Airbus (EADSF) (EADSY) Chief Executive Guillaume Faury acknowledged on Wednesday that the European planemaker may lose the annual aircraft order contest to Boeing (BA) for the first time in six years, citing a boost to the U.S. rival from settlements tied to American tariff disputes.

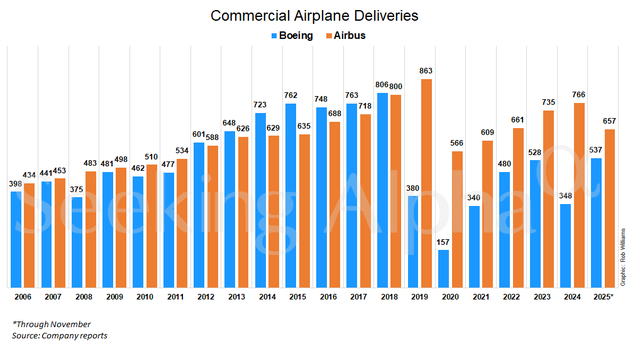

Speaking to France Inter radio, Faury said Airbus (EADSF) (EADSY) continues to lead Boeing (BA) in aircraft deliveries and in its overall backlog of unfilled orders, even as the balance of new bookings appears to be shifting.

Boeing (BA) has been lifted by strong interest in its 787 long-haul jet and reported 908 net orders between January and November after cancellations, compared with 700 for Airbus (EADSF) (EADSY) over the same period.

“The fact that we have been ahead on orders for five years means our order backlog is much higher than that of our main competitor,” Faury said. “But it is true that they have been helped by the American president as part of tariff negotiations with several countries, where plane orders became part of the resolution of trade disputes.”

Analysts say some airlines either placed Boeing (BA) orders or adjusted the timing of previously planned announcements this year to ease trade tensions with Washington, particularly in Asia, Reuters reported. U.S. aerospace officials, however, argue that the 787 is performing well on its own merits, independent of trade considerations. Airbus (EADSF) (EADSY), meanwhile, continues to dominate the narrow-body segment, led by its A321 model.

Although Airbus (EADSF) (EADSY) orders have trailed in recent months, Faury’s remarks suggest a likely change in the annual order rankings even as Airbus (EADSF) (EADSY) is expected to maintain its position as the world’s largest aircraft maker based on deliveries.

Asked about reports of a potential major order from China, Faury said he didn’t anticipate a near-term commitment for hundreds of new aircraft, instead pointing to regulatory approvals linked to older deals. Airbus (EADSF) (EADSY) said on Wednesday that it received clearance from Chinese authorities to proceed with deliveries of 120 aircraft previously ordered.

Industry sources have said Airbus (EADSF) (EADSY) had been counting on a possible order of up to 500 jets from China to meet internal targets, while Beijing is also in talks with Boeing (BA) on a similarly sized package. With China navigating strained trade relations with both the United States and Europe, Western analysts expect the country to maintain a balanced mix of aircraft imports as it ramps up fleet growth following several subdued years.

Faury also said Airbus (EADSF) (EADSY) has completed a major software recall affecting A320-family aircraft, including the A321. While as many as 6,000 jets were initially thought to be impacted, the final total was closer to 4,000 and all required fixes have now been carried out, he told France Inter.

Commercial airplane deliveries through November. (Company reports)