Wirestock/iStock Editorial via Getty Images

Wall Street analysts who cover Boeing (NYSE:BA) reacted positively to new Chief Executive Kelly Ortberg’s plan to improve product quality and restore the reputation of the aviation giant, though they acknowledged that the ongoing strike is a major roadblock.

Shares of Boeing (BA) fell as much as 3.2% on Thursday, a day after Ortberg made his first public remarks as CEO during the company’s third-quarter earnings call. Later in the day, factory workers in the Pacific Northwest rejected Boeing’s (BA) latest pay offer and went on with the strike.

Analyst are most concerned about Boeing’s (BA) cash burn as operations remain at a standstill, and whether the company’s credit rating will be downgraded to junk status. Another key question is how much further Boeing’s (BA) stock could fall and bottom out.

“The earnings call was valuable as an opportunity to hear priorities from new CEO Kelly Ortberg, but machinists will need to return to work for him to begin pursuing many of those priorities in earnest,” Seth Seifman, analyst at financial-services firm J.P. Morgan, said in an October 24 report.

Boeing (BA) reported a loss of $6.17 billion for the third quarter, and said it was likely to burn cash through the next three quarters before turning cash-flow-positive in the second half of 2025.

“On the financials, investors were surprised to hear Boeing’s (BA) forecast that it expects to burn cash next year, but the continuing strike is a reason for caution around the outlook, which already encompassed a wide range of outcomes,” Seifman said.

The variables include Boeing’s (BA) desire to maintain $10 billion of cash on its balance sheet, how much cash the company will burn through the end of next year and the need to roll over maturing debt, Seifman said. These uses of cash total about $20 billion, a level Boeing (BA) management was said to be considering, Reuters reported last week.

Labor deal close?

Analysts were optimistic that union members and Boeing (BA) are getting closer to a deal, based on how membership has voted on the offers. The first labor agreement six weeks ago was rejected by 95% of union members, while the second one this week was rejected by 64%.

A key point of contention is restoring Boeing’s (BA) defined-benefit pension plan, or compensating workers in another way.

Plane output

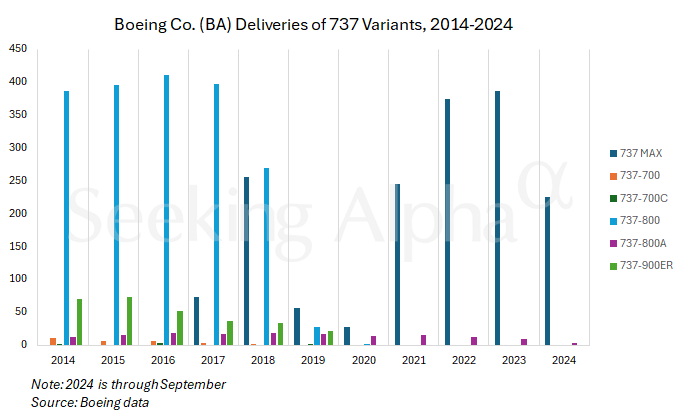

The 33,000 striking machinists work on the company’s best-selling plane, the 737 Max, which is critical to Boeing’s (BA) cash flow. The company has a backlog of 4,151 orders for the narrowbody plane. The backlog will take years to clear even if Boeing (BA) can boost deliveries of the plane to 50 a month, which had been a goal amid efforts to recover from the pandemic.

“The most important next step for Boeing (BA), for the near-term and long-term health of both the company and its suppliers, is reaching a conclusion on the strike and beginning to ramp up Max production,” Gavin Parsons, analyst at UBS, said in an October 24 report. “An improved offer could bridge that gap and signal the beginning of steady improvement in cash flow generation, rather than the current uncertainty around the magnitude of near-term cash burn.”

Even if Boeing (BA) can get workers back on the assembly line, the company is confronting regulatory scrutiny after a door plug on a 737 Max flown by Alaska Airlines blew out from the fuselage, or its main body. The Federal Aviation Administration capped output of the 737 Max at 28 a month until it satisfied that Boeing (BA) has taken steps to improve quality and safety.

“Boeing’s (BA) safety enhancements and its ability to continue to monitor and track important safety KPIs will be inherent to having the 737 Max production cap removed by the FAA,” Kristine Liwag, analyst at Morgan Stanley, said in an October 24 report. “From our understanding, the KPIs include: employee proficiency, notice of escapement rework hours, total rework hours, supplier shortages, traveled work, and airplane ticketing performance. Boeing’s target is to ensure all six stabilize in its so-called ‘green’ ranges, signifying acceptable levels of risk.”

Liwag said Boeing (BA) faces challenges in boosting plane output and stabilizing cash flow.

Morgan Stanley typically presents three scenarios for stocks – a bull case, base case and bear case. The bull case for Boeing (BA) is ramping up plane output through 2027 and hitting a price of $245 a share, while the bear case foresees delays in the FAA approval of two new variants of the 737 Max – the shorter 737 Max 7 and longer 737 Max 10 – and a price of $110 a share.

The base case has a price target of $170 a share, based on an estimated multiple of 18 times free cash flow per share for 2027, discounted back to 2026.

“We have seen many fits and starts, but execution will need to improve for a sustainable path to increased aircraft production rates of 50 a month for the 737 Max and 10 a month for the 787, which the company previously acknowledged as underpinning its potential annual FCF generation of $10 billion,” she said. “That said, the climb to produce 737 Max aircraft at a rate of 50 a month remains steep.”