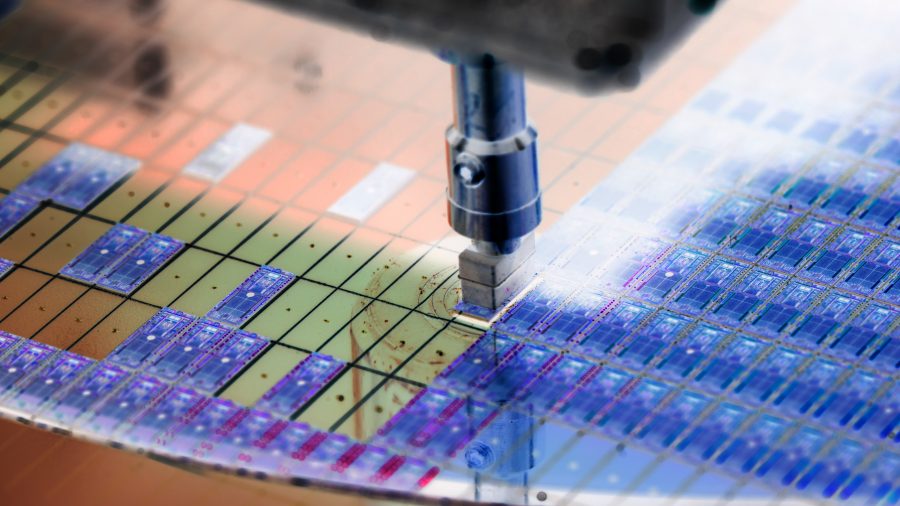

MACRO PHOTO/iStock via Getty Images

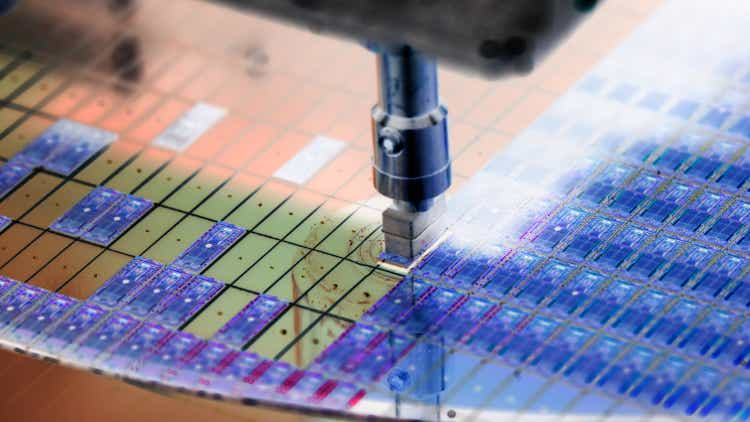

The global semiconductor foundry market saw a 13% year-over-year increase in revenue in the first-quarter to hit $72.29B, Counterpoint Research said, driven largely by ever-rising demand for artificial intelligence processors.

Of that, Taiwan Semiconductor (NYSE:TSM) was able to capture 35% of the expanded market in the first-quarter, due in part to its lead in 4nm and 3nm processing nodes and advanced packaging technologies, such as chip-on-wafer-on-substrate, Counterpoint added.

However, the outsourced semiconductor assembly and test part of the market is seeing “modest” growth at 7%, though companies like ASE Group, SPIL, and Amkor (AMKR) continue to benefit from AI advanced packaging spillovers, Counterpoint added.

“TSMC leads the pack, with its market share growing to 35% and achieving YoY revenue growth of mid-30% thanks to its dominance in leading-edge processes and high-volume AI chip orders,” Counterpoint associate director Brady Wang said. “Intel (INTC) and Samsung (OTCPK:SSNLF) Foundry trail behind, with Intel gaining traction via 18A/Foveros and Samsung facing yield challenges despite 3nm [gate-all-around] development.”

Separately, companies such as NXP Semiconductors (NXPI), Infineon (OTCQX:IFNNY) and Renesas are still dealing with “softness” in the automotive and industrial parts of the market. Henceforth, any type of “sustained recovery” in that part of the semiconductor industry is not likely to happen until at least the second-half of the year, Counterpoint added.

More on Taiwan Semiconductor

- The CoWoS Chokepoint: TSMC’s Quiet Monopoly On AI Memory Bandwidth

- TSMC’s AI Bet Pays Off

- Taiwan Semiconductor Is Valued Like It’s Late 2019 Again

- Apple, Qualcomm likely to launch 2nm chips next year, built by Taiwan Semi: Counterpoint

- U.S. plans to revoke waivers for allies’ chip plants in China: report