yuelan

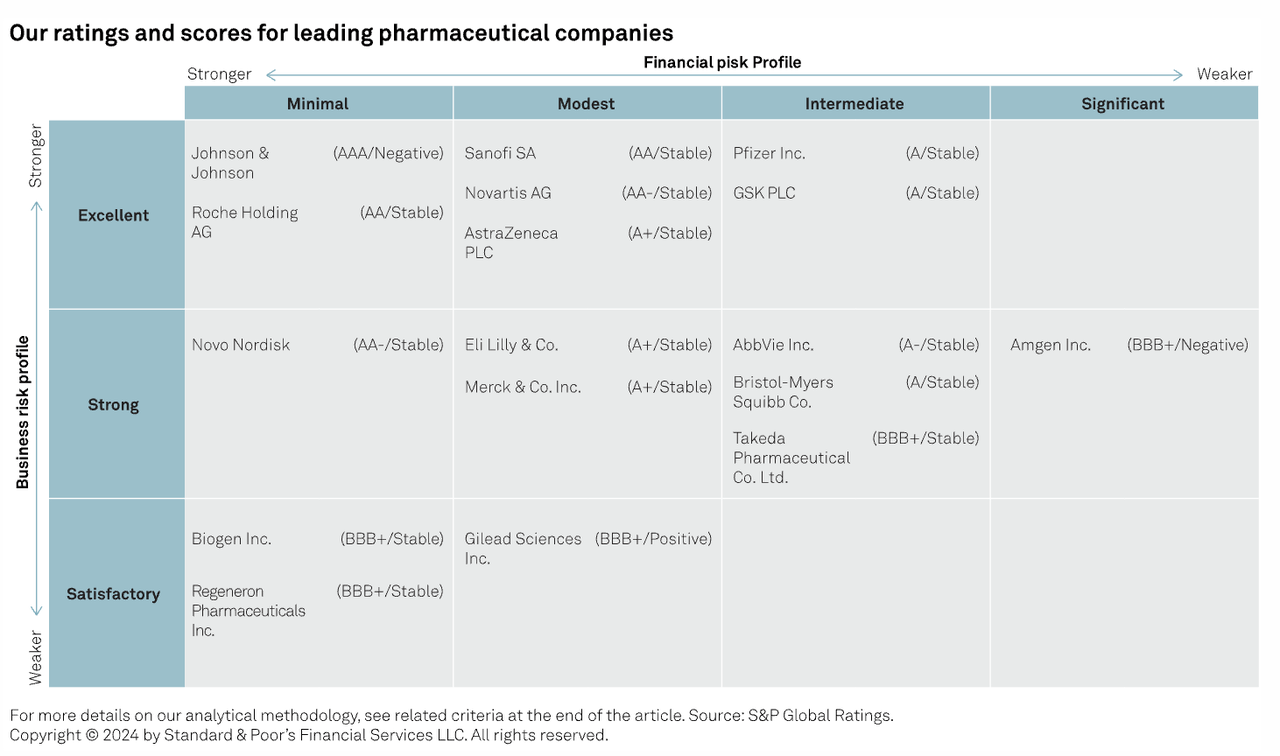

Johnson & Johnson (NYSE:JNJ) and Roche (OTCQX:RHHBY) are the strongest pharmaceutical companies, based on having the lowest business and financial risks among large drugmakers, according to a new S&P Global report.

J&J and Roche scored particularly well, respectively, in terms of scale and number of blockbuster meds compared to their peers.

S&P based its business strength rating on a number of factors including an assessment of competitive advantage (such as market position, barriers to entry, degree of competition); likelihood of sustaining revenue growth; scale, scope, and diversification (product, therapeutic, geographic, and customer); operating efficiency; and analysis of the stability of EBITDA margins.

“We place the greatest focus and weight on competitive advantage (derived from meaningful innovations) that is sustainable over the long term, reflecting the potential for premium pricing and product differentiation,” the report states. “We often base this evaluation on the amount of investment in R&D, track record of the R&D organization, strength of the pipeline and marketing products, and ability to sustain long-term revenue growth (even in the face of products losing exclusivity) and strong margins.

Novo Nordisk (NVO) was found to have a strong rating — the second best — in terms of business risk, while having a minimal risk — the best possible — for financial risk. Other top performing pharmas include Sanofi (SNY), Novartis (NVS) and AstraZeneca (AZN), which all were given a strong business risk profile with a modest — the second best — financial risk profile.

