U.S. credit card delinquencies, or accounts where borrowers have missed payments, barely budged in August, while net charge-offs, the loans banks have to write off as uncollectible, drifted higher. Both metrics held above their pre-pandemic levels.

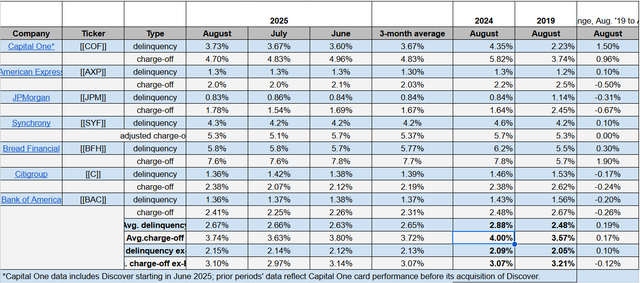

The average delinquency rate inched up to 2.67% in August from 2.66% in July, but fell from 2.88% a year earlier, according to Seeking Alpha’s compilation of credit card metrics. That compares with the pre-pandemic rate of 2.48% in August 2019.

Meanwhile, the average net charge-off rate rose to 3.74% from 3.63% in July and slid from 4.00% in August 2024. Six years ago, the rate stood at 3.57%.

Total card lending activity was $515.4B across the seven issuers tracked by SA, up 0.3% M/M and 26.4% Y/Y.

Card issuers’ shares mostly outpaced the broader stock market’s rise last month, amid expectations for an interest-rate cut by the Federal Reserve.

August 2025 credit card delinquencies, net charge-offs (Company filings, press releases)