Gold (XAUUSD:CUR) has staged a blistering rally in 2025, notching multiple record highs as investors responded to factors including a U.S. government shutdown, heightened geopolitical tensions, and optimism around interest rate cuts, turning to the metal as a traditional hedge against economic uncertainty.

While no bull run lasts forever, the foundations of gold’s ascent – particularly the structural shift in private and official sector demand – suggest that price risks remain skewed to the upside over the next 12 months in the face of ongoing global uncertainty, UBS said in a recent note.

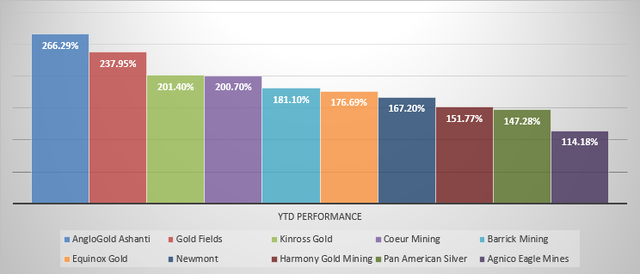

Spot gold (XAUUSD:CUR) is up 65% year-to-date, poised for a fifth consecutive month of gains. In comparison, top-performing large-cap gold stocks have delivered three-digit returns, with the leading four rising over 200% YTD.

Year-to-date, here are the top-performing large-cap stocks, illustrated in charts.

Seeking Alpha

And as gold mining stocks begin to deliver far stronger returns than bullion, below is a curated list of the top 10 gold stocks of 2025.

- AngloGold Ashanti (AU) — +266.29% YTD | Quant Rating: 4.92

- Gold Fields (GFI) — +237.95% YTD | Quant Rating: 4.97

- Kinross Gold (KGC) — +201.40% YTD | Quant Rating: 4.96

- Coeur Mining (CDE) — +200.70% YTD | Quant Rating: 4.95

- Barrick Mining (B) — +181.10% YTD | Quant Rating: 4.97

- Equinox Gold (EQX) — +176.69% YTD | Quant Rating: 4.96

- Newmont (NEM) — +167.20% YTD | Quant Rating: 4.97

- Harmony Gold Mining (HMY) — +151.77% YTD | Quant Rating: 4.88

- Pan American Silver (PAAS) — +147.28% YTD | Quant Rating: 4.94

- Agnico Eagle Mines (AEM) — +114.18% YTD | Quant Rating: 4.84

Here are some Gold and Gold Miner ETFs: (NYSEARCA:GLD), (IAU), (SGOL), (OUNZ), (BAR), (NYSEARCA:GDX), (GDXJ), (NUGT), (RING), and (DUST).