Richard Drury/DigitalVision via Getty Images

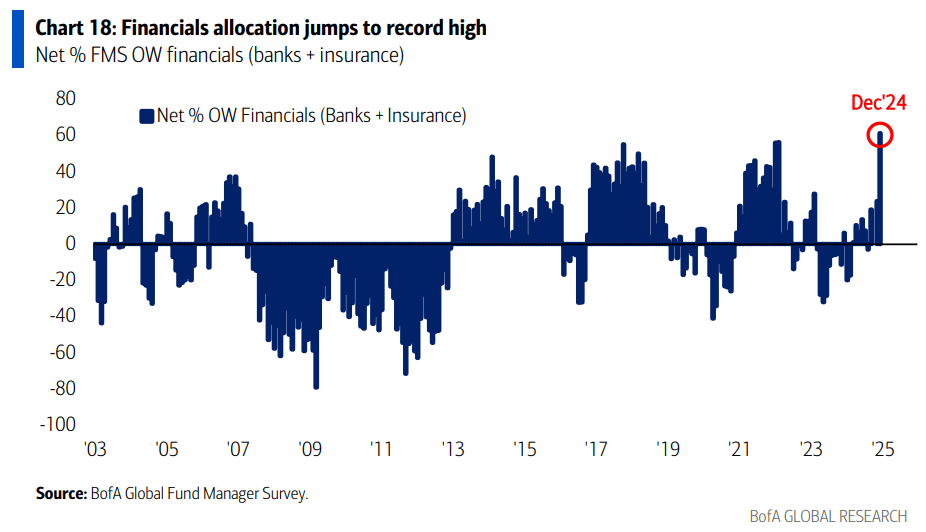

Allocation to financial stocks (NYSEARCA:XLF) reached an all-time high in December, according to BofA Securities’ Global Fund Manager Survey.

The net percentage of overweight banks (KBE) soared 23 percentage points month-over-month to net 41% overweight, the biggest monthly increase on record and the most overweight since January 2022.

Meanwhile, allocations to insurance stocks (KIE) rose 15 percentage points month-over-month to a net 20% overweight, the most since February 2014.

Top-rated bank stocks by Seeking Alpha quant metrics:

- Wells Fargo & Co. (WFC) – Quant rating: 4.92

- Third Coast Bancshares (TCBX) – Quant rating: 4.87

- The PNC Financial Services Group (PNC) – Quant rating: 4.84

- Northeast Community Bancorp (NECB) – Quant rating: 4.83

- Unity Bancorp (UNTY) – Quant rating: 4.81

- First Savings Financial Group (FSFG) – Quant rating: 4.80

- M&T Bank Corp. (MTB) – Quant rating: 4.79

- Private Bancorp of America (OTCQX:PBAM) – Quant rating: 4.78

- First United Corp. (FUNC) – Quant rating: 4.74

- East West Bancorp (EWBC) – Quant rating: 4.73

Top-rated insurance stocks by Seeking Alpha quant metrics:

- Kingstone Companies (KINS) – Quant rating: 4.98

- Root (ROOT) – Quant rating: 4.93

- Trupanion (TRUP) – Quant rating: 4.88

- The Allstate Corp. (ALL) – Quant rating: 4.88

- Hippo Holdings (HIPO) – Quant rating: 4.88

- The Progressive Corp. (HIPO) – Quant rating: 4.79

- The Travelers Companies (TRV) – Quant rating: 4.78

- United First Group (UFCS) – Quant rating: 4.78

- American Coastal Insurance (ACIC) – Quant rating: 4.77

- Mercury General Corp. (MCY) – Quant rating: 4.77