maybefalse

Intel’s (NASDAQ:INTC) recent slump could mean that the U.S. chipmaker may be replaced in the Dow Jones Industrial Average (DJI) after being a part of the blue-chip index for nearly a quarter of a century.

The company and Microsoft (MSFT) were the first two tech firms to join the 127-year-old index during the dot-com era in the late 1990s.

But Intel (INTC) has been struggling as its last earnings report raised concerns of its ability to turn around its business and prompted speculation that it may sell assets.

INTC slumped 8.8% to $20.10/share on Tuesday amid a broader chip stock decline, and has been trading near the lower end of its 52-week trading range ($18.84 -$51.28) for over a month.

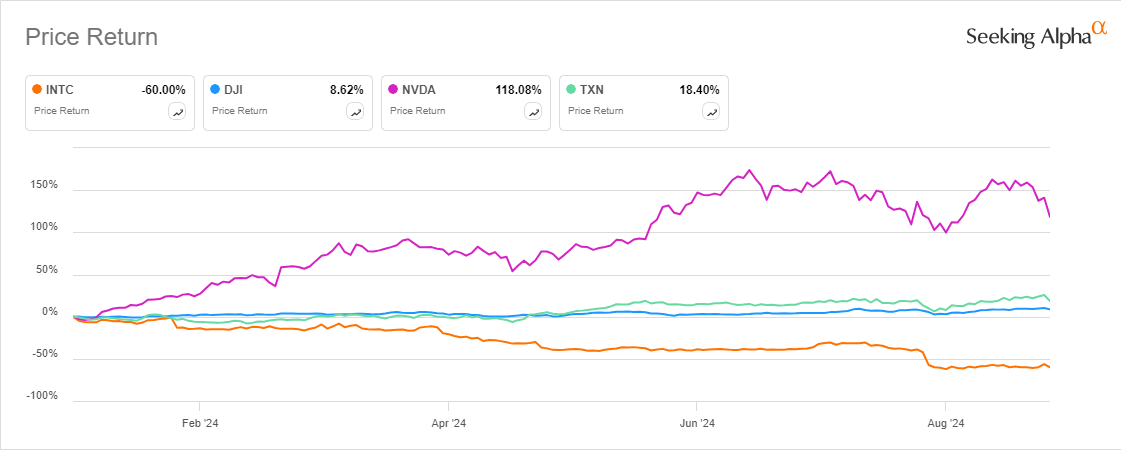

The stock, which lost more than half its value YTD, is the worst performer on the Dow (DJI) and has the lowest price in the index.

“Intel (INTC) being removed (from the Dow) was likely a long time coming,” Ryan Detrick, chief market strategist at Carson Group, told Reuters.

Dow (DJI) inclusions are decided after evaluating stock prices and whether the company helps the index maintain desired exposure to the sector. The last company to be added was Amazon (AMZN) in February, replacing Walgreens Boots Alliance (WBA).

Now the question is, which stock is well-positioned to replace Intel (INTC) in the Dow (DJI)?

The crowd favorite is Nvidia (NASDAQ:NVDA), which has been leading the AI wave and whose stock more than doubled in value this year. While some believe Nvidia is too volatile for the price-weighted Dow (DJI), its recent stock split likely made it the best candidate to give the index more AI representation.

Another potential candidate to replace Intel (INTC) in the Dow (DJI) is rival chipmaker Texas Instruments (NASDAQ:TXN), according to Daniel Morgan, senior portfolio manager, Synovus Trust. TXN has gained 18.4% this year.