ekapol

With 12 days left to trade in 2024, Goldman Sachs’s tactical specialist Scott Rubner said the market backdrop of positive flows keeps the bar high for investors to be bearish.

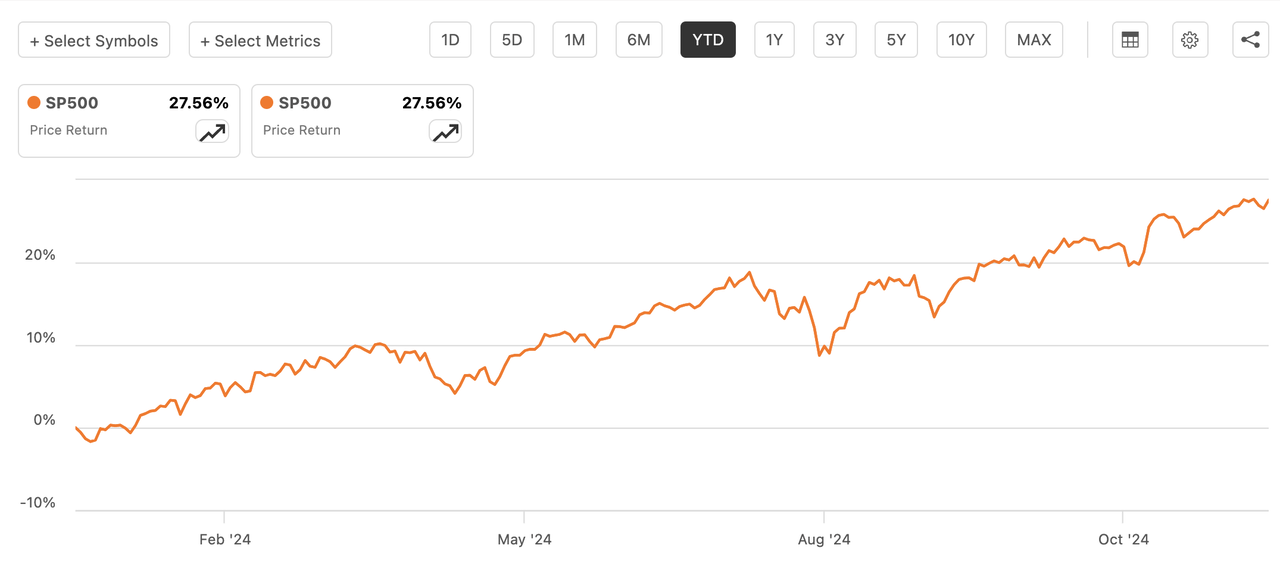

The equity benchmark S&P 500 (SP500) has surged +27% this year and there’s still potential for further growth, Rubner indicated in his flow-of-funds note published Thursday.

“We are entering the best seasonals of the year for U.S. equities,” he said, dashing in a sprinkle of caution. “I am looking to fade the equity market in the second half of January as risk of overshooting remains high.”

In the vein of the seasonal classic “The Twelve Days of Christmas,” here’s a look at Rubner’s rundown of positive flows:

12. Twelve handle vol-ing:

“Volatility is no longer a coach on the sidelines – it is the quarterback calling the plays from the huddle,” Rubner said. “As a result of lower implied volatility, we have seen significant re-leveraging from Vol-Target, CTA, and Risk Parity strategies.”

11. Eleven Trillion passive flow-ing:

$11.73T is the current tally of passive assets under management. Inflows of +186B into U.S. stocks over the last nine weeks has been the largest since February 2021.

10. Ten Billion Gamma muting:

The strategist said 2024 was a market of long index gamma which helped mute any material moves. Index desks were short gamma only twice, where moves were to be exacerbated, most notably on August 5th. “This has helped buffer any persistent weakness and created ‘buy the dip’ flow.”

9. $9 Trillion AUM is in money markets

Money markets have drawn in +$992B worth of inflows YTD. A move of just ~1% out of money markets represents a hefty $90B worth of rotational flow.

