jetcityimage

Ford (NYSE:F) is overhauling its electric vehicle strategy, which includes dropping its plan for a new electric SUV and ramping up U.S. battery production to better compete with lower-cost Chinese rivals.

The Detroit automaker’s EV business has continued to bleed money, and previously forecast that it would lose between $5B and $5.5B this year.

To cut its losses, Ford (F) announced that it will:

- Delay the successor to its F-150 Lightning electric pickup truck until 2027, after initially targeting a launch next year;

- Scrap plans for an electric three-row SUV and will instead offer hybrid gas-electric versions of its next three-row SUVs;

- Take a $400M non-cash charge for the write-down of SUV manufacturing assets and forecast additional expenses of up to $1.5B

- Trim capital spending on pure EVs from about 40% to 30% of its budget

- Move some battery production for Mustang Mach-E from Poland to Michigan to qualify for tax credits under the Inflation Reduction Act

- Manufacture batteries for E-Transit and F-150 Lightning in Kentucky, and for its upcoming electric van in Tennessee

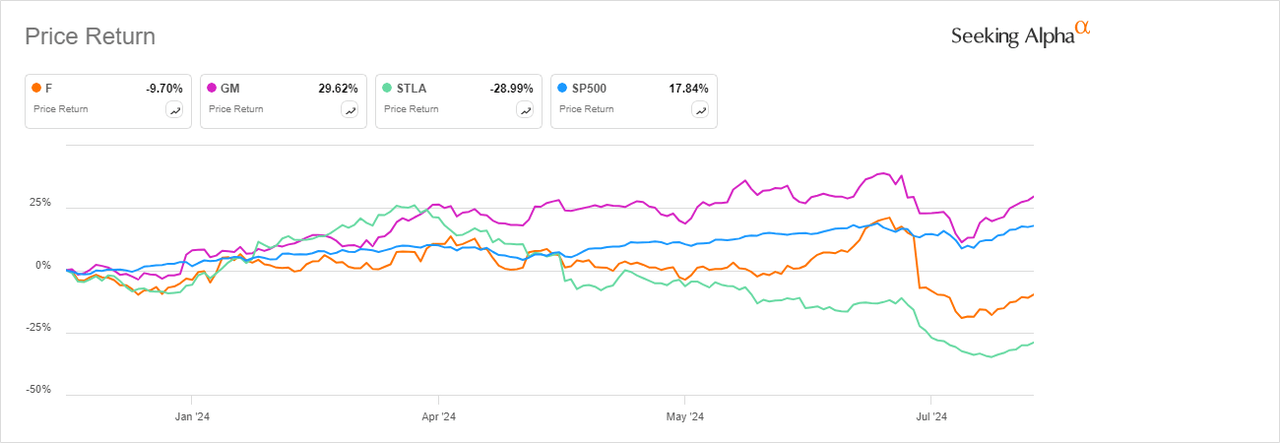

The strategy shift lifted Ford (F) shares to as high as 2.8% on Wednesday. Take a look at the stock’s performance compared to Detroit rivals this year: