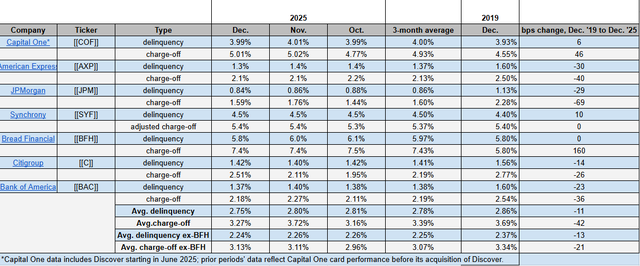

U.S. credit card delinquencies and net charge-offs both slid in December from a month ago, as borrowing costs eased after a third consecutive rate cut by the Federal Reserve.

The average delinquency rate drifted down to 2.75% from 2.80% in November and 2.86% in December 2019, before the pandemic hit, according to Seeking Alpha’s compilation of credit card metrics.

Meanwhile, the average net-charge off rate retreated to 3.27% last month from 3.72% in November and 3.69% in December 2019. Excluding Bread Financial’s (BFH) relatively outsized rates, net charge-offs rose to 3.13% from 3.11% in November.

The overall improvement in consumer credit health came before the Fed hit pause on the monetary easing implemented at its three previous meetings, increasing doubts about whether the Fed will resume its path of easing policy.

Card issuers are also contending with renewed political pressure after President Donald Trump earlier this month moved to place a 10% cap on credit card interest. But there remains substantial doubt about whether such a cap will succeed, as numerous previous efforts have failed.

December 2025 credit card delinquencies, net charge-off rates (Company filings, press releases)