Torsten Asmus

The Energy Select Sector SPDR Fund ETF (NYSEARCA:XLE), which tracks the energy sector, fell 4.5% in the second quarter of 2024, exactly opposite to the performance of the broader S&P 500 index (SP500), which rose 4.6% during the same period.

The fund, composed of companies that are into oil production, drilling, refining, and transportation, found itself among the worst-performing S&P 500 sectors for the one-month period, trailing down 0.62%.

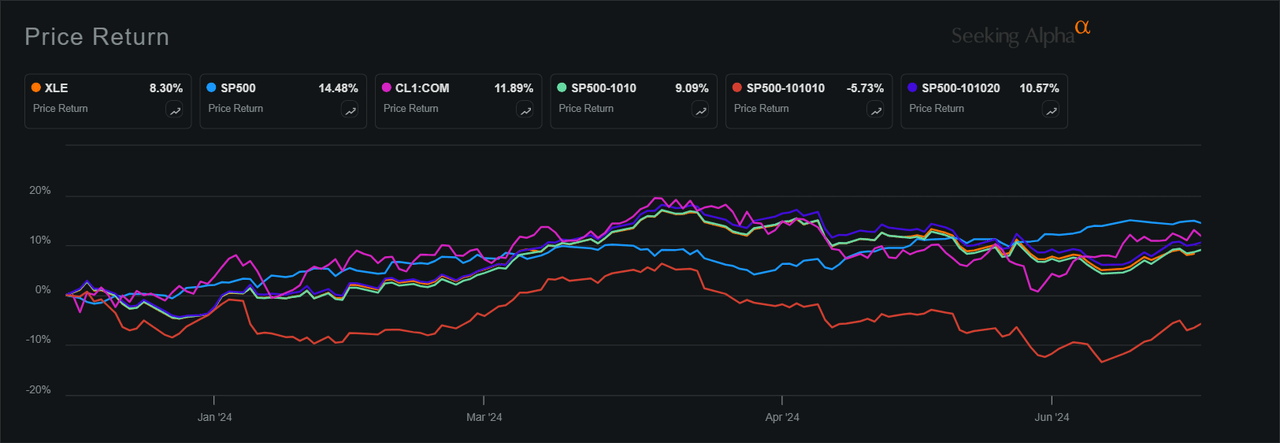

The ETF on a YTD basis, however, had risen 8.3% but was still far away from the near 15% rise in the benchmark index for the same period. Crude oil futures (CL1:COM) have risen 11.9%, while the S&P 500 Energy Index (SP500-1010) has risen 9.1% to date.

Within the index, the Energy Equipment & Services Index (SP500-101010) fell 5.7%, while the Oil, Gas, and Consumable Fuels Index (SP500-101020) rose 10.6% to date.

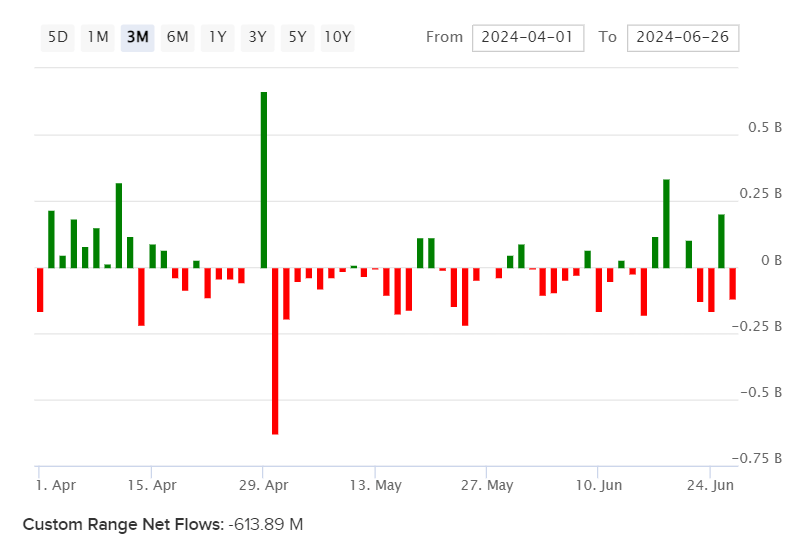

U.S. stock fund flows into and out of the energy sector have been in the red for most weeks in the second quarter of 2023. The energy-focused ETF has had a net outflow of $613.89 million for the quarter.

Image Source: etfdb.com

Top movers YTD

- Gainers:

- Targa Resources (TRGP) +48%

- Diamondback Energy (FANG) +31%

- Williams (WMB) +22%

- Valero Energy (VLO) +21%

- Marathon Oil (MRO) +19%

- Losers: APA Corp. (APA) -18%

- SLB (SLB) -9%

- Halliburton (HAL) -7%

- EQT Corp. (EQT) -4%

- ConocoPhillips (COP) -1%

What Quantitative Measures Say

XLE has a Buy rating from Seeking Alpha’s Quant Rating system with a score of 4.05 out of 5, supported by A+ in liquidity and A in the expenses category. The ETF got an A- for momentum. However, it got a B+ for dividends and a D- for risks.

What Analysts Say

Seeking Alpha contributor JR Research said in their June 14 report that XLE’s solid “B+” momentum grade underscores the robustness of its buying sentiment. They added that the recent pessimism doesn’t suggest a significant trend reversal into a downtrend bias. XLE’s relatively attractive dividend yield of 3.3% should attract income investors as the Fed moves closer to cutting interest rates.

“The energy sector’s earnings growth estimates aren’t falling off a cliff. The stakeholders have remained disciplined in their production capacity, helping to keep crude oil prices relatively high. As seen with the dip-buying confidence… Saudi Arabia’s influence cannot be understated. The growth normalization in EVs underscores the complexities of the energy transition thesis. To bolster the energy requirements of the AI upcycle, more robust data center growth estimates will likely require the participation of all energy players. In other words, I have not assessed sufficient structural weakness in the energy sector’s thesis to convince me to change my bullish assessment of its growth prospects,” they said in the report. The author has maintained a “Buy” rating for the fund.