Sundry Photography

Johnson & Johnson (NYSE:JNJ) is set to kick off the second quarter pharma earnings on Wednesday, with investors focusing on the drugmaker’s guidance amid U.S. President Donald Trump’s ongoing threats to impose tariffs on the sector.

The New Brunswick, New Jersey-based pharmaceutical giant is expected to post EPS of $2.68, implying a decline of 5%, while revenue is expected to rise 2% to $22.86 billion during the quarter.

President Trump this month reiterated his plans to impose tariffs on pharmaceutical goods, threatening to charge as much as 200% as levies on a sector that has largely been immune from his trade war. However, he did not specify the timing of the likely tariffs.

Earlier in April, J&J top boss Joaquin Duato said the tariffs can create disruptions in the supply chain, leading to shortages. The company provided its first forecast that accounts for tariffs, saying that it estimates tariff-related costs of about $400 million, which are primarily expected to impact its MedTech division.

J&J has gained 2% since its first-quarter results. Overall, the stock has risen 8% so far this year, compared to the 6.5% rise in the broader S&P 500 index.

Analysts are confident in the company’s pharmaceutical segment, given its strong cancer drug sales and a growing pipeline. Seeking Alpha analysts and Wall Street are bullish and rated the stock a Buy.

“JNJ’s largest division-Innovative Medicine, faces tough comps and margin pressure from STELARA erosion, but DARZALEX and TREMFYA could help ameliorate pressure,” pointed out a recent Seeking Alpha analysis by The Alpha Sieve. However, the analysis added that the second quarter could mark the weakest sales growth of the year.

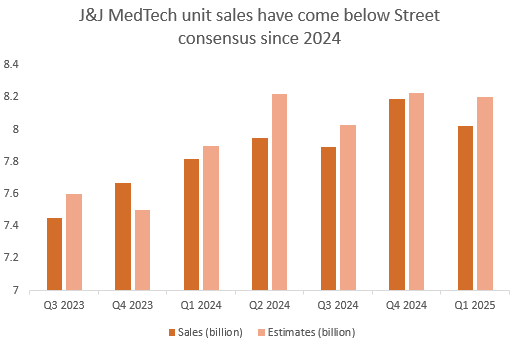

Market will also focus on how the healthcare company plans to navigate the softness in its MedTech division, especially since the business has been facing continued headwinds in the Asia Pacific, specifically in China.

Another Seeking Alpha analysis by Envision Research noted that there are certain downside risks related to the stock, including legal issues and higher tariff costs.

“Johnson & Johnson faces legal pressures from talc lawsuits, which are likely to create persisting growth and valuation headwinds,” the analysis said.

Seeking Alpha’s Quant rating considers the stock a Hold, dragged down by valuation and growth factor.

Over the last three months, EPS estimates have seen seven upward revisions, compared to eight downward revisions, while revenue estimates have seen 12 upward revisions versus one downward move.

The healthcare bellwether’s has shown a pretty impressive performance, with the company beating both EPS and revenue estimates 100% of the time over the last two years.

J&J MedTech Sales (Seeking Alpha)

More on Johnson & Johnson

- Johnson & Johnson: What To Expect From The Upcoming Q2 Earnings?

- Johnson & Johnson: Patience Will Be Rewarded

- Johnson & Johnson: Undervalued Dividend King With 65% Upside Potential

- Short bets against S&P 500 healthcare stocks climb in June; MRNA tops list again

- Earnings week ahead: JPM, BAC, GS, MS, C, JNJ, TSM, ABT, PEP, MMM, SLB, UAL, NFLX, and more