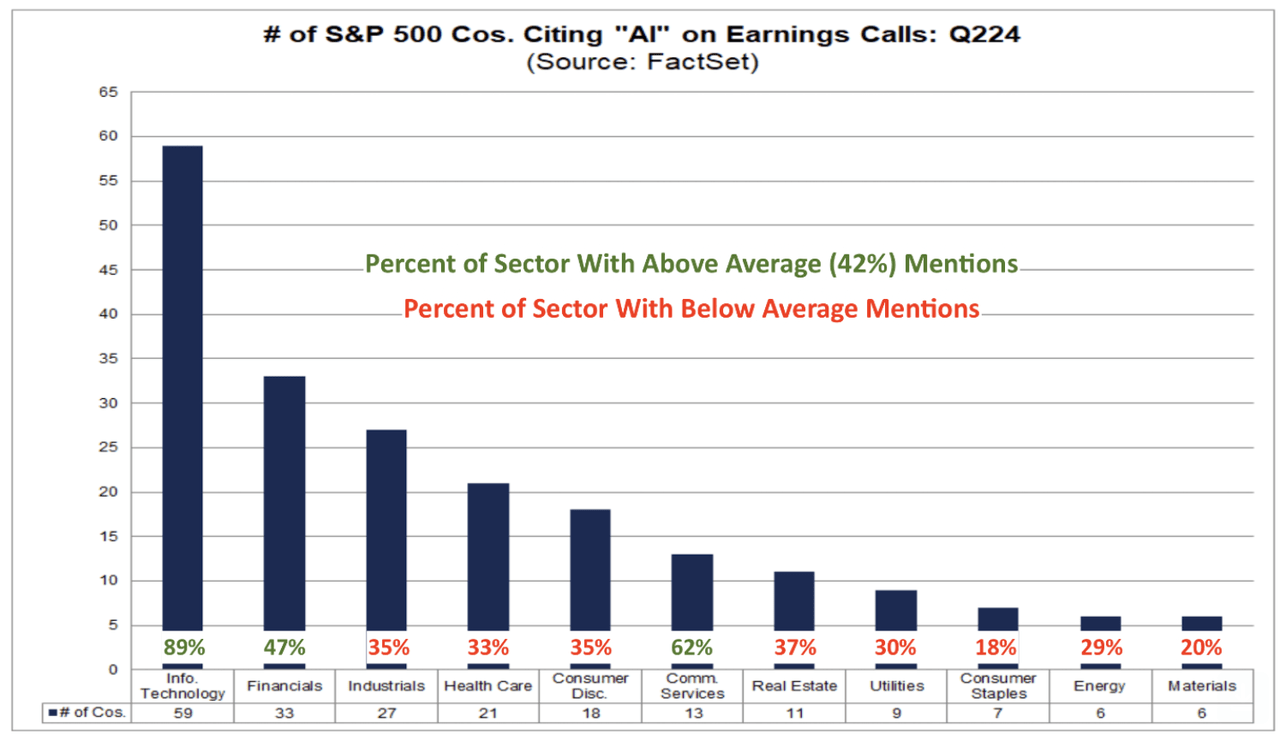

There was no mention of the term “AI” on Q2 earnings calls held by 58% of S&P 500 (SP500) companies, the financial research firm said in a note, citing FactSet data.

“One can view this either positively or negatively in terms of adoption rates. On the plus side, we still have more than half the S&P 500 to go, a very rich opportunity for AI system providers,” Nicholas Colas and Jessica Rabe, DataTrek’s co-founders, said in a Sunday note. “On the downside, it calls into question the relevance of this hot new technology.”

The Information Technology, Communications Services and Financials are the only three S&P 500 (SP500) “truly engaging” with AI, with those groups mentioning the technology on their Q2 calls above the 42% average.

Information Tech lead with 89% of companies discussing AI, followed by Communication Services at 62%, with that group including mega-cap tech companies Meta (META), Alphabet (GOOG, GOOGL), and cell/Internet providers. Financials stood at third, with 47% of companies engaging in AI talk.

“We think this data reflects good news for the AI story because, as much hype as this topic has received, it is still not top of mind for many of America’s largest companies,” DataTrek said. “Moreover, there is plenty of room for growth in non-Tech S&P sectors that should be able to leverage this technology once providers have built the right tools.”

Meta (META), Google (GOOG)(GOOGL), along with Nvidia (NVDA) and the rest of the Magnificent 7 group of mega-tech companies drove nearly 30% of the S&P 500’s (SP500) weight last year.