Userba011d64_201

The AI theme will be under further scrutiny this week with quarterly results due from tech behemoths including Microsoft (MSFT), and Bank of America says markets are shifting into assessing how investments into the growing technology are paying off.

Expected capital expenditures in AI by so-called hyperscalers such as Microsoft (MSFT), Meta Platforms (META) and Amazon (AMZN) have been upwardly revised by $18B to compared with only a $2B increase in sales forecasts since March, Bank of America said in a note. Expressing it another way, AI capex has been revised up $9 for every +$1 sales.

The AI investment cycle will likely roll on “but the AI hype days are over,” Savita Subramanian, BofA’s head of US equity and quantitative strategy, said. “[As] AI transitions from ‘tell me’ to ‘show me’, companies clearly monetizing AI are likely to lead from here,” she said. The market has been in the AI “tell me” phase over the last 12 months, she said.

Subramanian named ServiceNow (NOW) and Adobe (ADBE) as examples of companies monetizing AI, with shares of each jumping following their most-recent earnings reports.

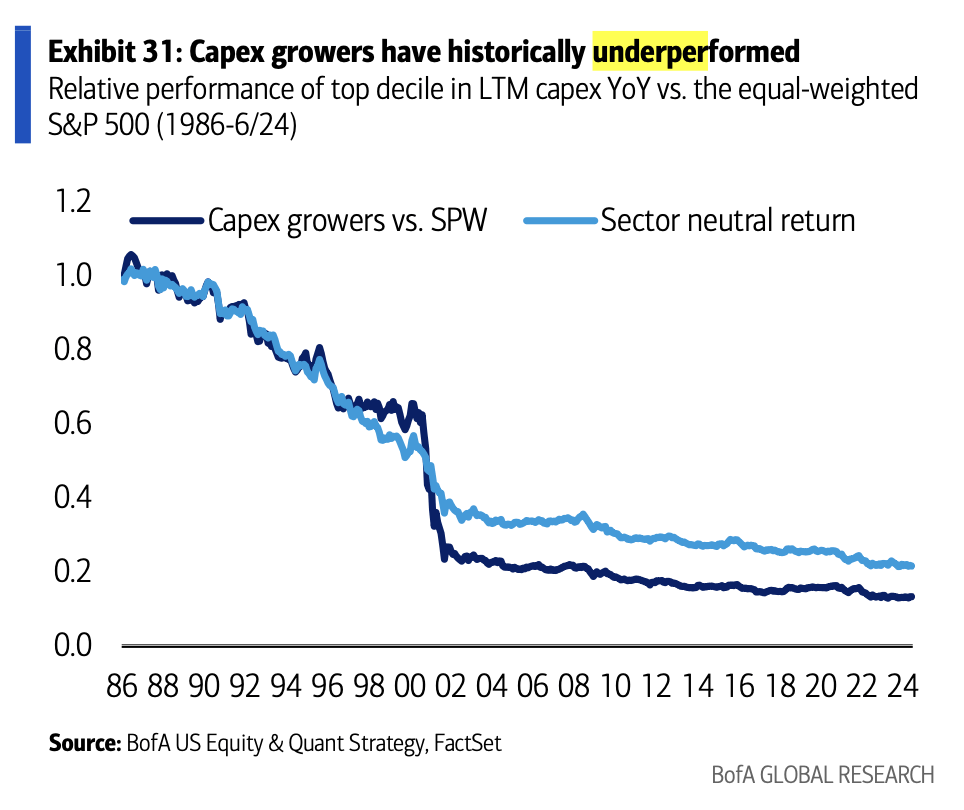

Hyperscalers Alphabet (GOOG)(GOOGL), Microsoft (MSFT), Meta Platforms (META) and Amazon (AMZN) are expected to account for most of the S&P 500’s (SP500)(SPY) capex growth in 2024, at $198B. Subramanian said historically, companies that are in reinvestment cycles underperform, sharing this chart:

Quarterly results are due this week from Microsoft (MSFT), Meta Platforms (META) and Amazon (AMZN). AI chipmaker Nvidia (NVDA) is slated to release its next report in late August.