cemagraphics

The Industrial Select Sector SPDR Fund ETF (XLI) rose +2.16% for the week ended Aug. 16, while the SPDR S&P 500 Trust ETF (SPY) surged +4%.

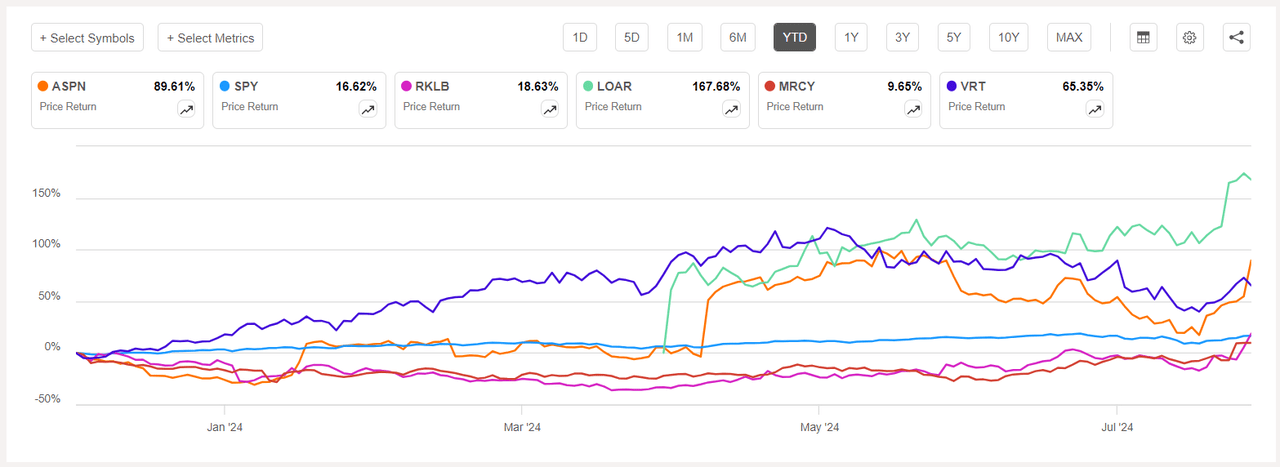

Aspen Aerogels (NYSE:ASPN) was the top industrial gainer (in the segment), while Hillenbrand (NYSE:HI) saw its stock decline following a rating downgrade. All the 11 S&P 500 sectors ended the week in the green. Year-to-date, or YTD, XLI has climbed +11.39%, while SPY has soared +16.62%.

The top five gainers in the industrial sector (stocks with a market cap of over $2B) all gained more than +11% each this week. YTD, all 5 of these stocks are in the green.

Aspen Aerogels (ASPN) +36.93%. The aerogel insulation products maker’s stock has been on a gaining streak since Aug. 8 (following its earnings post market on Aug. 7). This week the stock surged the most on Friday +22.57%. YTD, +89.61%.

ASPN has a SA Quant Rating — which takes into account factors such as Momentum, Profitability, and Valuation among others — of Hold. The stock has a factor grade of D- for Profitability and B for Growth. The average Wall Street Analysts’ Rating differs and has a Strong Buy rating, wherein 7 out of 11 analysts tag the stock as such.

Rocket Lab USA (RKLB) +22.16%. The shares soared +12.52% on Friday after the space company announced that it has successfully packed and shipped two Mars-bound spacecraft to Cape Canaveral, Florida in preparation for launch. The stock had also surged on Thursday (+12.55%). YTD, +18.63%.

The SA Quant Rating on RKLB is Hold, with a score of B- for Valuation and B+ for Momentum. The average Wall Street Analysts’ Rating is more positive, with a Buy rating, wherein 7 out of 12 analysts see the stock as Strong Buy.

The chart below shows YTD price-return performance of the top five gainers and SPY:

Loar (LOAR) +21.97%. The company — which makes components for aircraft, and aerospace and defense systems — saw its stock surge +18.91% on Tuesday after its second quarter results wherein it revised its outlook upwards for 2024. YTD, +53.59%. The average Wall Street Analysts’ Rating on LOAR is Buy.

Mercury Systems (MRCY) +12.64%. The defense and aerospace product maker’s stock jumped +17.65% on Wednesday after fiscal fourth quarter results (post market Tuesday) beat estimates. YTD, +9.65%. The SA Quant Rating on MRCY is Buy, which is in contrast to the average Wall Street Analysts’ Rating of Hold.

