JHVEPhoto/iStock Editorial via Getty Images

Bank of America is positive on Hasbro(NASDAQ:HAS) ahead of the holiday season. Following recent store visits, the firm believes the toy giant’s store presentation and shelf space has improved, led by Play Doh end cap presentations at Target (TGT) and Walmart (WMT), as well as a strong assortment of Beyblade with some stock outs evident. Retailers were also noted to have a nice display of Transformers product to complement the movie release on September 14 and also now appear to be carrying Monopoly Go! physical board game following its release on August 1. “We believe inventory levels are clean and HAS is not seeing any pushback following back-to-school,” highlighted analyst Alexander Perry.

Channel checks from Bank of America suggest strong momentum in demand for Hasbro’s (HAS) recent Magic sets. The firm believes that the recent Bloomburrow set release has sold very well, and has helped bring new players into the game, due in part to simpler mechanics, the approachable, and charming/whimsical art.

Google trends suggest peak search interest for Bloomburrow was ~70% higher than Modern Horizons 3, and both sets had higher search interest to Wilds of Eldraine & Commander Masters released in Q3 of last year. “Additionally, we believe there is strong player excitement for the upcoming Duskmourn set release, with Google search interest already surpassing Modern Horizons 3,” highlighted BofA. The analyst team hiked is Q3 EPS estimate of Hasbro (HAS) to $1.27 from $1.14 to reflect stronger Magic growth. BofA’s price objective on Hasbro (HAS) was raised to $9, based on a multiple of 18X to 19X on the 2025 EPS estimate.

Recent industry data for Monopoly Go! was also positive, suggesting a 4% increase in net app revenue in August, led by an increase in revenue per user.

Bank of America has a Buy rating on Hasbro (HAS) as it sees benefits from the shift to gaming/digital gaming alongside a turnaround in the consumer products segment. Positive 2025 earnings drivers for Hasbro (HAS) called out include a full year of royalties beyond minimum guarantees for Monopoly Go!, a return to growth for Magic given Final Fantasy & Marvel sets, and a return to low single-digit consumer product growth as the toy industry returns to more normalized levels.

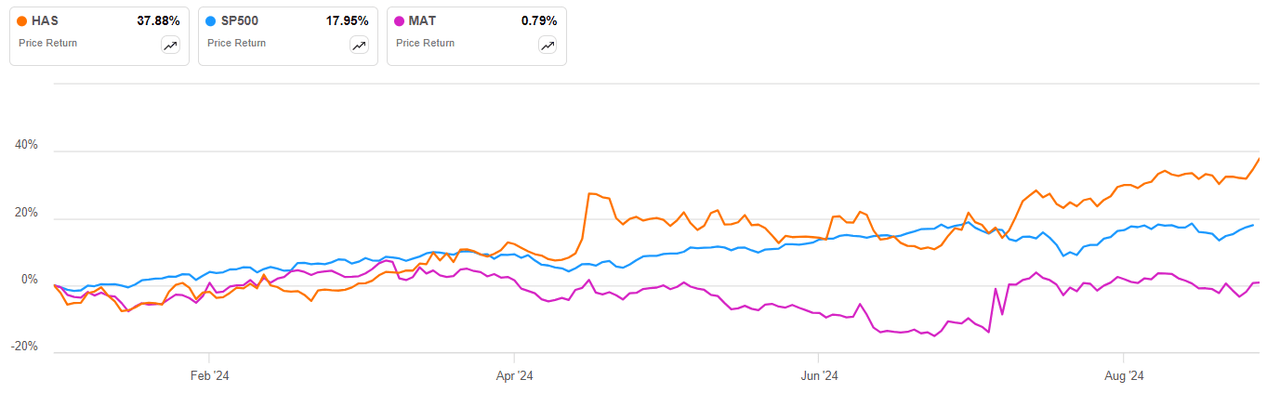

Shares of Hasbro (HAS) were up 2.25% in late morning trading on Monday. The toy stock has outperformed the broad market and rival Mattel (MAT) in 2025.

Last week at the Goldman Communacopia Conference, Hasbro (HAS) CEO Chris Cocks said the toy giant sees more growth opportunity in the digital side of the company as the business of play extends to older ages than in the past. He also said partnerships are also significant and are a key part of Hasbro’s (HAS) strategy. In terms of digital play, Hasbro (HAS) thinks it has a ten-year lead over competitors.

More on Hasbro

- Hasbro’s Q2 2024: Digital Dominance Amid Traditional Toy Challenges

- Hasbro, Inc. 2024 Q2 – Results – Earnings Call Presentation

- Hasbro, Inc. (HAS) Q2 2024 Earnings Call Transcript

- Hasbro expresses confidence in digital business, holiday season during conference presentation

- Dividend Roundup: Walmart, Home Depot, Chevron, Hasbro, and more