With Oracle (ORCL) set to report earnings this week and capital expenditure plans closely watched, BofA says there’s a new sheriff in town when it comes to spending.

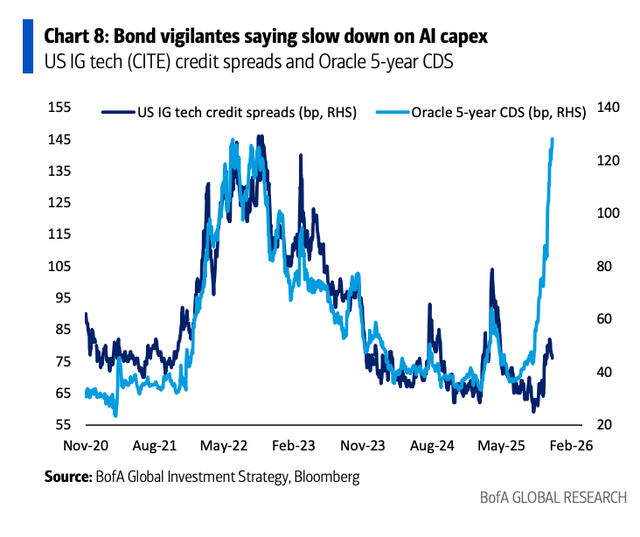

Strategist Michael Hartnett said in a note that bond vigilantes are now the “new regulators of AI capex” and they are saying “slow the growth.”

Investors should look to AI adopters rather than spenders as credit spreads rein in capex, he said.

Capex at hyperscalers like Oracle, Amazon (AMZN), Microsoft (MSFT), Alphabet (GOOG) (GOOGL) (GOOG) and Meta (META) will jump from 50% cash ($240B) in 2024 to 80% ($540B) in 2026, Hartnett said.

BofA