Compassionate Eye Foundation/Mark Langridge/DigitalVision via Getty Images

The recession that economists were expecting to hit in late 2023 or 2024 never materialized as consumers continued to surprise in their strength of their spending. September retail sales, once again, showed a resilient U.S. consumer.

And with that spending comes the use of credit cards. For seven major credit card issuers, loans increased 0.4% M/M to $406B. Still, credit quality remained relatively stable during the month.

Credit card issuers saw delinquency rates rise, but net charge-offs fall in September, according to the average of seven banks

The average delinquency rate increased to 2.99% from 2.88% in August and 2.84% in September 2023. The average net charge-off rate, or the percentage of loans the companies deem as uncollectible, declined to 3.79% from 3.86% in August and 3.21% in last year’s September.

JPMorgan Chase’s (NYSE:JPM) retained the lowest levels of both delinquencies and net charge-offs, and stayed below pre-pandemic levels.

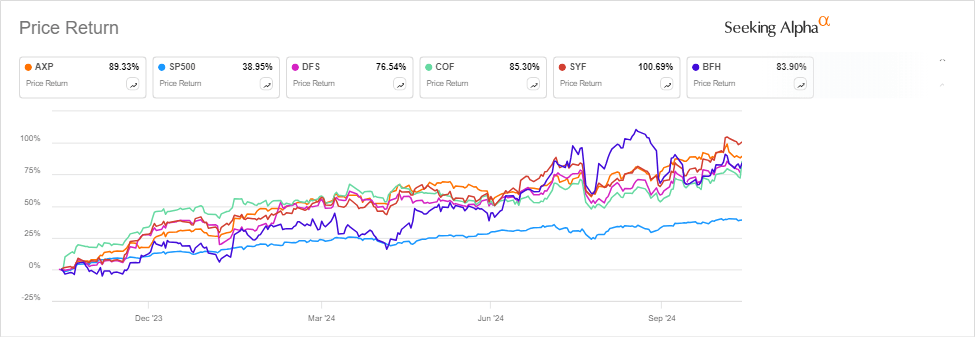

Overall, investors must be feeling good about the consumer finance space, as the stocks of American Express (NYSE:AXP), Discover Financial (DFS), Capital One Financial (NYSE:COF), Synchrony Financial (NYSE:SYF), and Bread Financial (NYSE:BFH) — the closest to pure-play credit card stocks — outperformed the S&P 500 in the past year. For example, Synchrony’s (SYF) stock price doubled in the past year and American Express’s (AXP) climbed 89%, compared with the S&P 500’s 39% increase during the same period.

The SA Quant system ranks American Express (AXP), Synchrony Financial (SYF) and Discover Financial (DFS) the highest among the credit card names. All three scored A- or higher grades in profitability and growth.

Wall Street analysts rated Citigroup (NYSE:C), Bank of America (NYSE:BAC), and JPMorgan Chase (JPM) the highest, while SA Analysts preferred Citi, Discover Financial (DFS), and Bread Financial (BFH).

|

2024 |

2023 |

2019 |

|||||||

|

Company |

Ticker |

Type |

Sept. |

August |

July |

3-month average |

Sept. |

Sept. |

bps change, Sept. ’19 to Sept. ’24 |

|

delinquency |

4.53% |

4.35% |

4.28% |

4.39% |

4.31% |

3.71% |

82 |

||

|

charge-off |

5.23% |

5.82% |

5.79% |

5.61% |

4.16% |

3.93% |

130 |

||

|

delinquency |

1.4% |

1.3% |

1.3% |

1.33% |

1.30% |

1.50% |

-10 |

||

|

charge-off |

1.9% |

2.2% |

2.1% |

2.07% |

1.70% |

2.00% |

-10 |

||

|

delinquency |

0.87% |

0.84% |

0.83% |

0.85% |

0.95% |

1.17% |

-30 |

||

|

charge-off |

1.57% |

1.64% |

1.51% |

1.57% |

1.60% |

2.32% |

-75 |

||

|

delinquency |

4.8% |

4.6% |

4.6% |

4.67% |

4.4% |

4.4% |

40 |

||

|

adjusted charge-off |

6.2% |

5.7% |

6.3% |

6.07% |

4.4% |

5.3% |

90 |

||

|

delinquency |

6.4% |

6.2% |

6.2% |

6.27% |

6.3% |

5.9% |

50 |

||

|

charge-off |

7.4% |

7.8% |

8.0% |

7.73% |

6.7% |

5.3% |

210 |

||

|

delinquency |

1.44% |

1.46% |

1.44% |

1.45% |

1.33% |

1.52% |

-8 |

||

|

charge-off |

2.53% |

2.38% |

2.59% |

2.50% |

2.13% |

2.61% |

-8 |

||

|

delinquency |

1.48% |

1.43% |

1.42% |

1.44% |

1.30% |

1.59% |

-11 |

||

|

charge-off |

2.52% |

2.48% |

2.36% |

2.45% |

2.11% |

2.54% |

-2 |

||

|

Avg. delinquency |

2.99% |

2.88% |

2.87% |

2.91% |

2.84% |

2.83% |

16 |

||

|

Avg.charge-off |

3.79% |

3.86% |

3.94% |

3.86% |

3.21% |

3.35% |

44 |

||

|

Avg. delinquency ex-BFH |

2.42% |

2.33% |

2.31% |

2.35% |

2.27% |

2.32% |

10 |

||

|

Avg. charge-off ex-BFH |

3.33% |

3.37% |

3.44% |

3.38% |

2.68% |

3.12% |

21 |

||

Source: Company filings, statements.