ArtistGNDphotography

Investors should consider getting exposure to the equal-weighted S&P 500 Index and setting aside mega-cap technology names and small- and medium-capitalization stocks, Bank of America (BofA) says.

Improving fundamentals are key to why investors looking to diversify beyond mega-caps (SP500)(NYSEARCA:SPY) should think about the equal-weighted S&P 500 Index, Savita Subramanian, BofA’s head of U.S. equity and quantitative strategy, said in a research note Wednesday.

Profit growth is one reason. The S&P 500 (SP500) excluding the Magnificent 7 group of mega-cap stocks — Amazon (AMZN), Alphabet (GOOG)(GOOGL), Apple (AAPL), Meta (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA) — is on course to expand earnings by 8% Y/Y in Q2. That would be the first quarter of growth for so-called S&P 493 since 4Q22, Subramanian said.

But small-cap stocks as tracked by the Russell 2000 (RTY)(NYSEARCA:IWM) are stuck in an earnings recession that’s been ongoing since Q4 2022, she said. S&P 600 (SP600) earnings were down 11% Y/Y so far in Q2.

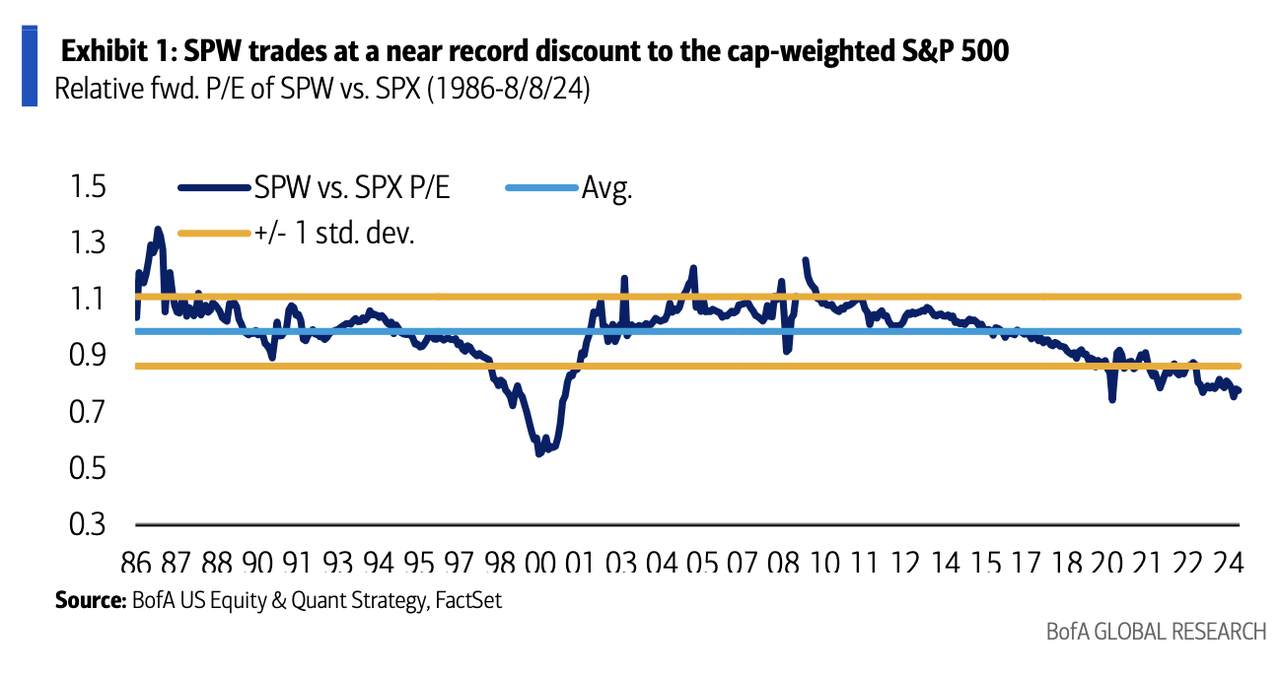

Meanwhile, even with mega-caps pacing the market’s recent pull-back, the equal-weighted S&P 500 (SP500) is trading at an “extreme discount” to the S&P 500, approaching “Tech Bubble” levels, Subramanian said, and published this chart:

“Admittedly, the equal-weighted S&P 500 is 8% more expensive than the Russell 2000 (RTY) vs. a 1% historical average,” she said. “But don’t forget risk,” she said. “Based on the current equity risk premium, the equal-weighted S&P 500 should trade at a premium to the S&P 500 (SP500) and should trade at a 12% premium to the Russell 2000 (RTY), all else equal.”

“Admittedly, the equal-weighted S&P 500 is 8% more expensive than the Russell 2000 (RTY) vs. a 1% historical average,” she said. “But don’t forget risk,” she said. “Based on the current equity risk premium, the equal-weighted S&P 500 should trade at a premium to the S&P 500 (SP500) and should trade at a 12% premium to the Russell 2000 (RTY), all else equal.”

The Invesco S&P 500 Equal Weight ETF (NYSEARCA:RSP), with assets of $53.4B, was up more than 6% YTD.