Spencer Platt/Getty Images News

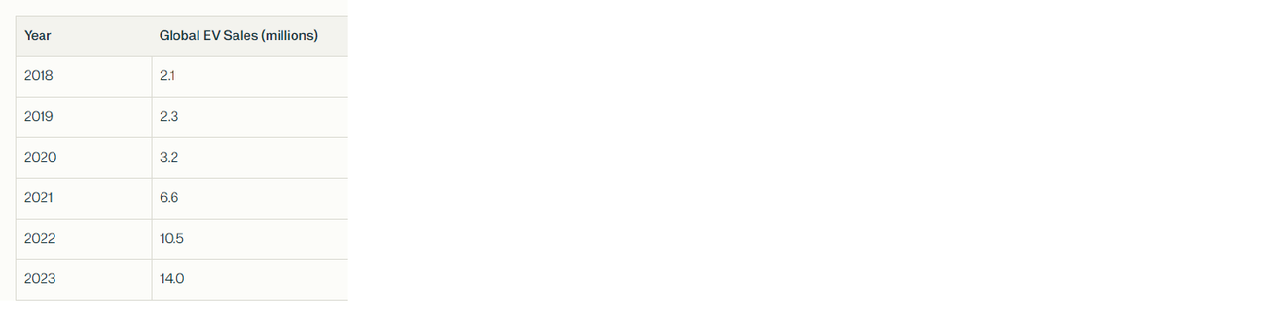

Global electric vehicle market share has grown from 2.6% in 2019 to an estimated 17% in 2024. The steady growth has occurred despite EV adoption rates varying significantly across different regions. While some European countries like Norway have achieved EV market shares of over 70%, many developing economies still have adoption rates below 1%. EV sales are also highly concentrated, with the large markets of China, Europe, and the United States accounting together for around 95% of all sales in 2023.

While EV demand has missed some of the high-flying expectations of both analysts and investors, the growth of all-electric and plug-in hybrid electric vehicles has clearly put legacy automakers in a tough position. Traditional ICE makers such as Volkswagen (OTCPK:VLKAF), General Motors (GM), Ford Motor (F), Honda Motor (HMC), and Hyundai (OTCPK:HYMTF) have all pulled back on some of their EV targets after EV sales growth rates slowed in Q1-Q2 of 2024 and with the timing of their EV model introductions lagging Tesla (NASDAQ:TSLA) and Chinese electric vehicle makers such as ZEEKR Intelligent (ZK), BYD Company (OTCPK:BYDDF), Li Auto (LI), NIO (NIO), and XPeng (XPEV). Of course, that stands in contrast to the bold proclamation of Volkswagen (OTCPK:VWAGY) CEO Herbert Diess in 2022 that the German automaker could be ahead of Tesla (TSLA) by 2025 and some of the bold talk from the Detroit auto players.

Electric vehicle investors are closely tracking the most recent revelations from Volkswagen (OTCPK:VLKAF), which said it was considering closing a large vehicle plant and a component factory due largely to competition from Chinese rivals. The troubles at the German automaker underscore long-standing concerns about how effectively traditional automakers, who thrived in the era of internal combustion, can compete as the industry transitions to electric options.

China is the best example of the struggles of the ICE legacy auto giants. Shenzhen-based BYD Company (OTCPK:BYDDF) is the clear electric vehicle market share leader in China, with more than 30% of the market on a year-to-date basis. The other major competitors are Tesla (TSLA), GAC Aion, SAIC Motor, Changan, Li Auto (LI), NIO (NIO), Geely Automotive (OTCPK:GELYF), XPeng (XPEV), and Great Wall Motor. Through EV partnerships, legacy players such as BMW (OTCPK:BMWYY), Volkswagen (OTCPK:VLKAF), Mercedes-Benz (OTCPK:MBGAF), General Motors (GM), Honda Motor (HMC), and Ford Motor (F) are also active in the Chinese market, but have failed, for the most part, to keep up with the growth rates of the domestic players even after investing hundreds of millions of dollars.

Looking ahead, there is a risk of tariffs and trade wars complicating the efforts of legacy ICE manufacturers even further to gain market share against their more nimble all-electric competitors.