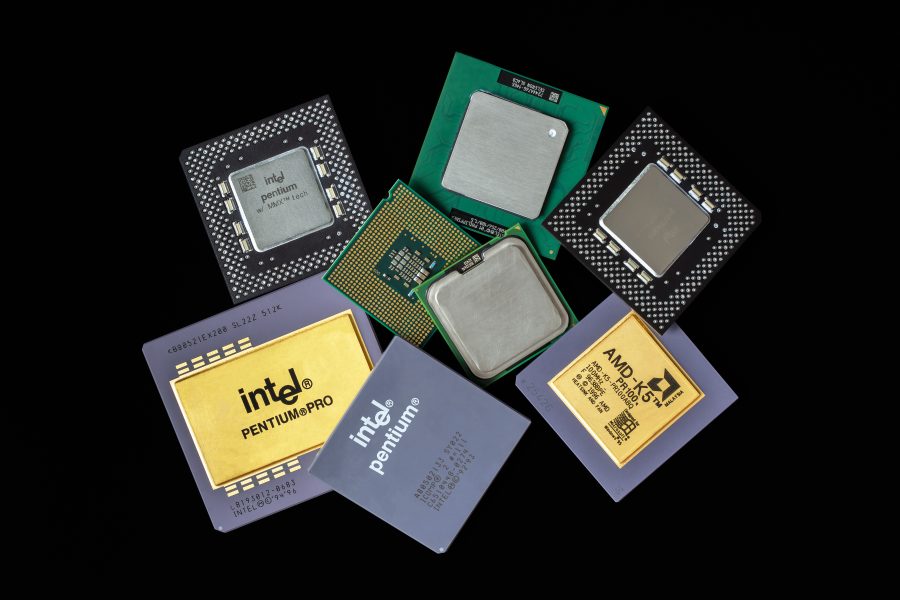

Andrei Berezovskii/iStock Editorial via Getty Images

Intel (NASDAQ:INTC) shares spiked 7.5% after Bloomberg reported the Trump Administration is considering the U.S. taking a financial stake in the chipmaker to help it expand domestic foundry plans.

The plan would help Intel develop a factory hub in Ohio, according to people familiar with the issue, the report said. At one point, Intel planned to develop the site into the largest chip foundry on the planet. There are no details on the amount the U.S. would invest in the company or even its legality as the plan remains “fluid.”

“We look forward to continuing our work with the Trump administration to advance these shared priorities, but we are not going to comment on rumors or speculation,” Intel said to Bloomberg.

The plan allegedly emerged from a meeting earlier this week between Intel CEO Lip-Bu Tan and U.S. President Donald Trump at the White House.

Although the plan sounds unorthodox, last month, the U.S. Department of Defense announced a public-private partnership with MP Materials (MP) to accelerate the build-out of an end-to-end U.S. rare earth magnet supply chain and reduce dependency on foreign sources.

Under the agreement, the Pentagon will become MP Materials’ largest shareholder after buying $400M of a newly created class of preferred shares that are convertible into MP Materials’ common stock. It will also buy a warrant allowing it to purchase additional common stock in the company.

Shares for MP Materials spiked 40% on the news.