JHVEPhoto/iStock Editorial via Getty Images

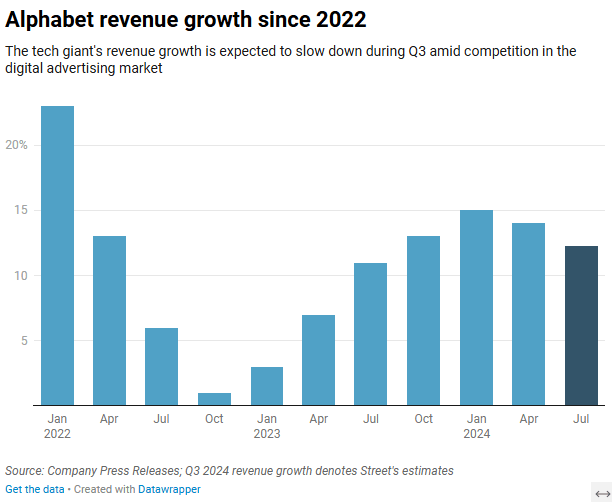

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) is expected to post a slow revenue growth for the third quarter on Tuesday, as the tech giant is pressured by regulatory scrutiny and intense competition in its core advertising business.

Wall Street expects the California-based company to post EPS of $1.85, while revenue is expected to rise 12.3% at $86.22 billion during the quarter.

The Google parent, which faces competition from rivals including TikTok and Amazon when it comes to advertising budget, suffered a pushback from investors due to light revenue at YouTube and the company flagging higher expenses for the year. Alphabet’s stock fell 4% since its second quarter results in July.

Wedbush analyst Scott Devitt expects Google Search growth of +11.5% Y/Y in the third quarter (in line with the Street estimates) and YouTube Ads growth of +11.5% Y/Y, slightly below consensus of +11.9%.

“We see some near-term risk to YouTube performance given Netflix recently reduced prices and Amazon plans to ramp ad load for Prime Video in 2025, however the platform’s vast reach and reasonable price, coupled with the expectation that most incremental CTV budgets should come from linear TV, helps limit the downside risk in our view,” said Canaccord Genuity analyst Maria Ripps.

Investors will also watch out for updates on the AI product roadmap, cost reduction initiatives and clues as to how Alphabet may deal with potentially being broken up after reports that the Justice Dept. was considering a push to break up the tech behemoth following the agency’s antitrust case victory.

“We note legal costs are going to be significant in 2H24 given the company’s multiple ongoing trials, which we believe are significant enough to weigh on overall profitability,” pointed out JMP analyst Andrew Boone.

This is Alphabet’s first results after Anat Ashkenazi took over as the company’s new chief financial officer in June.

Over the last three months, EPS estimates have seen seven upward revisions, compared to three downward revisions, while revenue estimates have been revised upward 11 times versus three downward moves.

Seeking Alpha analysts, Wall Street and Seeking Alpha’s Quant ratings are all bullish and consider the stock a Buy and above.

Alphabet has gained over 19% so far this year, lagging the near 22% rise in the broader S&P500 Index.