A strong holiday shopping season spurred most consumer finance stocks higher in the past month, with many credit card, Buy Now, Pay Later, and fintech app stocks outperforming the S&P 500’s 4.5% increase.

Preliminary data from card network Visa (V) reflected a 4.2% year-over-year boost in holiday retail spending of all types, including cash and check, while Mastercard (MA) estimated that consumers spent 3.9% more than a year ago, excluding autos.

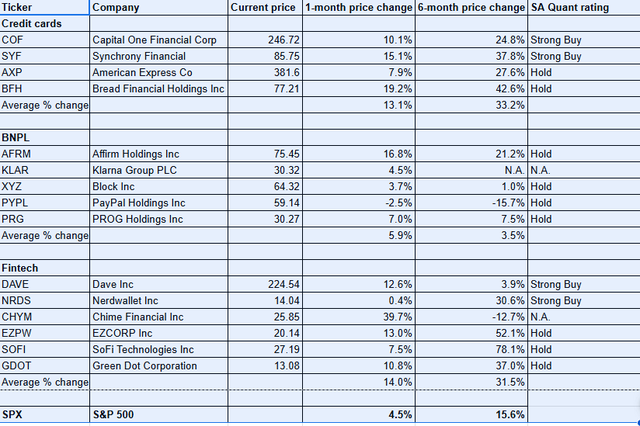

Of all the names in the chart below, the biggest stock gain was scored by newly public Chyme Financial (CHYM), rising almost 40% in the past month. The fintech app stock started trading on June 12 after it raised $864M in its IPO. Among credit card names, Bread Financial (BFH), known for issuing store-brand cards, surged 19%. In the BNPL subsector, Affirm Holdings (AFRM) turned in the best performance, with a 16.8% rise.

Some stocks struggled, despite healthy consumer spending. PayPal (PYPL) dipped 2.5% in the past month, and is down 16% as its branded checkout performance has disappointed Wall Street. Block (XYZ), owner of Cash App and BNPL financing provider Afterpay, rose a paltry 3.7%, lagging the S&P 500. In consumer fintech names, Nerdwallet (NRDS) barely budged, rising only 0.4% in the past month.

Consumer finance stocks gain in past month (Seeking Alpha)