Michael Vi/iStock Editorial via Getty Images

Rising prices and an uncertain economic situation have increasingly forced consumers to turn to credit cards to make ends meet. At the same time, the interest rates for these purchases have soared to new highs.

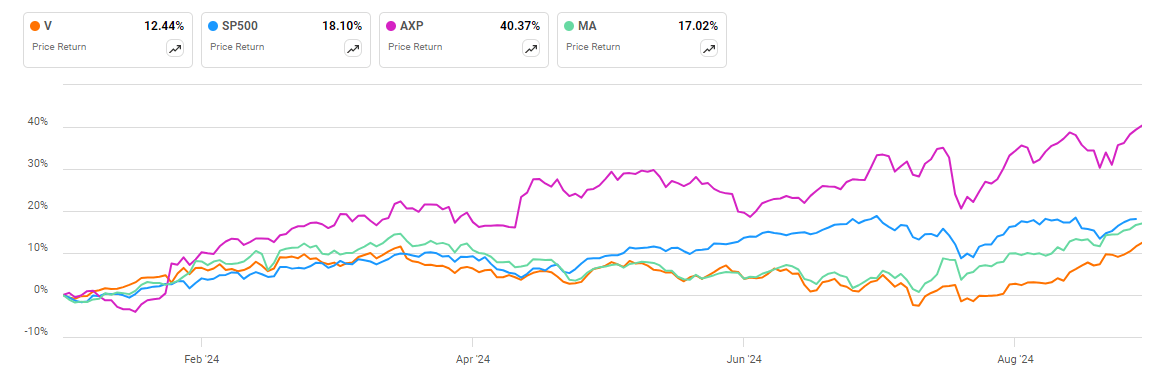

As a result of these macro factors, many of the industry’s biggest players have drawn significant attention from investors. This has been a boon for shares of credit card giants American Express (NYSE:AXP), Visa (NYSE:V) and Mastercard (NYSE:MA), which have drifted higher through 2024 and have set new 52-week highs.

The upward momentum has come as consumers become even more reliant on credit cards. A study issued by the Federal Reserve Bank of New York showed that credit card debt jumped to $1.14T in Q2, or about $6,500 per person. This was up 10.8% from last year.

Meanwhile, the cost of carrying credit card debt has jumped dramatically. Data provided by Bankrate showed that the average retail credit card currently has a record APR of 30.45%. That compares to a level of 28.93% in 2023 and a mark of 24.35% just three years ago.

The favorable macro environment has carried over into stock prices for the major credit card firms. During Tuesday’s trading, MA, AXP and V all set fresh 52-week highs.

Each of the stocks has posted a double-digit advance so far in 2024, although MA and V have trailed the S&P 500 so far this year, due to a slump during much of the middle of the year. AXP is the standout in the group, climbing consistently through the year and now posting a gain of more than 40% since the close of 2023.

Looking at AXP as representative of the group, opinions on the stock have become split. A survey of analysts published on Seeking Alpha shows an average Buy rating, although the Wall Street community as a whole gives the stock a Hold consensus.

Drilling down on the bullish perspective, Noah’s Arc Capital Management still sees more room to run for AXP, even with the strong performance so far this year.

“American Express has uniquely segmented the consumer credit-card market by focusing on higher-income consumers, who are less susceptible to economic downturns to power their business,” the firm explained.

Noah’s Arc Capital added: “While the luxury-card company’s shares have run up a bunch since this time last year, I really do believe that there is more upside to go as the market realizes that American Express has the right business model at the right time to address the right part of consumer market.”

Meanwhile, Daniel Urbina has a more cautious view. The Seeking Alpha analyst praised the firm’s “consistent revenue growth across segments” but argued that the stock is fairly valued and that growth rates are normalizing.

“I find this stock an attractive income play for patient investors due to its track record of incrementing its dividend (ex-COVID) at appealing levels,” Urbina said, but warned that the stock sits “fairly valued based on several valuation methods” and “I can’t find a clear catalyst for the stock to outperform the market going forward.”

More on credit card companies

- Visa Is Going To Lose Its Momentum Soon (Technical Analysis)

- Visa: Familiarize Yourself With The Three-Pillar Growth Trajectory

- Visa Inc. (V) Presents at Goldman Sachs Communacopia + Technology Conference (Transcript)

- American Express consumer credit card charge-off rate ticks up in August

- Mastercard to buy Recorded Future for $2.65B