jetcityimage

The Industrial Select Sector SPDR Fund ETF (XLI) rose +1.15% for the week ended July 26, while, the SPDR S&P 500 Trust ETF (SPY) fell -0.83%.

Earnings were the main theme this week, helping 3M to the top spot among industrial gainers, while dragging down trucking company Saia.

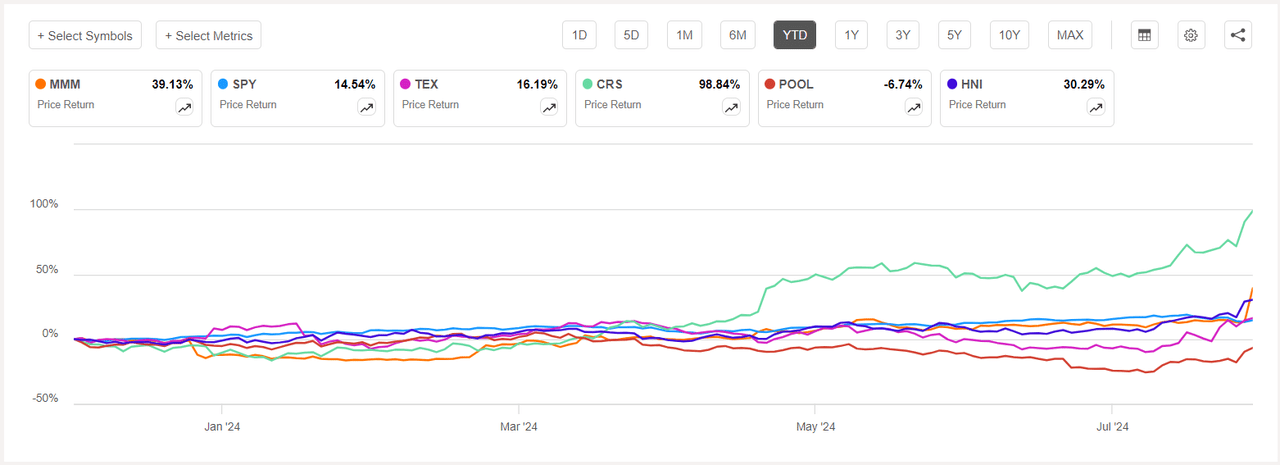

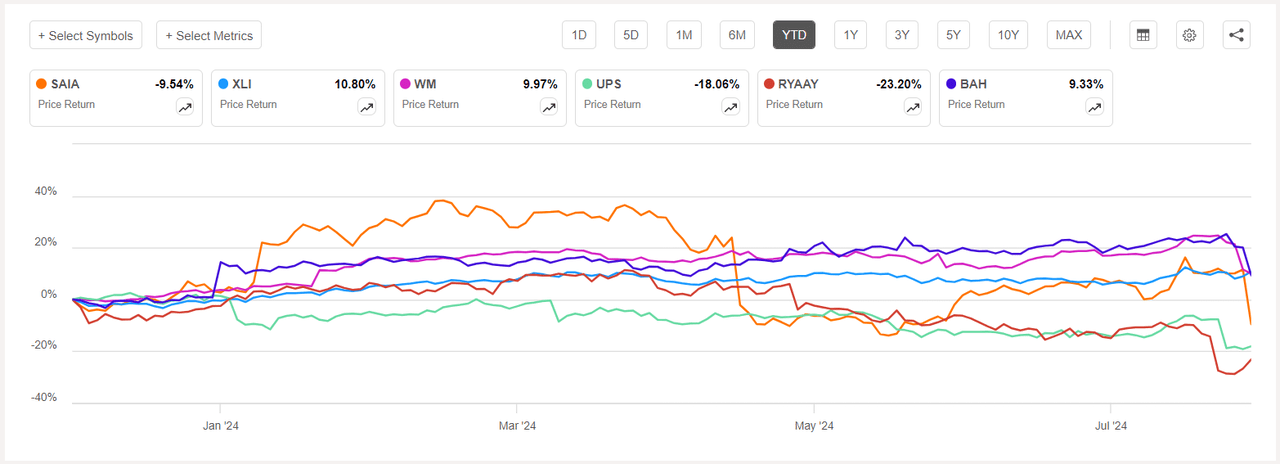

Industrials was among the 7 of the 11 S&P 500 sectors which ended the week in the green. Year-to-date, or YTD, XLI has climbed +10.80%, while SPY has soared +14.54%.

