anyaberkut

Oppenheimer listed additions to its OPCO Trifecta list in highlighting top sector ideas, and among the ideas was buying Russell 1000 Health Care Growth stocks.

Four health care stocks were recommended in a weekend technical analysis note alongside four stocks each from the Industrials, Financials and Technology groups.

More broadly, Oppenheimer said it sees recent S&P 500 (SP500) weakness “as a correction in an uptrend,” because it doesn’t believe equity cycles top with the type of broad-based breadth it saw exhibited in July trade.

“While the breakdown in rates and leadership suggests the equity cycle is maturing, our work suggests a seasonal setback should be followed by a year-end rally. We’ll be watching the quality of this rally to gauge our 2025 outlook,” Ari Wald, head of technical analysis, said.

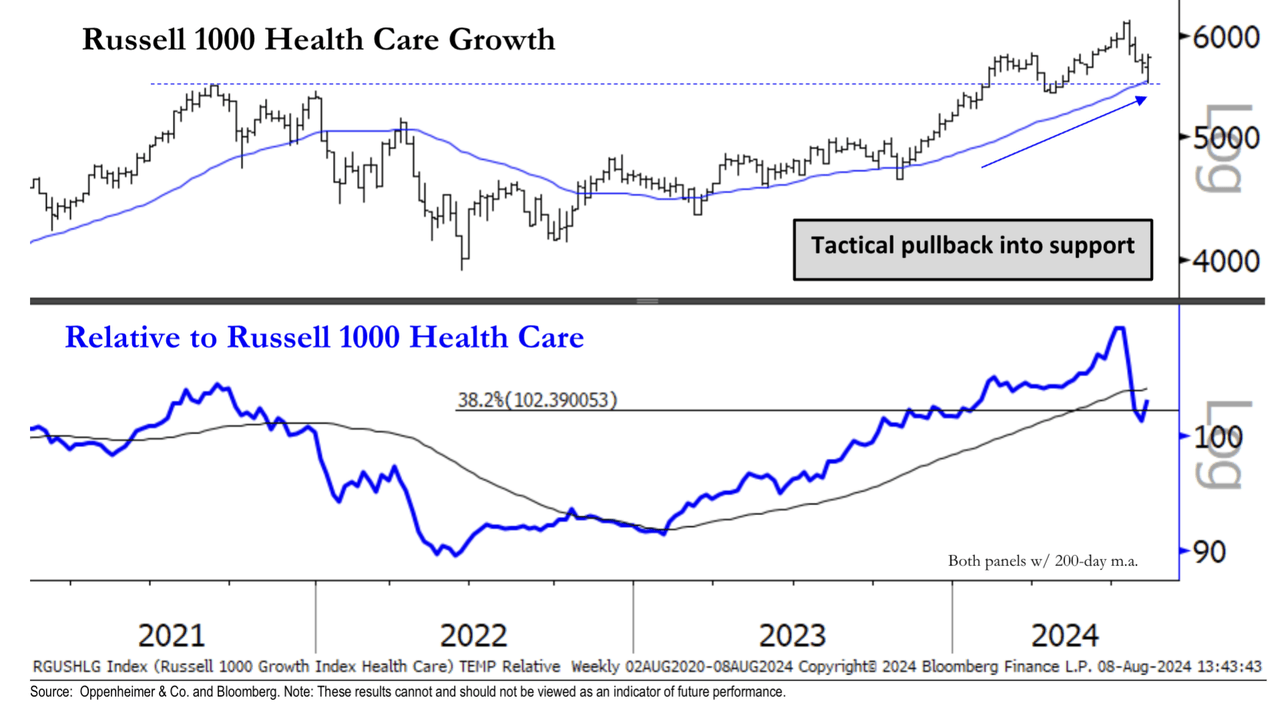

Oppenheimer said the Russell 1000 Health Care Growth section of the stock market exhibits bullish trend characteristics and recommends buying on this pullback. Oppenheimer’s OPCO Trifecta list carries stocks that are fundamentally rated “outperform,” screen positively in its trend work, and are supported by top-down tailwinds.

Its OPCO Trifecta additions in Russell 1000 Health Care Growth are:

- HCA Healthcare (NYSE:HCA)

- Merit Medical Systems (NASDAQ:MMSI)

- Neurocrine Biosciences (NASDAQ:NBIX)

- Viking Therapeutics (NASDAQ:VKTX)

In Industrials:

In Financials:

- Cboe Global Markets (BATS:CBOE)

- Goldman Sachs Group (NYSE:GS)

- Jefferies Financial Group (NYSE:JEF)

- JPMorgan Chase & Co. (NYSE:JPM)

In Technology:

Here’s what was deleted from the OPCO Trifecta list:

(DPZ), (SPXC), (ROP), (INTU), (UBER), (AMZN), (DKNG), (RSI), (NRDS), (LYV), (HUBS), (PTC), (OKTA), (DDOG), (ESTC), (PANW), (CRWD), (FROG), (MRVL), (V), (CG), (SEIC).