CharlieAJA

Although the peak of the earnings season has passed, next week will still feature a diverse group of prominent companies releasing their quarterly financial results. This earnings lineup includes companies in the cybersecurity, semiconductor, retail, auto and manufacturing sectors.

Market participants will be closely watching notable tech players such as Zoom Video Communications (NASDAQ:ZM), Snowflake (NYSE:SNOW), Palo Alto Networks (NASDAQ:PANW), Workday (NASDAQ:WDAY) and Analog Devices (NASDAQ:ADI).

Retailers will also be in the spotlight, with updates anticipated from Target (NYSE:TGT), Lowe’s (NYSE:LOW), Macy’s (M), Ross Stores (ROST), TJX Companies (TJX), and Estée Lauder (EL) and Urban Outfitters (URBN).

Investors will also be paying close attention to several Chinese companies reporting next week. The docket includes social media player Weibo (WB), internet technology firm NetEase (NTES), search engine Baidu (BIDU), video platform Bilibili (BILI) and electric vehicle maker XPeng (XPEV).

Other notable companies reporting next week include healthcare giant Medtronic (MDT), fitness company Peloton (PTON), shipping firm ZIM Integrated (ZIM), Canadian bank Toronto-Dominion (TD), e-commerce platform PDD Holdings (PDD) and financial software provider Intuit (INTU).

Below is a rundown of major quarterly updates anticipated in the week of August 19–23:

Monday, August 19

ZIM Integrated Shipping Services (ZIM)

ZIM is set to unveil its financial results on Monday morning. Analysts predict robust year-over-year revenue growth of approximately 35%.

While Wall Street analysts and Seeking Alpha’s Quant Rating system maintain a cautious Hold stance on the stock, Envision Research, a Seeking Alpha Investing Group Leader, offers a contrasting view. They rate ZIM as a Buy and anticipate consistent dividends throughout the year, potentially yielding over 10% and providing downside protection.

However, Mike Zaccardi, another Seeking Alpha author, expresses concerns about ZIM’s profitability due to potential spot rate declines. He maintains a Hold rating and highlights uncertainties in the company’s 2024 and 2026 projections.

- Consensus EPS Estimates: $1.80

- Consensus Revenue Estimates: $1.78B

- Earnings Insight: ZIM has missed EPS and revenue expectations in 6 of the past 8 quarters.

Also reporting: 3D Systems Corporation (DDD), Palo Alto Networks (PANW), The Estée Lauder Companies (EL), Cara Therapeutics (CARA), Ayro (AYRO), Meta Materials (MMAT), Bit Digital, (BTBT), Seelos Therapeutics (SEEL), Citius Pharmaceuticals (CTXR), Agora (API), Moleculin Biotech (MBRX), Forward Industries (FORD), and more

Tuesday, August 20

Lowe’s Companies (LOW)

Just a week after rival Home Depot (HD) provided upbeat Q2 results but set full-year guidance below expectations, Lowe’s Companies (LOW) is poised to announce its quarterly update before Tuesday’s opening bell.

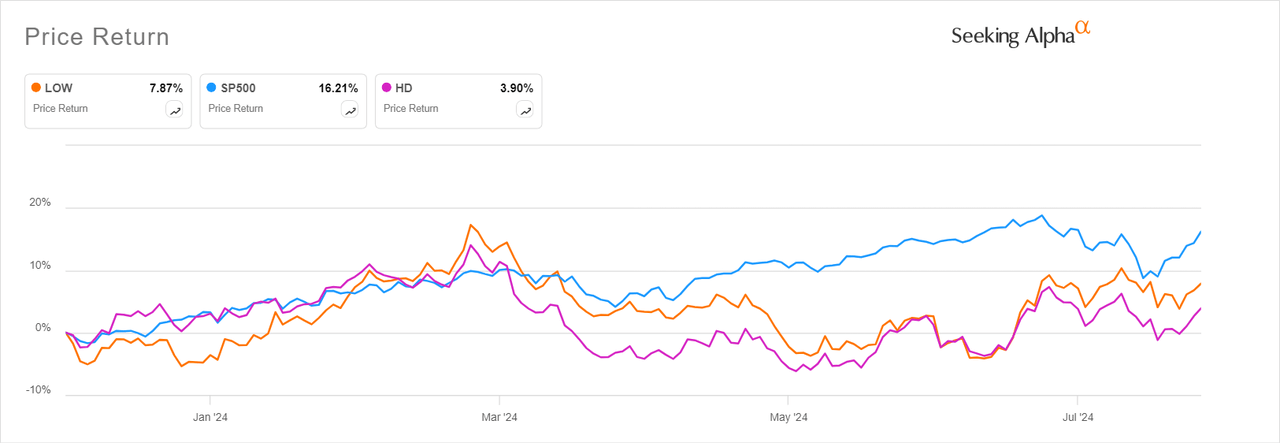

Lowe’s has outperformed Home Depot since the start of 2024 and is recommended as a Buy by Wall Street analysts. However, Seeking Alpha’s Quant Rating system maintains a Hold rating on the stock.

SA author Kenio Fontes notes that Lowe’s is a company known for its shareholder remuneration through business expansion, dividends and stock repurchases, but the firm currently faces some challenges. These include growth and valuation risks, as well as increasing macroeconomic concerns, making the stock unattractive and resulting in a Sell rating.

- Consensus EPS Estimates: $4.00

- Consensus Revenue Estimates: $23.96B

- Earnings Insight: Lowe’s has beaten EPS estimates in 8 consecutive quarters and revenue expectations in 4 of those reports.

Also reporting: Medtronic (MDT), XPeng (XPEV), Workhorse Group (WKHS), Nano Dimension (NNDM), Sociedad Química y Minera de Chile S.A. (SQM), Navios Maritime Partners L.P. Common Units (NMM), Vipshop Holdings Limited (VIPS), Keysight Technologies (KEYS), Coty (COTY), Toll Brothers (TOL), Nano-X Imaging (NNOX), Futu Holdings Limited (FUTU), Emeren Group (SOL), Jack Henry & Associates (JKHY) and more.

Wednesday, August 21

Target (TGT)

Target is set to announce its quarterly results on Wednesday morning. Following Walmart’s strong Q2 performance, expectations are high for Target. Analysts predict a profit increase of over 20% on the back of modest revenue growth.

Recently, CFRA upgraded Target’s rating from Hold to Buy, citing potential EPS upside and expansion opportunities. The firm believes Target can achieve a 6% EBIT margin in the next fiscal year due to improved operations and cost savings.

Wall Street analysts share this optimism, with a consensus Buy rating.

However, Seeking Alpha’s Quant Rating system maintains a Hold rating on the stock. While SA author Mike Zaccardi upgraded TGT from Hold to Buy due to resilient consumer spending and improved technical indicators, the overall sentiment remains cautious.

- Consensus EPS Estimates: $2.19

- Consensus Revenue Estimates: $25.22B

- Earnings Insight: The company has beaten EPS and revenue estimates in 5 of the past 8 quarters.

Also reporting: Zoom Video Communications (ZM), Snowflake (SNOW), Macy’s (M), PDD Holdings (PDD), The TJX Companies (TJX), Analog Devices (ADI), Agilent Technologies (A), Alcon (ALC), JinkoSolar Holding (JKS), Wolfspeed (WOLF), Synopsys (SNPS), Immersion Corporation (IMMR), Urban Outfitters (URBN) and more.

Thursday, August 22

Workday (WDAY)

Workday (WDAY) is slated to announce its Q2 results after market close on Thursday. Despite surpassing expectations in Q1, the back-office software provider lowered its full-year revenue guidance to $7.7B and $7.725B, as compared to the prior range of $7.73B and $7.78B. Workday anticipated Q2 subscription revenue to be $1.895B and an adjusted operating margin of 24.5%.

Both Wall Street analysts and Seeking Alpha’s Quant Ratings system view the stock as a Buy.

SA contributor Star Investments highlights that, “There are several long-term reasons investors may be interested in Workday (WDAY). The company addresses some of the largest markets in enterprise software. It estimates its total addressable market as $142 billion but has only captured approximately 5% of its TAM.”

- Consensus EPS Estimates: $1.65

- Consensus Revenue Estimates: $2.07B

- Earnings Insight: The company has beaten EPS and revenue estimates in all the last 8 quarters.

Also reporting: Baidu (BIDU), Peloton Interactive (PTON), Intuit (INTU), Canadian Solar (CSIQ), iQIYI (IQ), Bilibili (BILI), Ross Stores (ROST), NetEase (NTES), Weibo Corporation (WB), Advance Auto Parts (AAP), BJ’s Wholesale Club Holdings (BJ), Hovnanian Enterprises (HOV) and more.

Friday, August 23

The end of the week will see few earnings reports, with The Buckle (BKE), The Cato Corporation (CATO) and Elastic N.V. (ESTC) all scheduled to report their earnings in the pre-market hours.

Also reporting: 60 Degrees Pharmaceuticals (SXTP), Grupo Financiero Galicia S.A. (GGAL), Ascendis Pharma A/S (ASND), So-Young International (SY) and more.