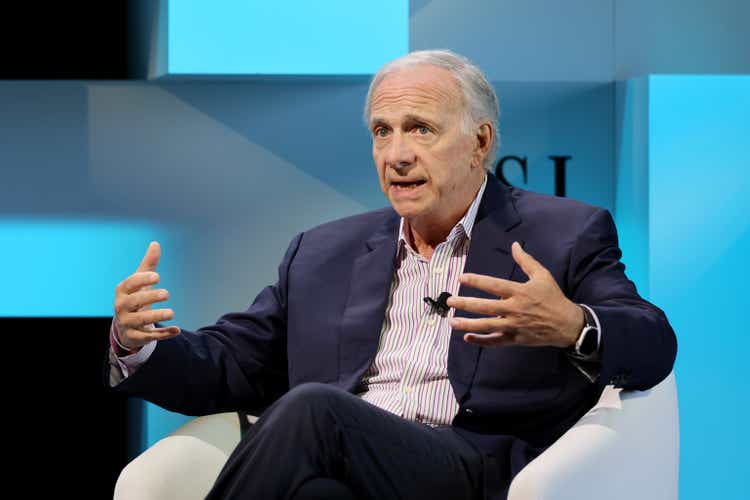

Dia Dipasupil/Getty Images Entertainment

Bridgewater Associates, the hedge fund founded by billionaire Ray Dalio, reduced its positions in Nvidia (NASDAQ:NVDA), to 4.75M shares from 6.56M, Amazon (NASDAQ:AMZN), to 1.41M from 2.65M, Meta Platforms (NASDAQ:META), to 802K from 962K, and Microsoft (NASDAQ:MSFT), to 870K from 1.09M, during Q3 2024, according to its latest 13F filing issued on Wednesday.

Meanwhile, the firm boosted its holdings in Lam Research (NASDAQ:LRCX), to 276K from 67K, Apple (NASDAQ:AAPL), to 1.03M from 469K, and Constellation Energy (NASDAQ:CEG), to 768K from 194K.

It took new stakes in Micron Technology (NASDAQ:MU), with 984K shares, and Alibaba Group Holding (NYSE:BABA), with 512K shares.

The fund exited its positions in Walt Disney (NYSE:DIS), Thermo Fischer Scientific (NYSE:TMO) and Tractor Supply Company (TSCO), the filing showed.