The Good Brigade

U.S. delinquencies and net charge-offs extended their decline in April, though both remain comfortably above their pre-pandemic levels.

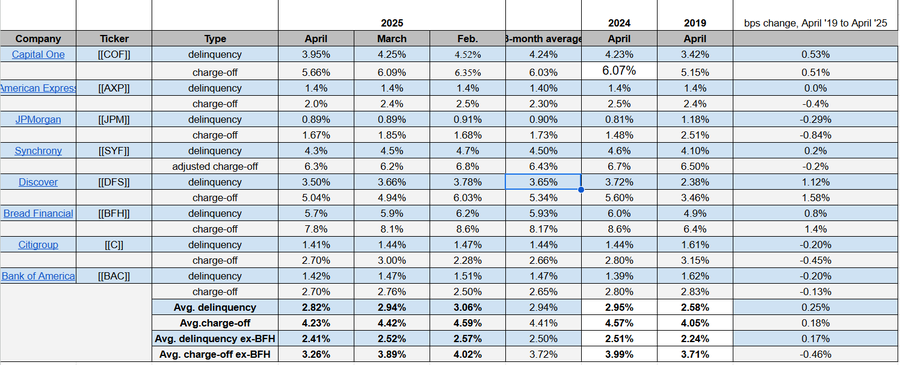

The average delinquency rate retreated to 2.82% from 2.94% in March and from 2.95% in April 2024, according to Seeking Alpha’s compilation of credit card metrics. Still, that compares with 2.58% in April 2019, before the Covid-19 pandemic hit.

Similarly, the average April net charge-off rate of 4.23% slid from 4.42% in the earlier month and 4.57% a year ago. But it advanced from 4.05% in April 2019.

With Bread Financial’s (NYSE:BFH) outsized delinquency and charge-off rates excluded, the average delinquency rate also fell to 2.41% from 2.52% in March and 2.51% in April 2024, but still surpassed the 2.24% mark five years before.

Ex-BFH average net charge-off rate of 3.26% compared with 3.89% in March, 4.02% in April 2024 and 3.71% in April 2019.

“Given the hyper focus on signs of consumer weakness,” said Evercore ISI analyst John Pancari, the April data “will likely be a net positive as DQ trends do not yet indicate a reversal of consumer credit trends & should support flat to lower NCOs,” he wrote in a note to clients.

Among the card issuers recording higher net charge-offs, on a M/M basis, include Synchrony Financial (NYSE:SYF) and Discover Financial Services (NYSE:DFS).

On Capital One Financial (NYSE:COF), in particular, Pancari noted its implied Q2 auto net charge-offs and delinquencies screen positively relative to his and consensus estimates.

April 2025 credit card delinquencies, net charge-offs (April 2025 credit card delinquencies, net charge-offs (Company filings, press releases))

More on Bread Financial Holdings, Discover Financial Services, etc.

- A Pair Trade Opportunity By Bank of America’s Preferred Stocks

- A Pair Trade Opportunity By JPMorgan’s Preferred Stocks

- Preferred Stocks To Sell (Part 1): JPMorgan’s JPM.PR.C

- Bank of America, Advanced Micro Devices decline as investment firms disclose reduced positions

- Citi credit card delinquency, net charge-off rates retreat in April