David Ramos

Intel (NASDAQ:INTC) has rebuffed Arm Holdings (NASDAQ:ARM) after it showed interest in potentially acquiring its product division, with the troubled chipmaker insisting that the business is not for sale, a person with direct knowledge of the matter told Bloomberg.

Arm’s (ARM) high-level inquiry reportedly did not include interest in Intel’s (INTC) manufacturing operations. It’s unclear if talks are ongoing or have ended.

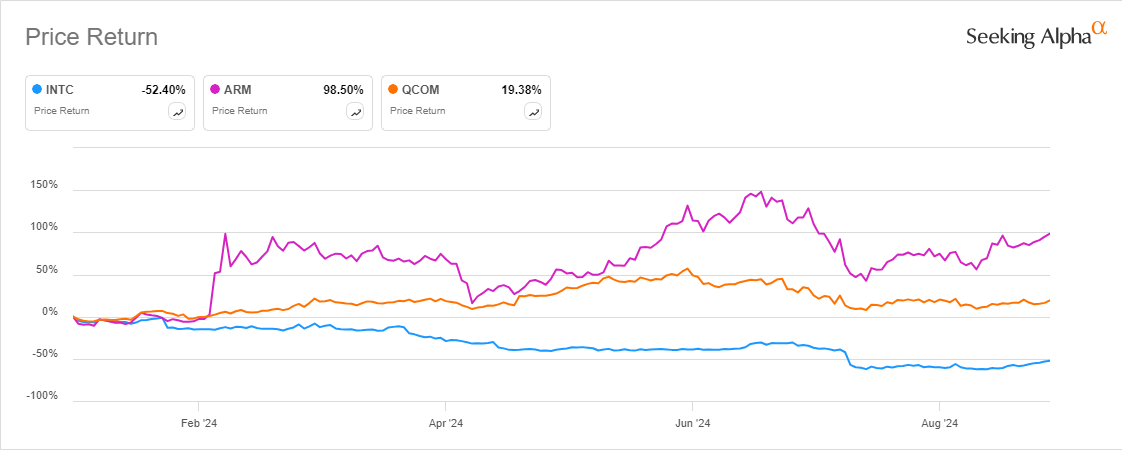

There has been a lot of takeover speculation surrounding Intel (INTC), with Qualcomm (QCOM) reportedly interested in buying a part of the company, or possibly a full takeover.

Intel (INTC) also reportedly received an investment offer of up to $5B from Apollo (APO), but analysts are not convinced this capital injection would be enough to save the company.

The chipmaker has been struggling to turn around its business amid dwindling profits and fierce competition. It has slashed its workforce, scaled back expansion plans and paused its dividend to cut costs.

Intel (INTC) is also weighing separating its chip product division from manufacturing operations. It is also looking to sell part of its stake in programmable chip unit Altera to private equity investors.

Take a look at the stock returns of Intel (INTC), Arm (ARM) and Qualcomm (QCOM) so far this year: