Sean Gallup/Getty Images News

Google’s (NASDAQ:GOOG) (NASDAQ:GOOGL) years-long dominance over the $300 billion search advertising market faces growing threats from newer rivals such as artificial intelligence and social video.

ByteDance’s (BDNCE) TikTok, the short-form video platform that says it has 170 million users in the United States, recently gave brands a way to target consumers based on their search queries, directly challenging Google’s biggest source of revenue, The Wall Street Journal reported Sunday.

Another threat is coming from Perplexity AI, a search venture backed by Amazon (NASDAQ:AMZN) founder Jeff Bezos. The platform this month will show ads alongside answers generated by AI. Previously, Perplexity relied on subscription revenue for its higher-powered AI capabilities.

Perplexity AI’s valuation was about $3B after a funding round this summer that also included SoftBank. That’s compared to nearly $160B for OpenAI and $24B for Elon Musk’s xAI, according to CrunchBase.

Amazon for years has been making inroads into the search-ad market, with studies showing that a significant number of product searches start on the e-commerce platform, completely bypassing Google.

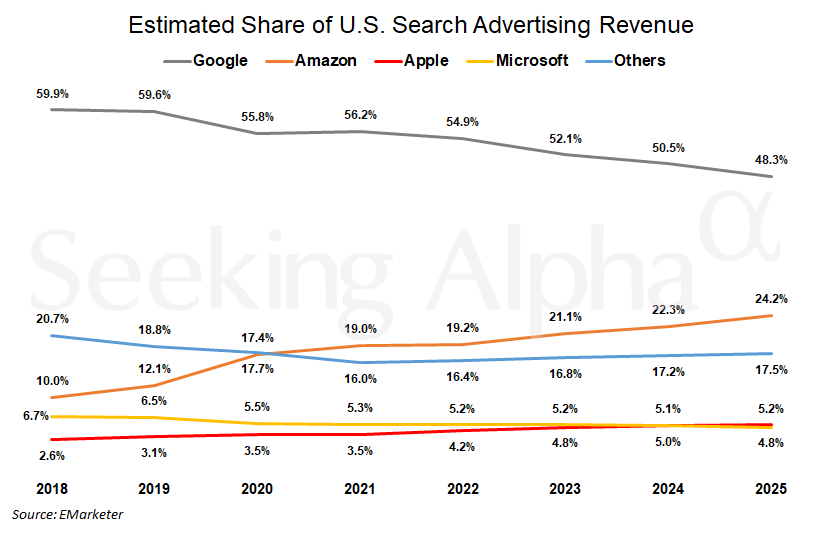

The search giant’s share of the U.S. search ad market next year will fall below 50% for the first time in more than a decade, according to a forecast from research firm eMarketer.

Microsoft (NASDAQ:MSFT), which is the big backer of Open AI, has inserted ads in AI-generated answers on a limited basis, and introduced sponsored links and comparison-shopping ads for a Bing chatbot, the Journal said. Meta (NASDAQ:META) could benefit with Meta AI in the Facebook search bar and through its WhatsApp and Instagram apps. Apple (NASDAQ:AAPL) could also look to advertising within Apple Intelligence, which is a feature of the iPhone 16 line.

The overall search ad market is still expanding as brands seek to reach consumers who provide clues about their shopping plans with their search queries. But Amazon’s 17.6% growth will exceed Google’s 7.6% next year, eMarketer forecasts.

Of course that pursuit of ad dollars will further ramp up the already huge demand for AI processing power, benefiting chip companies like Nvidia (NVDA), Broadcom (AVGO), Taiwan Semi (TSM) and ASML (ASML).