Tara Moore

U.S. credit card delinquencies and net charge-offs rebounded last month after May’s pullback, with both metrics exceeding above prepandemic levels.

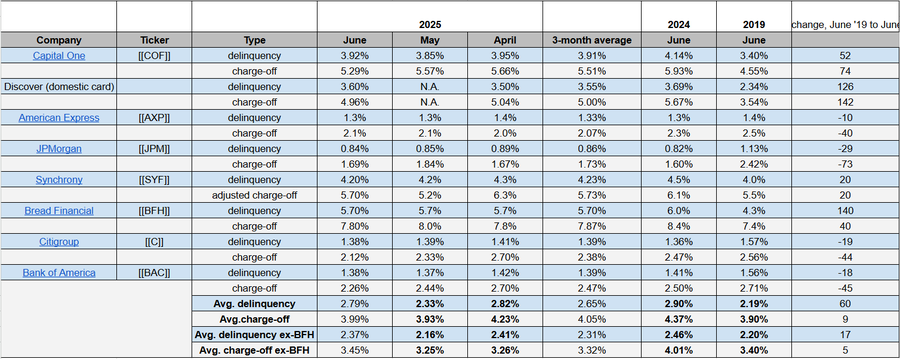

The average delinquency rate accelerated to 2.79% in June from 2.33% in May and retreated from 2.90% a year earlier, according to Seeking Alpha’s compilation of credit card metrics. That compares with its prepandemic mark of 2.19% in June 2019.

Meanwhile, the average net charge-off rate edged up to 3.99% in June from 3.93% in the earlier month, but slid from 4.37% in June 2024. It surpassed the June 2019 rate of 3.90%

Delinquencies track late payments, while net charge-offs track debts that are written off as uncollectible.

Excluding Bread Financial’s (NYSE:BFH) outsized rates, the two metrics still rose sequentially, on average, in June.

Bread’s June delinquency rate stood 140 basis points above the prepandemic rate, representing the largest six-year increase among the credit card issuers covered by SA.

May 2025 credit card delinquencies, net charge-offs ((Company filings, press releases))

More on Bread Financial Holdings, Capital One Financial, etc.

- Capital One Financial Corporation (COF) Q2 2025 Earnings Call Transcript

- Capital One Financial Corporation 2025 Q2 – Results – Earnings Call Presentation

- Synchrony Financial: Still Bullish But More Cautious Near All-Time Highs

- JPMorgan, Bank of America subpoenaed by House over Chinese IPO – report

- Bread Financial’s June credit card delinquency unchanged, charge-offs down