Michael M. Santiago/Getty Images News

Striking unionized workers at Boeing (NYSE:BA) will meet on Wednesday to ratify a new proposed contract that includes a 35% pay hike over four years, in a vote that could potentially end a month-long strike at the planemaker that has costed the Dow 30 component billions of dollars and has stopped production of its airplanes.

Around 33K Boeing (NYSE:BA) employees in the West Coast have been on strike since September 13, bringing the production of models such as the company’s best-selling 737 MAX to a halt.

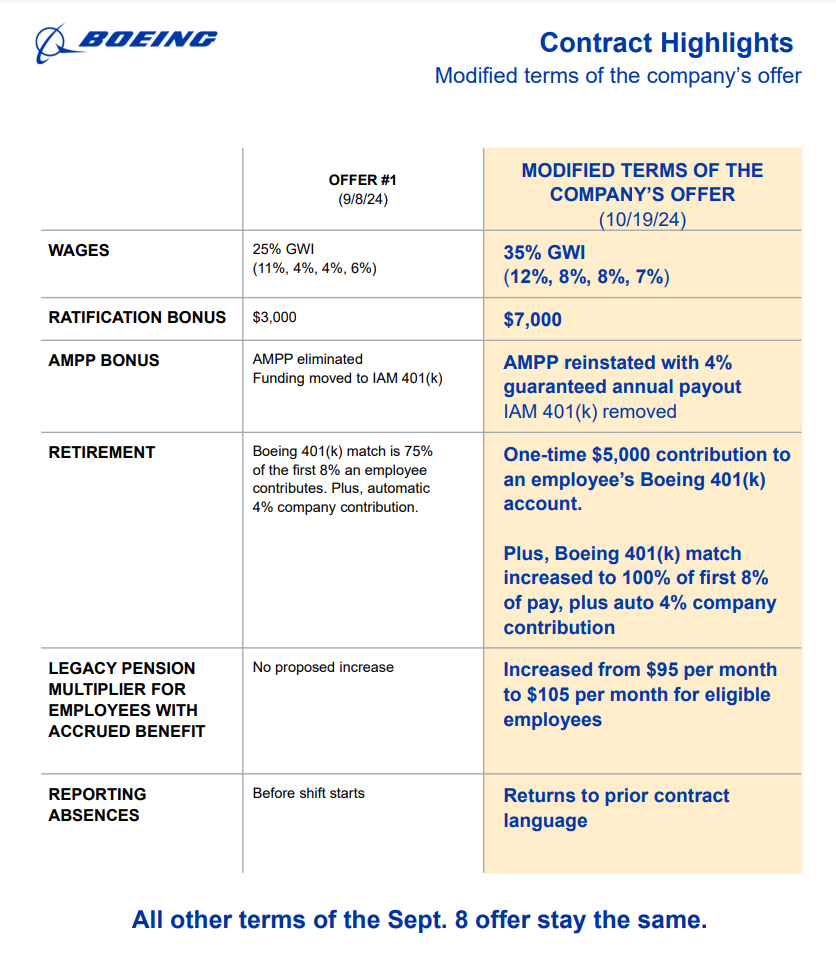

The International Association of Machinists and Aerospace Workers (IAM) on Saturday said the new contract had been obtained with the help of Acting U.S. Secretary of Labor Julie Su. Boeing (BA) said it was looking forward to its employees voting on the negotiated proposal. See the new terms below, as provided by the company:

Boeing’s new contract terms (company website)

Boeing (BA) stock has not seen much of a decline since the strike began. From September 13 to its last close, the stock is -1.13%. However, on a YTD basis, it’s a very different picture: Boeing (BA) has plunged -40.5%.

The strike came at a time when the company was mired in regulatory scrutiny over safety issues in its airplanes. The stock has been on a downward spiral since a blown door plug accident on an Alaska Airlines (AAL) flight in early January, triggering a series of events that also saw the early exit of its top boss and Senate hearings.

See below for a brief timeline of the latest strike:

- September 13: Around 33K IAM members and Boeing (BA) employees overwhelmingly vote to reject a renewed contract, sparking off the union’s first strike against the Dow 30 component since 2008.

- October 8: S&P Global Ratings puts Boeing’s (BA) ‘BBB-‘ issuer credit rating and senior unsecured debt ratings on CreditWatch with negative implications. The agency also estimates that the strike is costing the company more than $1B per month.

- October 11: Boeing (BA) files an unfair labor practice charge with the National Labor Relations Board against IAM, accusing the striking workers of “bad faith bargaining.”

- October 11: Boeing (BA) reveals plans to cut about 10% of its total workforce and delay the first delivery of its 777X jet by a year. The Arlington, Va.-based firm says it will recognize $5B in earnings charges.

- October 15: Boeing (BA) files for a mixed shelf of up to $25B, comprising senior debt securities, subordinated debt securities, common stock, preferred stock, depositary shares, stock purchase contracts, and stock purchase units.

Wall Street analysts currently rate Boeing (BA) stock a Buy, while SA Authors have a Hold recommendation. Seeking Alpha’s Quant rating on the stock is also a Hold. The system grades Boeing a C on valuation, a D on momentum, and a D- on growth and profitability.

Recent bull commentary on Boeing (BA) by Seeking Alpha contributor Curonian Research:

“Boeing’s brand strength, rooted in decades of safety and reliability, is unmatched and will help it weather current financial and operational issues.

Despite production delays and quality issues, Boeing’s competitive position and growing global air traffic ensure continued demand for its aircraft.

Boeing is trading at a significant discount, presenting a unique investment opportunity with potential for substantial upside as operational issues are resolved.”

Recent bear commentary on Boeing (BA) by Seeking Alpha contributor Envision Research:

“Based on its operating losses, CAPEX requirements, and debt obligations, I see a large chance for BA to run out of cash in the next 6-12 months.

Such cash flow and liquidity issues could trigger a credit downgrade to junk grade in the near term.

A downgrade subsequently can further increase its borrowing costs, worsen its capital allocation choices, and lead to further stock price declines.”