owngarden

ETFs focused on China pushed higher Tuesday after China’s central bank launched fresh measures to aid the world’s second-largest economy, although some analysts say Chinese authorities may need to make additional moves to bolster sluggish growth.

The People’s Bank of China cut its reserve requirement ratio to the lowest level since at least 2020, and unveiled efforts to support the struggling property market, among other actions overnight. China is aiming to hit its full-year growth target of ~5% in the wake of the COVID pandemic.

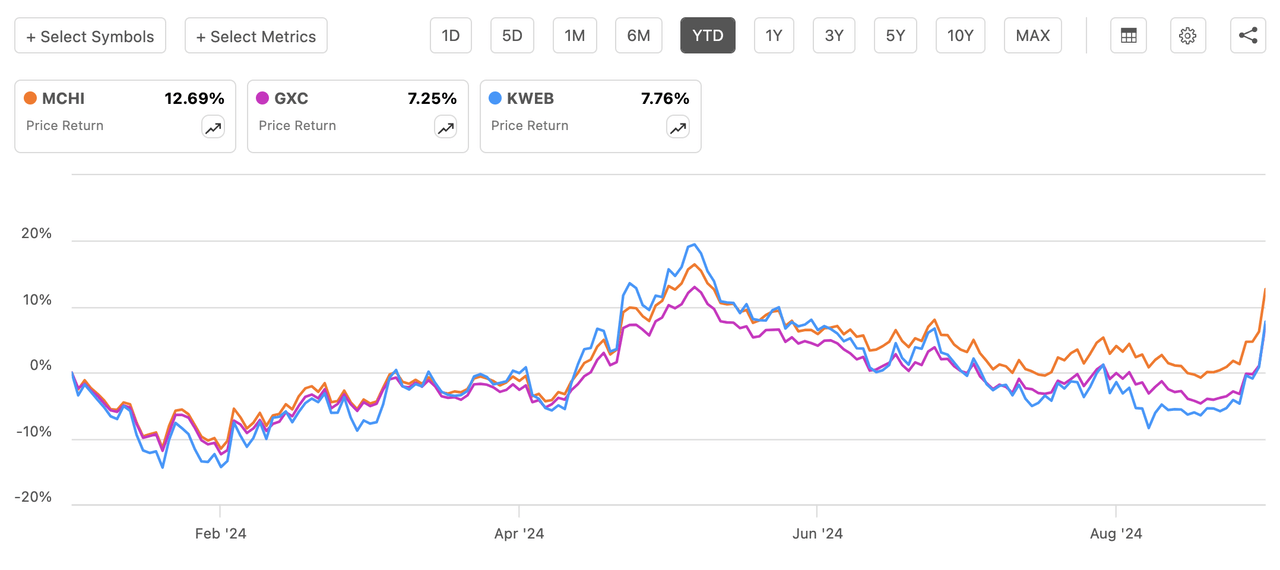

On Wall Street, the iShares MSCI China ETF (NASDAQ:MCHI) soared as much as 7.9% to 46.71, the highest since May 20. The BlackRock fund managing $4.4B in assets later pared the gain to 7.5%. The $4.33B KraneShares CSI China Internet ETF (NYSEARCA:KWEB) climbed 8.1% and earlier hit its highest price since June.

In China trade, the Shanghai Composite Index (SHCOMP) and Hong Kong’s Hang Seng (HSI) each gained +4%.

“Surprise market support measures by the PBOC should help improve investor sentiment and liquidity, and push both onshore and offshore markets to react positively in the near term,” Laura Wang, Morgan Stanley’s chief China equity strategist, said in a note. But true improvements in macro conditions are needed for a sustainable market recovery, she said.

“We believe more leverage needs to be taken to essentially maximize the impact of these programs – more home purchases upon lower down payment ratio; borrowing by listed companies to buy back shares, de facto borrowing by institutional investors to buy stocks, etc.,” Wang said.

The PBOC’s 20bp policy rate cut, and its 50bp cut to rates on existing mortgage loans are among the monetary and financial measures that will boost confidence to some extent, Nomura said. However, “we believe fiscal stimulus should take the front seat,” Nomura Chief China Economist Ting Lu said. Among his suggestions, Beijing could provide direct funding to stabilize the property market, “as the housing crisis is the root cause of these shocks.”

Back in ETFs, the SPDR S&P China fund (NYSEARCA:GXC) and the Global X MSCI China Consumer Disc ETF (NYSEARCA:CHIQ) each bulked up 7.6% during Tuesday’s session.

Among U.S.-listed Chinese stocks, Tencent Holdings (OTCPK:TCEHY) +6.3%, Alibaba (BABA) +6.6%, Nio (NIO) +9.5%, and China Construction Bank Corporation (OTCPK:CICHY) +7.3%.