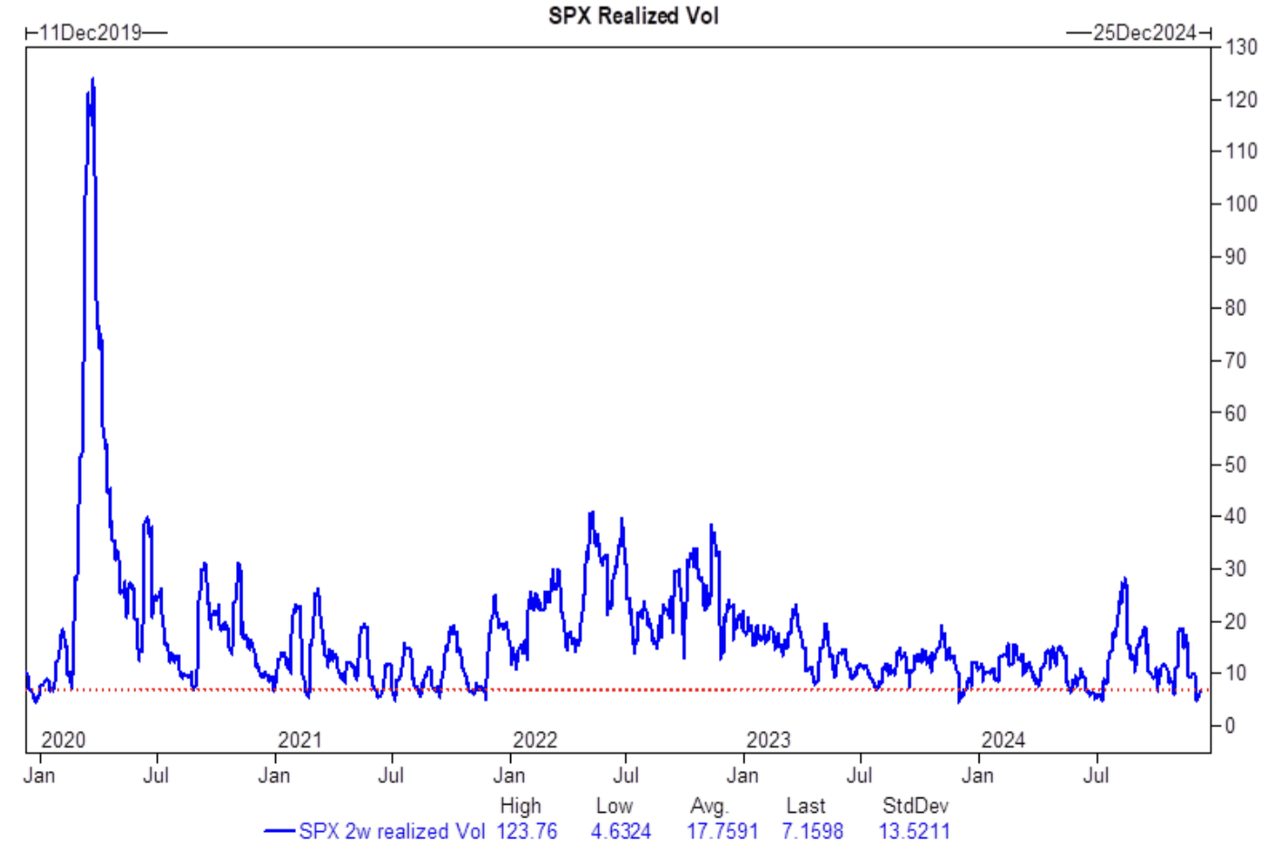

8. Eight realized vol a-grinding:

Rubner said two week S&P 500 realized vol is 8%. “I dropped in the red line on this chart – it pretty much doesn’t get lower than this,” he said of the chart below:

7. Seven magnificent stocks a-rising:

A basket of the Magnificent 7 stocks – Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL), Meta (META), Nvidia (NVDA), Microsoft (MSFT), and Tesla (TSLA) – is up +50% versus the S&P 500’s (SP500) +27% advance. That also towers a 20% rise in the benchmark’s other 493 stocks. “Impressive” has been the Mag7’s rise in the past 10 sessions, he said.

6. Six Thousand hats a-tossing:

The strategist said he’s ordered a “SPX 7K hat” with the S&P 500 (SP500) conquering the 5,000- and 6,000-points levels in 2024 alone.

5. Five crypto coins:

“Dear crypto friends – welcome to passive flows and congrats on the ETF’s,” Rubner said, following a banner year for bitcoin (BTC-USD). The cryptocurrency surpassed $100,000 this month for the first time and has soared +128% in 2024. Altcoin ethereum (ETH-USD) has jumped +66%.

4. Four years of Trump:

President-elect Donald Trump will be back in the White House in 2025. Rubner said there are three trades his desk likes upon his return: deregulation, financial beneficiaries, and small business activity. He called out three ideas: (GSXUDREG), (GSFINWIN) and (GSXUSMBB).

3. Three Trillion market-caping:

Allocate $1 into the S&P 500 ETF into a 401K retirement account, and 33 cents get allocated into the top seven stocks, a record high, the strategist said. Also, the Magnificent 7 stocks represent a record 33% weight in the S&P 500 (SP500).

2. Two turtle dovish cuts:

The Federal Reserve looks set to deliver another rate cut of 25 basis points at its meeting next week, with more on deck in 2025. “What’s priced in? Seems like a lot of bonds to buy if yields move lower. Also the move is moving lower,” he said:

Dollar value of a basis point (DV01) over the next 1 week…

a. Flat tape: Buyers $17.44mm ($3.67mm into the US)

b. Up tape: Buyers $51.66mm ($18.23mm into the US)

c. Down tape: Buyers $0.57mm ($0.87mm into the US)

DV01 Over the next 1 month…

d. Flat tape: Buyers $21.59mm ($7.46mm into the US)

e. Up tape: Buyers $199.48mm ($96.10mm into the US)

f. Down tape: Sellers $62.87mm ($4.13mm into the US)

1. And a Santa rally in the S&P:

Investors are getting into the third-best two-week period of the year since 1928, followed by the best two-week period of the year since 1929.

Investors can track the S&P 500 (SP500) through ETFs including: (NYSEARCA:VOO), (NYSEARCA:IVV), (NYSEARCA:SPY), (SH), (RSP), and (UPRO).