Bets against Utilities Select Sector SPDR Fund ETF (XLU) increased in November compared to the end of October, with Alliant Energy (LNT) being the most shorted stock in the sector and Eversource Energy (ES) taking the spot for the least shorted.

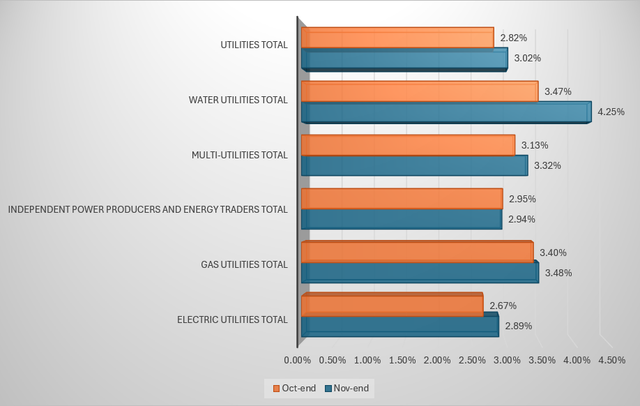

Average short interest across S&P 500 utilities stocks was 3.02% of shares float at the end of November, up from 2.82% at the end of October.

The S&P 500’s Utilities Select Sector SPDR Fund ETF (XLU) was nearly 13.6% so far this year, compared to the broader S&P500 market’s gain of over 17% during the same period.

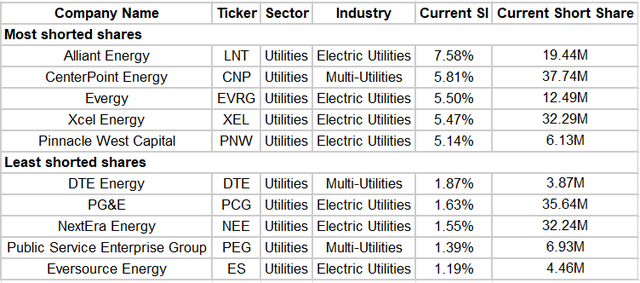

Stocks with the least and largest short positions

Average short interest as a percentage of floating shares

Seeking Alpha

Alliant Energy (LNT) had 19.44 million shares sold short as of November, or 7.58% of shares float.

CenterPoint Energy (CNP) was the second-most shorted stock with short interest of 5.81%, followed by Evergy (EVRG) with 5.50%, Xcel Energy (XEL) with 5.47%, and Pinnacle West Capital (PNW) with 5.14%.

Eversource Energy (ES) was the least shorted stock, with 4.46 million shares sold short as of November, or 1.19% of shares float.

Public Service Enterprise Group (PEG) was the second-least shorted stock, with short interest of 1.39%, followed by NextEra Energy (NEE) with 1.55%, PG&E (PCG) with 1.63% and DTE Energy (DTE) with 1.87%.

Industry analysis

Average short interest as a percentage of floating shares

Seeking Alpha

Water Utilities was the most shorted industry within the sector, with 4.25% short interest as of November end, which increased from 3.47% a month ago.

Gas Utilities stood at the second spot with 3.48% short interest as of the end of November, up from 3.40% at the end of October.

Multi utilities stocks took the third spot with 3.32% short interest as of November end, compared to 3.13% at the end of October.

Independent Power & Renewable Electricity Producers stood at the fourth spot with 2.94% short interest as of the end of November, marginally down from 2.95% at the end of October.

Bets against the Electric Utilities sector as a whole have increased to 2.89% at the end of November, compared to 2.67% a month ago.