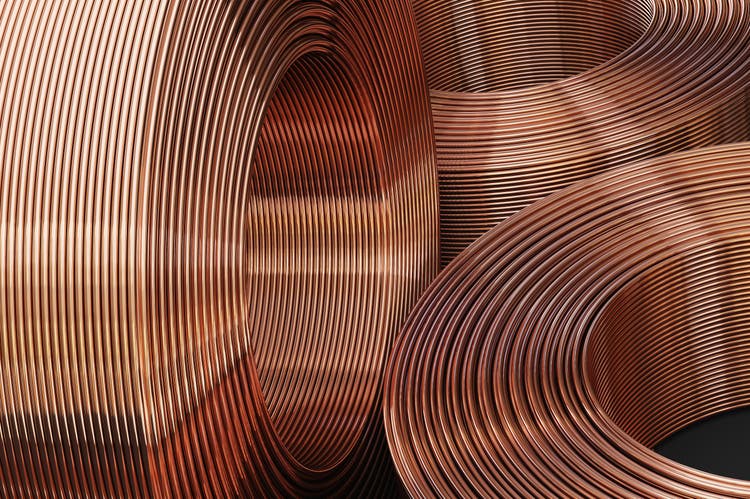

SimoneN/iStock via Getty Images

Freeport McMoRan (NYSE:FCX) +7.1% in Tuesday’s trading, surging to the top of the S&P 500 leaderboard, as China’s new stimulus measures announced in support of its economy and equity markets are lifting commodities of all kinds, including crude oil.

The People’s Bank of China said in a rare public briefing that it would cut a short-term interest rate, reduce the amount of capital banks are required to hold in reserve, and provide other measures to support China’s struggling housing sector and equity market – as policymakers make their broadest swing so far to hit this year’s 5% growth target.

The moves helped lift copper prices (HG1:COM) more than 3% to a 10-week high, aided by expectations of improving demand in top consumer China, and iron ore futures (SCO:COM) on China’s Dalian Commodity Exchange posted their best intraday gain in more than a year.

Among other big gainers among global miners: Hudbay Minerals (HBM) +7.6%, Alcoa (AA) +7.2%, Southern Copper (SCCO) +7.1%, Vale (VALE) +6.4%, Century Aluminum (CENX) +5.8%, Rio Tinto (RIO) +4.9%, BHP (BHP) +4.7%, Teck Resources (TECK) +3.5%.

Also: Glencore (OTCPK:GLCNF) (OTCPK:GLNCY), Anglo American (OTCQX:AAUKF) (OTCQX:NGLOY), Fortescue (OTCQX:FSUMF)

ETFs: (COPX), (CPER), (OTC:JJC)

Most steelmakers are rallying, including Cleveland-Cliffs (CLF) +7.4%, Steel Dynamics (STLD) +3.8%, Nucor (NUE) +3.1%, but US Steel (X) +0.3%.

Lithium miners also are up sharply, including Lithium Americas (LAC) +7.6%, Arcadium Lithium (ALTM) +5.6%, Sigma Lithium (SGML) +5.6%, SQM (SQM) +4.9%, Albemarle (ALB) +4.3%.