nespix

Google parent Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL) will anchor this week’s run of major tech names including Apple (AAPL) reporting quarterly results, and Alphabet’s update could spark a jump in Big Tech stocks, according to hedge fund manager Dan Niles.

Alphabet (GOOG)(GOOGL) will release its Q3 report late Tuesday, followed by fellow Magnificent 7 constituents Meta (META) and Microsoft (MSFT) on Wednesday, and Amazon (AMZN) and Apple (AAPL) on Thursday. Alphabet (GOOG)(GOOGL) leading the rollout this week is “important” in setting expectations, Dan Niles, founder and portfolio manager of Niles Investment Management, said in a post on X (formerly Twitter) on Monday.

Google “may report a solid Q3 with solid Google Cloud results helped by strong political ad spend,” he said, recalling Alphabet’s (GOOG)(GOOGL) stock slide after its Q2 report in July and other pressure points that have led the stock since then to lag in performance against the S&P 500 (SP500) and the Mag 7 group.

Risk lies in the company providing “qualitative commentary,” he said. “However, taken in total, I think the Google results will spark a relief rally especially if there is no qualitative forward guidance,” Niles said. He said risk in qualitative commentary may lie in:

- The U.S. presidential election divert consumer attention from spending as much time online and

- Thanksgiving landing on November 28th this year vs. the 23rd in 2023, leaving fewer days between Black Friday and Christmas for online shopping ads.

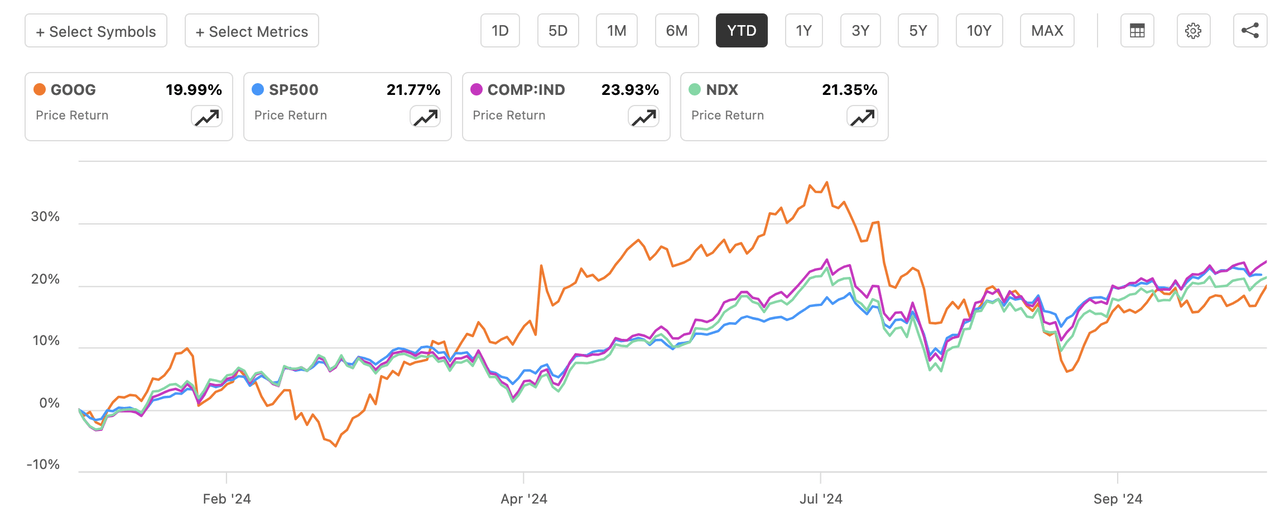

Alphabet (GOOG)(GOOGL) stock has declined 9.8% since the Q2 report through Friday. The company beat Q2 top- and bottom- line estimates, but its stock fell 5% the day after the report that included a miss in YouTube revenue expectations. Niles noted during that period, the S&P 500 (SP500) had gained 7% and Mag 7 stocks had risen 11%, on average.

Niles said ad strength at Google (GOOG)(GOOGL) has implications for META (META) ad revenue, and Google Cloud growth has implications for Microsoft’s (MSFT) cloud computing platform Azure and Amazon’s (AMZN) Web Services business.

“Google’s Traffic Acquistion Cost has implications for (AAPL) services revenues though this is much less important than iPhone results,” Niles said.

This year, Alphabet (GOOG)(GOOGL) shares were up ~19% and the S&P 500 (SP500) has climbed 22%. The tech-concentrated Nasdaq Composite (COMP:IND) has risen 24% this year, and the Nasdaq-100 (NDX) has bulked up 21%.

Investors seeking to track equities through ETFs, S&P 500 (SP500) ETFs include (SPY), (RSP) (SH), (VOO), and (IVV). Nasdaq ETFs include (QQQ), (TQQQ), and (SQQQ).