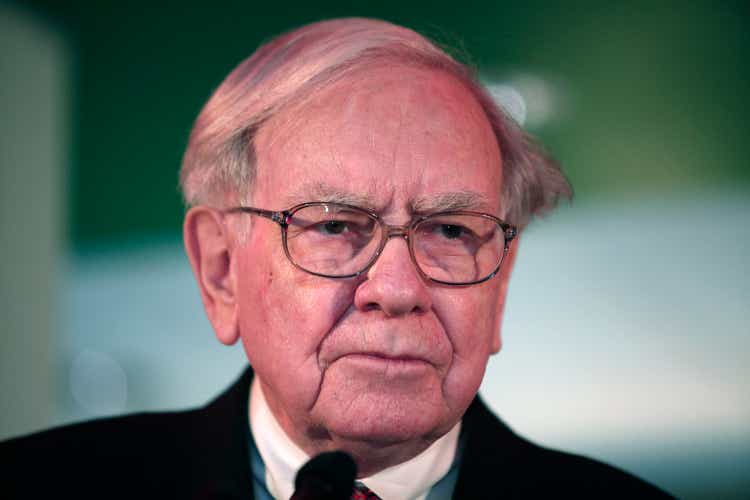

Bill Pugliano/Getty Images News

Warren Buffett’s Berkshire Hathaway (NYSE:BRK.A)(NYSE:BRK.B) has continued its sell-off of Bank of America (NYSE:BAC) stock, this time in a series of sales worth $982M.

Berkshire made its latest sales on August 23, 26 and 27, it disclosed in a filing on Tuesday. The investment firm has sold of $5.4B worth of BofA stock since mid-July, equating to a nearly 13% interest in the second-largest bank in the U.S.

Buffett’s firm still holds the largest stake in BofA (BAC), with 903.9M shares. BofA shares slipped 0.15% in the pre-market hours ahead of trade on Wednesday.

Earlier this month, Berkshire also disclosed its stake in Apple (AAPL) has been cut by nearly half. Its quarterly filing at the beginning of August showed a fair value of $84.2B for its equity investment in Apple (AAPL) at the end of Q2, compared to $135.4B in Q1.

Berkshire’s (BRK.A)(BRK.B) overall cash pile rose to a record $276.94B at end of Q2, from $188.99B at end-March.