aluxum

Marko Kolanovic, JPMorgan Chase’s (JPM) former chief global markets strategist, on Tuesday highlighted some of the issues facing the economy and Wall Street today.

JPMorgan (JPM) in early July said Kolanovic was “exploring other opportunities” after nearly two decades at the bank. Kolanovic was the chief global markets strategist and co-head of global research.

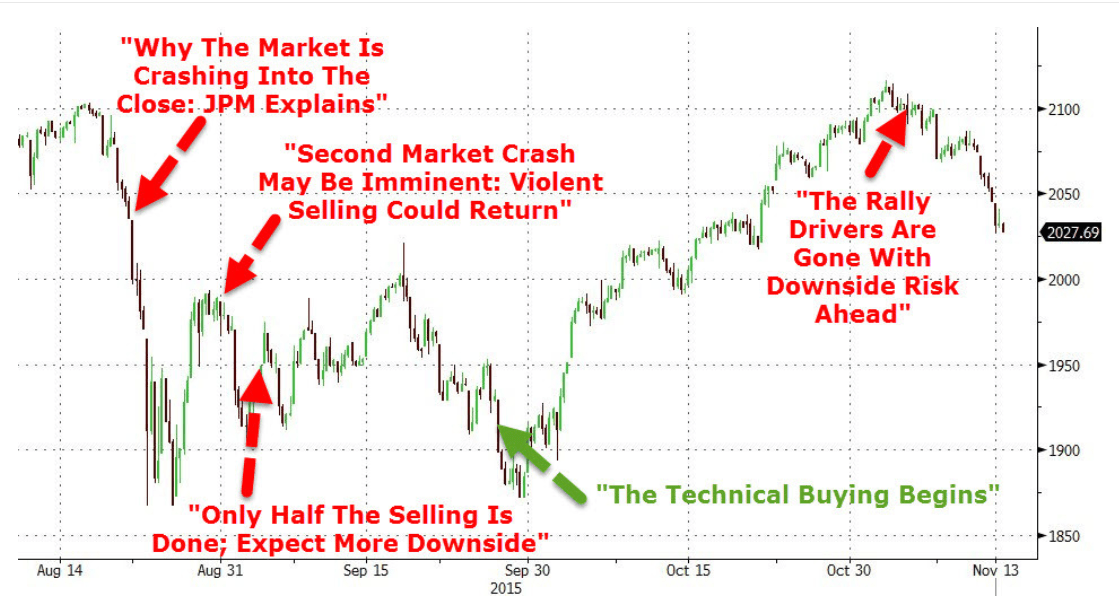

Kolanovic shared a chart on X (formerly Twitter) depicting a breakdown of a selloff in the S&P 500 (SP500) from August to September 2015, in which the benchmark index slipped 10.5%. The chart also depicts the subsequent rebound into November. See below:

“August 2015 selloff. Today, there are different issues (U.S. election risks, major wars, YC inversion, Sahm rule, Ch11 filings/credit cards…),” Kolanovic said.

Today, the S&P 500 (SP500) has been on a downward trajectory since the June consumer price index report published on July 11. The gauge has shed 2.69% up to its last close in that period, and is 4.11% lower from its record close.

In his time with JPMorgan (JPM), Kolanovic perhaps became infamously known for his conflicting stock-market calls over the past two years which differed significantly from Wall Street’s actual performance.

Kolanovic was consistently bullish on U.S. equities for much of 2022, a year in which the benchmark S&P (SP500) slumped nearly 20%. The analyst turned bearish towards the end of the market bottoming out, and remained firmly so even as the S&P (SP500) rebounded almost 25% in 2023 and advanced more than 14% in H1 2024.

Here are some exchange-traded funds that track the benchmark S&P 500 (SP500): (SPY), (VOO), (IVV), (RSP), (SSO), (UPRO), (SH), (SDS), and (SPXU).