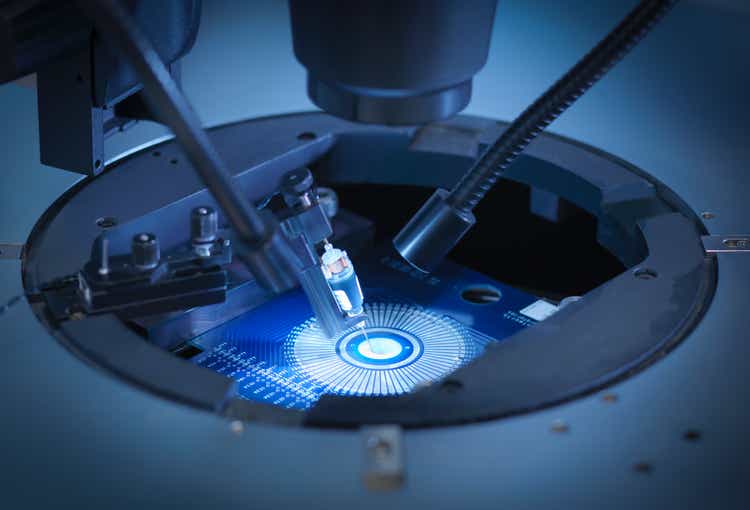

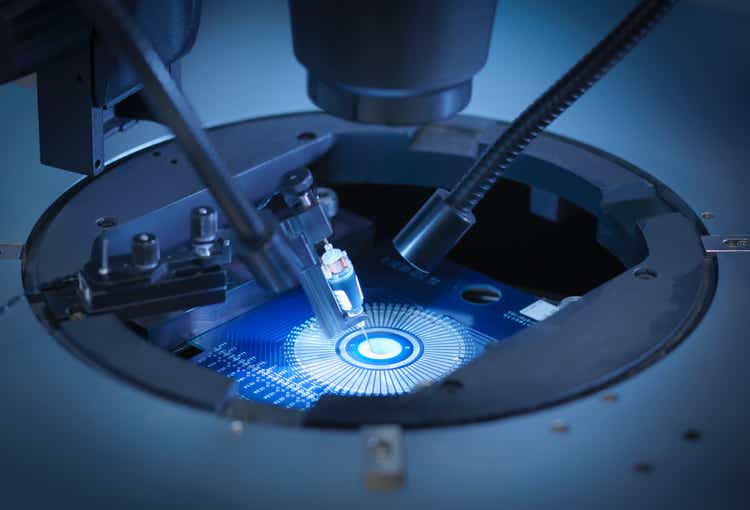

Monty Rakusen

Recent issues from Intel (INTC) and Samsung (OTCPK:SSNLF) are likely to negatively impact the semiconductor equipment market, with wafer fab equipment spending coming in lower-than-expected, investment firm Cantor Fitzgerald said.

“We are proactively cutting our official [wafer fab equipment] estimates to get ahead of this (removing CXMT/Swaysure spending entirely from CY25) and reflect other industry developments (i.e., continued TSMC strength, Intel pushouts, Samsung Taylor delays, ongoing NAND softness, etc.),” analysts led by C.J. Muse wrote in a note to clients.

The analysts now see 2025 wafer fab equipment spending at $105B, down from a prior outlook of $115B. They also tweaked their forecast for 2026 to be $115B, down from a prior range of $115B to $125B.

As such, they see earnings implications for Applied Materials (NASDAQ:AMAT), ASML (NASDAQ:ASML), KLA Corp. (NASDAQ:KLAC) and Lam Research (NASDAQ:LRCX).

Applied Materials is likely to earn $10 and $12 per share in fiscal 2025 and 2026, while ASML earns €30 and €34 per share, respectively. KLA Corp. should earn $32 and $37 per share, while Lam Research earned $38 and $46 per share, respectively.

There’s also been a re-rating in the stock, with the analysts weighing in on the debate of whether it’s temporary or permanent.

“On 1yr average multiples, all 4 stocks [AMAT, KLAC, LRCX, ASML] are cheap; but on 3yr and 5yr averages, AMAT, KLAC, and LRCX have considerable downside,” the analysts wrote. “Our sense is both — in that orders are bottoming and fundamentals will modestly recover in CY25 with even greater recovery into CY26. Yes, regulatory risk remains, but cyclically we are at the point where you are supposed to buy the group. Shares are likely range-bound into DOC/BIS announcement, but we suspect the sell-off in early September marked a bottom for Semi Cap.”

Cantor lowered its price target on ASML to €1,000, however, sentiment is “clearly way too negative” and that ASML is the stock to buy at current levels.

The investment firm also cut its target on KLA Corp. and Lam Research to $925 and $1,000, respectively. However, it kept its $250 price target on Applied Materials.

“The point — we think the group bottomed in 1H September, we likely could see more turbulence from DOC/ BIS over the next few weeks, but once downside certainty is set, the group is likely ripe to move higher once again,” the analysts added. “We think the majority of the bad news is baked into shares, and now is the time to cover shorts and begin to tactically add to positions.”