AlexLMX/iStock via Getty Images

As the earnings season slows down, several high-profile companies from diverse sectors are yet to release their quarterly results in the coming week.

Tech giants like NVIDIA (NASDAQ:NVDA) and Snowflake (NYSE:SNOW), along with retail heavyweights Walmart (NYSE:WMT) and Target (NYSE:TGT), will offer insights into how they are navigating current economic challenges.

Chinese firms Baidu (NASDAQ:BIDU), electric vehicle manufacturer NIO (NYSE:NIO), and XPeng (NYSE:XPEV) will also provide valuable updates amid a changing global landscape.

Additionally, industry leaders like Medtronic (NYSE:MDT), Deere (NYSE:DE), and Palo Alto Networks (NASDAQ:PANW), along with diversified companies like ZIM Integrated Shipping (NYSE:ZIM), The TJX Companies (NYSE:TJX), and Sociedad Química y Minera de Chile (NYSE:SQM), are expected to shed light on sectoral trends.

Investors will be keen to monitor these updates to gauge the health of the broader market and sector-specific dynamics as we approach year-end.

Below is a rundown of major quarterly updates anticipated in the week of November 18 to 22:

Monday, November 18

Trip.com Group (NASDAQ:TCOM)

Trip.com Group (TCOM) is set to release its Q3 results after the market closes on Monday, with analysts anticipating a 5% drop in profits, despite a 13% expected increase in revenue.

YTD, the stock has surged around 66%, earning a Strong Buy rating from both Wall Street analysts and Seeking Alpha’s Quant rating system.

According to SA contributor Caffital Research, Trip.com Group Limited (TCOM) is poised to benefit from China’s resurgent travel industry. While the pandemic significantly impacted TCOM’s revenue between 2020 and 2022, the recent travel boom has fueled impressive growth momentum, expected to continue in Q3. Caffital Research views TCOM as slightly undervalued, offering an attractive entry point, but acknowledges the presence of potentially cheaper alternatives within the travel sector.

- Consensus EPS Estimates: $0.97

- Consensus Revenue Estimates: $2.17B

- Earnings Insight: The company has exceeded revenue expectations in all the last 8 quarters, and EPS in 6 of those reports.

Also reporting: Kandi Technologies Group (NASDAQ:KNDI), EHang Holdings Limited (EH), Niu Technologies (NIU), Twist Bioscience Corporation (TWST), Bit Digital (BTBT), AECOM (ACM), Oragenics (OGEN), and more.

Tuesday, November 19

Walmart (WMT)

In one of the most closely watched reports of the week, Walmart (WMT) is set to release its Q3 results before the market opens on Tuesday. Analysts anticipate 4% Y/Y growth in both top and bottom lines.

Sell-side analysts are optimistic about the stock, with a consensus Buy recommendation. However, the Seeking Alpha Quant Rating system remains cautious, maintaining a Hold rating.

The Value Portfolio, an investing group leader, recommends selling Walmart (WMT) stock, citing concerns over its high valuation, and slowing growth rate. Despite Walmart’s strong market position and profitability, the group sees risks stemming from declining inflation and potential shifts in low-wage labor dynamics. The stock’s lofty valuation, with a P/E ratio nearing 40+, limits shareholder returns, especially with a modest 1% dividend yield and less impactful share repurchases. With most year-to-date returns driven by multiple expansion, these gains may not continue.

Meanwhile, SA columnist Cash Flow Venue highlights that Walmart’s robust free cash flow supports substantial shareholder rewards, such as dividends and stock repurchase, which enhance long-term portfolio performance. While acknowledging that the company’s valuation appears stretched, suggesting potential stock price volatility, the columnist notes that long-term investors who secured an attractive yield on cost continue to benefit from consistent rewards. Although the stock is not a buy due to valuation concerns, Cash Flow Venue asserts that Walmart’s leadership, adaptability, and strong negotiating power justify holding the stock.

- Consensus EPS Estimates: $0.53

- Consensus Revenue Estimates: $166.44B

- Earnings Insight: Walmart has exceeded EPS and revenue expectations in 100% of the past 8 quarters.

Also reporting: Medtronic (MDT), Lowe’s Companies (NYSE:LOW), XPeng (XPEV), Workhorse Group (WKHS), Star Bulk Carriers (SBLK), Vipshop Holdings Limited (VIPS), SELLAS Life Sciences Group (SLS), Oaktree Specialty Lending Corporation (OCSL), Keysight Technologies (KEYS), Weibo Corporation (WB), Futu Holdings Limited (FUTU), Ayro (AYRO), Jacobs Solutions (J), Elbit Systems (ESLT), and more.

Wednesday, November 20

NVIDIA (NVDA)

Chip giant NVIDIA (NVDA) will headline this week’s earnings reports, set to release its Q3 results after the market closes on Wednesday. Analysts are forecasting over 80% Y/Y growth in both revenue and EPS.

While sell-side analysts have a Strong Buy consensus on the stock, Seeking Alpha analysts have assigned a Hold rating, citing concerns over its valuation.

Several Wall Street firms have raised their price targets on Nvidia ahead of its Q3 earnings report, citing strong demand for AI chips and the potential for upside surprises. Analysts from HSBC, Oppenheimer, Susquehanna, Wedbush, Raymond James, and Mizuho have increased their price targets, with HSBC setting the highest at $200. The consensus view is that Nvidia’s strong momentum in AI will drive solid Q3 results and a positive outlook for the future.

