Coterra Energy (CTRA) +2.5% and Devon Energy (DVN) +1.4% after Financial Times reported the two companies are nearing a deal to merge in what would be the largest oil and gas deal in the U.S. shale industry in nearly two years.

Talks are at an advanced stage, and a deal that would create a company with an enterprise

value of ~$57B could come together as soon as early next week, according to the report.

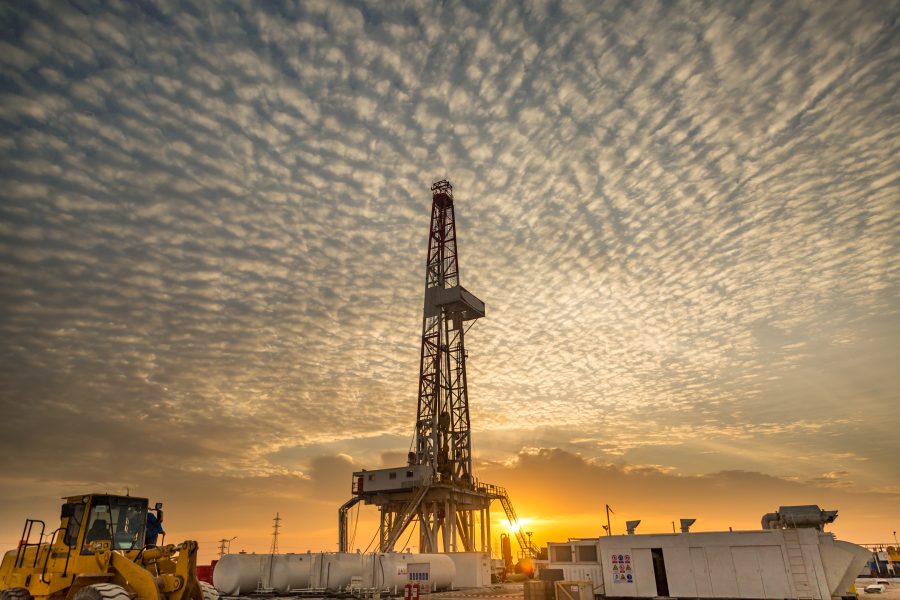

Both companies own numerous assets in the Permian Basin, and combining their operations would allow them to compete against larger rivals at a time when low crude oil prices are straining many companies in the shale sector.

Bloomberg first reported two weeks ago that the companies were pursuing a deal; shares in Coterra (CTRA) and Devon (DVN) have gained 12% and 7%, respectively, since the first report of merger talks.