peshkov

Morgan Stanley selected Coca-Cola (NYSE:KO), Keurig Dr Pepper (NASDAQ:KDP), Monster Beverage (NASDAQ:MNST) and Philip Morris International (NYSE:PM) as its top picks in the broad consumer staples group that includes beverage, household products, and tobacco names.

Coca-Cola Co (NYSE:KO): Analyst Dara Mohsenian and his team see Coca-Cola (NYSE:KO) as increasingly in a league of its own, with sustained organic sales growth above peers and benefiting from a sequentially weaker dollar. The company is also seen having greater pricing power and steady existing historical volume growth unlike peers. Structural market share momentum and higher growth from expansion in the Fairlife acquisition in the U.S. are also seen as positives.

Keurig Dr Pepper Inc (NASDAQ:KDP): The firm believes KDP’s valuation does not reflect a sustained acceleration in relative organic sales momentum vs CPG peers, driven by highly visible strength in the U.S. Refreshment segment on sustained pricing power and market share gains. Consistent international growth was also highlighted as a positive. “While we see near-term coffee profit downside on higher costs, we expect greater lagged pricing in H2, which should drive a coffee OSG rebound,” highlighted Mohsenian.

Philip Morris International (NYSE:PM): Morgan Stanley views the tobacco giant as an outlier in a scarce growth CPG environment, with robust topline and profit momentum driven by its smoke-free portfolio. PM was also noted to have the highest long-term growth profile among mega-cap CPG peers, while trading at a ~27% discount to theoretical fair value based upon regression analysis.

Monster Beverage Corp (NASDAQ:MNST): The energy drink heavyweight makes the Morgan Stanley short list due to the resurgence in U.S. sales growth behind rebounding category growth, the positive impact of price increases, and sequential U.S. market share improvement with building innovation, and easier comparisons. International sales growth is seen supporting the bull case. “We do acknowledge Monster’s multiple has moved up but with building sequential topline growth, but we see further room for multiple expansion, with a scarcity of OSG in a challenged CPG group,” wrote Mohsenian.

On a quantitative analysis basis, Philip Morris International (NYSE:PM) has the top Seeking Alpha Quant score of the entire consumer staples sector.

Seeking Alpha

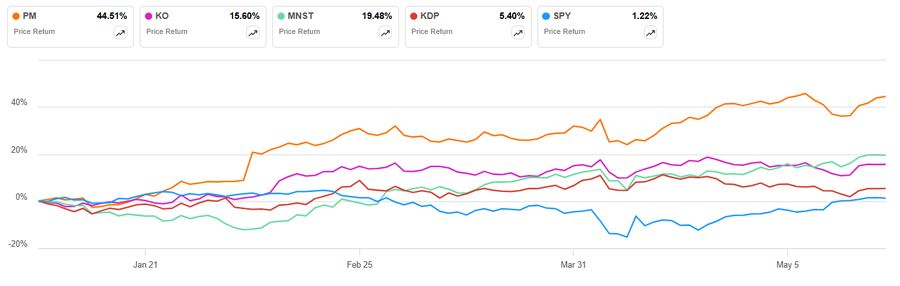

All four consumer staples stocks have outperformed the S&P 500 Index on a year-to-date basis.

More on consumer staples stocks

- 5 Compelling Arguments To Buy Monster Beverage

- Monster Beverage: The Big Boy Seems To Be Struggling

- Monster Beverage Earnings Review: Overvalued Despite Strong Market Position

- Goldman Sachs Prime: Staples’ short selling was the largest in 5+ years

- Short bets for most S&P 500 consumer staples surge in April