“NVIDIA’s Q3 Earnings Could Ignite $200 Rally,” projects SA author Yiannis Zourmpanos.

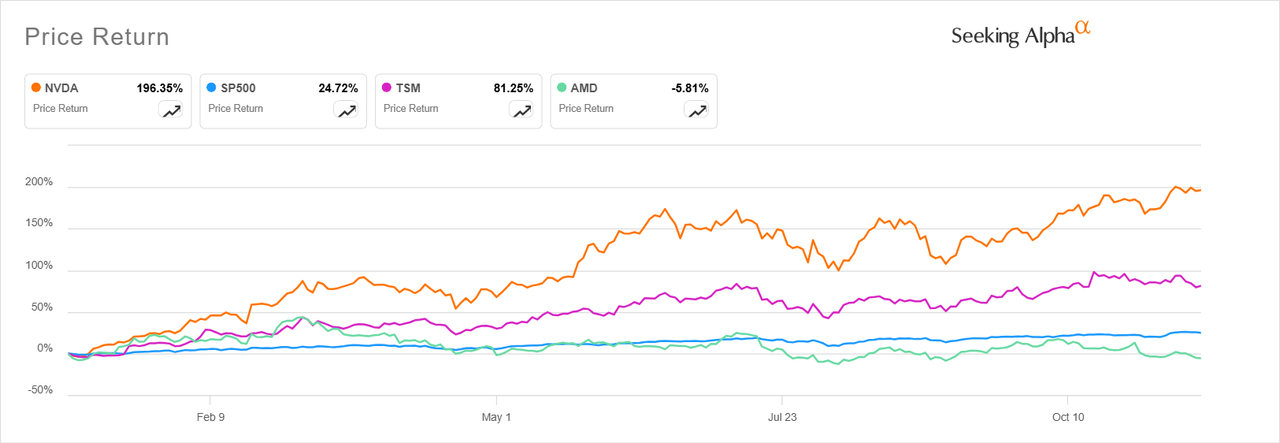

The Santa Clara-based chip company has demonstrated outstanding performance, with its stock +196% over the course of this year.

- Consensus EPS Estimates: $0.74

- Consensus Revenue Estimates: $33.03B

- Earnings Insight: Nvidia outperformed revenue estimates in 7 of the last 8 quarters, while exceeding EPS expectations in all of them.

Target (TGT)

Following Walmart’s (WMT) earnings report, Target (TGT) is set to announce its Q3 results before the opening bell on Wednesday.

After a strong Q2 performance, the company raised its adjusted EPS outlook to a range of $9.00 to $9.70, up from the previous range of $8.60 to $9.60.

Evercore ISI recently initiated a negative TAP call on Target ahead of its earnings report, anticipating a negative share price reaction and a deceleration in Q3 sales growth.

Despite this, Wall Street remains generally bullish on the stock, with sell-side analysts maintaining a Buy rating and Seeking Alpha’s Quant Rating system assigning it a Strong Buy rating.

SA Investing Group Leader Sungarden Investment Publishing notes, “TGT’s solid combination of yield, valuation, and stability is favored compared to WMT’s excessive valuation and very low dividend yield.”

- Consensus EPS Estimates: $2.30

- Consensus Revenue Estimates: $25.90B

- Earnings Insight: The company has beaten EPS and revenue estimates in 6 of the past 8 quarters.

Also reporting: NIO (NIO), Snowflake (SNOW), Palo Alto Networks (PANW), Nano Dimension (NNDM), The TJX Companies (TJX), ZIM Integrated Shipping Services (ZIM), Sociedad Química y Minera de Chile S.A. (SQM), Wix.com (WIX), Williams-Sonoma (WSM), AgEagle Aerial Systems (UAVS), Galectin Therapeutics (GALT), Immersion Corporation (IMMR), and more.

Thursday, November 21

Deere & Company (DE)

Deere & Company (DE) is scheduled to report FQ4 results before the market opens on Thursday. The Illinois-based tractor manufacturer holds a Buy rating from sell-side analysts and a Hold rating from Seeking Alpha’s Quant Rating system.

Last month, reports emerged that the U.S. Federal Trade Commission is investigating Deere’s agricultural equipment repair practices for potential violations of antitrust or consumer protection laws.

SA Investing Group Leader Daniel Jones highlights that, despite recent declines in revenue and profit due to market weakness, Deere appears fairly valued at worst and slightly undervalued if market conditions improve.

- Consensus EPS Estimates: $3.96

- Consensus Revenue Estimates: $9.28B

- Earnings Insight: Deere & Company (DE) has beaten EPS and revenue expectations in straight 8 quarters

Also reporting: Baidu (BIDU), Intuit (INTU), iQIYI (IQ), Cerence (CRNC), NetApp (NTAP), Elastic N.V. (ESTC), Baozun (BZUN), Ross Stores (ROST), Nano-X Imaging (NNOX), American Eagle Outfitters (AEO), UGI Corporation (UGI), Copart (CPRT), Alaunos Therapeutics (TCRT), Microbot Medical (MBOT), Abeona Therapeutics (ABEO), BJ’s Wholesale Club Holdings (BJ), KE Holdings (BEKE), and more.

Friday, November 22

The week concludes with a sparse array of earnings reports, including confirmed pre-market announcements on Friday from Kanzhun (BZ), Buckle (BKE), and Cheetah Mobile (CMCM).

Also reporting: Anavex Life Sciences (AVXL), Ebang International Holdings (EBON), Newegg Commerce (NEGG), Banco Macro S.A. (BMA), StealthGas (GASS), and more.