Vertiv (VRT) +11.14%. The Westerville, Ohio-based company — which makes products for data centers and communication networks — saw its stock rise the most on Wednesday (+5.14%) this week. YTD, +65.35%. The SA Quant Rating on VRT is Hold, which differs from the average Wall Street Analysts’ Rating of Strong Buy.

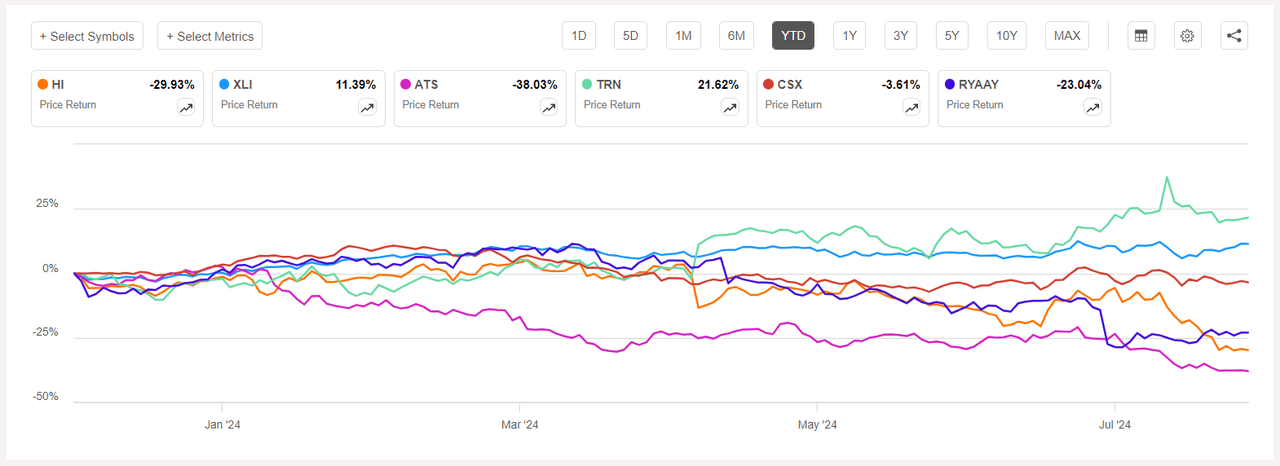

This week’s top five decliners among industrial stocks (market cap of over $2B) all lost more than -1% each. YTD, 4 out of these 5 stocks are in the red.

Hillenbrand (HI) -6.84%. The material handling equipment and systems maker’s stock fell -6.64% on Monday, its lowest in nearly four years, after D.A. Davidson downgraded the shares to Neutral from Buy and cut the price target to $33 from $54. YTD, -29.93%.

The SA Quant Rating on HI is Sell, with a factor grade of D for Growth and C- for Profitability. The average Wall Street Analysts’ Rating disagrees and has a Buy rating, wherein 3 out of 5 analysts view the stock as Strong Buy.

ATS (ATS) -2.16%. The automation solution provider’s stock has dipped -7.95% YTD. The SA Quant Rating on ATS is Sell, with a score of D- for Momentum and C+ for Valuation. The average Wall Street Analysts’ Rating differs and has a Buy rating, wherein 5 out of 8 analysts tag the stock as such.

The chart below shows YTD price-return performance of the worst five decliners of the week and XLI:

Trinity Industries (TRN) -1.73%. Trinity, which provides rail transportation products and services, saw its stock dip the most on Monday (-3.25%). YTD, the stock is the only one among this week’s decliners which is the green for this period, +21.62%. The SA Quant Rating on TRN is Strong Buy, while the average Wall Street Analysts’ Rating is Buy.

CSX (CSX) -1.71%. Shares of the Jacksonville, Fla.-based rail-based freight transportation provider has fallen -3.61% YTD. The SA Quant Rating on CSX is Hold, while the average Wall Street Analysts’ Rating is Buy.

Ryanair (RYAAY) -1.41%. The Irish airline’s stock has declined -23.04%, YTD. The SA Quant Rating on RYAAY is Hold, which is in contrast to the average Wall Street Analysts’ Rating of Strong Buy.