The top five gainers in the industrial sector (stocks with a market cap of over $2B) all gained more than +12% each this week. YTD, 4 out of these 5 stocks are in the green.

3M Company (NYSE:MMM) +22.36%. Shares of the company, which makes safety products and industrial equipment, soared to its highest in nearly two years, (+22.99%) in Friday’s trading to top all gainers on the S&P 500 and Dow Jones indexes, after beating Q2 earnings expectations and raising its full-year outlook. YTD, +39.13%.

MMM has a SA Quant Rating — which takes into account factors such as Momentum, Profitability, and Valuation among others — of Hold. The stock has a factor grade of A+ for Profitability and F for Growth. The average Wall Street Analysts’ Rating concurs and has a Hold rating too, wherein 10 out of 18 analysts tag the stock as such.

Terex (TEX) +18.24%. The stock jumped +10.96% on Monday after the lifting and material-handling equipment maker said it was acquiring Environmental Solutions Group from Dover in a $2B all-cash transaction. YTD, +16.19%.

The SA Quant Rating on TEX is Buy with a score of A- for Valuation and B- for Momentum. The average Wall Street Analysts’ Rating differs and has a Hold rating, wherein 10 out of 15 analysts see the stock as such.

The chart below shows YTD price-return performance of the top five gainers and SPY:

Carpenter Technology (CRS) +17.97%. The specialty metals maker’s stock rose +10.91% on Thursday after fourth quarter results beat estimates. YTD, +98.84%. The SA Quant Rating on CRS is Strong Buy, and the average Wall Street Analysts’ Rating is also positive with a Buy.

Pool (POOL) +13.18%. Covington, La.-based company’s stock rose +10.01% on Thursday after second quarter results beat estimates and the pool equipment distributor reaffirmed its FY24 EPS outlook. YTD -6.74%. The SA Quant Rating on POOL is Sell, which is in contrast to the average Wall Street Analysts’ Rating of Buy.

HNI (HNI) +12.70%. The company, which makes workplace furnishings and residential building products, saw its stock jump +10.35% on Thursday after non-GAAP EPS surpassed analysts’ expectations. YTD, +30.29%. The SA Quant Rating and the average Wall Street Analysts’ (total 1 analyst in this case) Rating, both on HNI is Strong Buy.

This week’s top five decliners among industrial stocks (market cap of over $2B) all lost more than -10% each. YTD, 3 out of these 5 stocks are in the red.

Saia (NASDAQ:SAIA) -18.30%. The trucking company’s stock fell -18.95% on Friday after second quarter results missed estimates. YTD, -9.54%. The SA Quant Rating on SAIA is Hold, with a factor grade of B- for Growth and D+ for Profitability. The average Wall Street Analysts’ Rating disagrees and has a Buy rating, wherein 8 out of 20 analysts view the stock as Strong Buy.

Waste Management (WM) -11.60%. The Houston-based company’s stock dipped -8.03% on Thursday after second quarter results fell short of analysts’ expectations. However, YTD, the stock is in the green, +9.97%.

The SA Quant Rating on WM is Hold, with a score of C for Momentum and D for Valuation. The average Wall Street Analysts’ Rating differs and has a Buy rating, wherein 8 out of 22 analysts view the stock as Strong Buy.

The chart below shows YTD price-return performance of the worst five decliners of the week and XLI:

United Parcel Service (UPS) -11.26%. The stock declined -12.05% on Tuesday after Q2 results came in below Wall Street’s expectations. YTD, -18.06%. The SA Quant Rating on UPS is Hold, while the average Wall Street Analysts’ Rating is Buy.

Ryanair (RYAAY) -10.41%. The Irish airline’s stock tumbled -15.41% on Monday after Q1 profit declined and the company warned that Q2 fares would be “materially” lower than last summer. YTD, -23.20%. The SA Quant Rating on RYAAY is Sell, which is in contrast to the average Wall Street Analysts’ Rating of Strong Buy.

Booz Allen Hamilton (BAH) -10.39%. The consulting and analytics services provider’s stock fell -8.95% on Friday after first quarter results missed estimates. YTD, +9.33%. The SA Quant Rating on BAH is Hold, while the average Wall Street Analysts’ Rating is Buy.