The assessment included 17 of the world’s largest drugmakers.

S&P noted that overall business strength for pharmas has somewhat decreased over the past few years “due to industry and regulatory developments.”

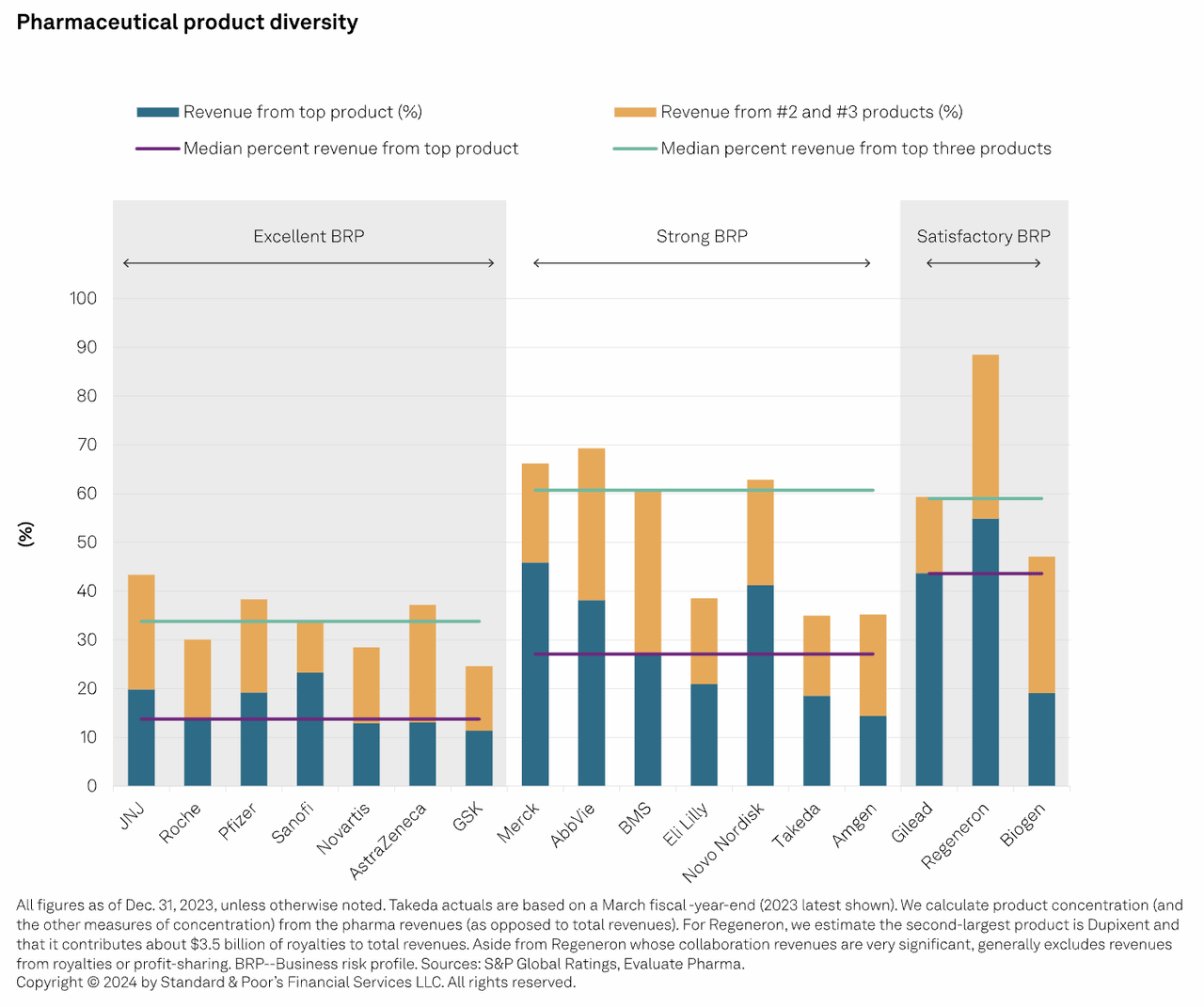

Interestingly, pharmas with the highest stock returns — at least year to date — were not listed among the strongest rates companies. This includes Eli Lilly (LLY), which is up ~58% year to date thanks to strong sales of its GLP-1 drugs for type 2 diabetes and weight loss, Mounjaro (tirzepatide) and Zepbound (tirzepatide), and Regeneron Pharmaceuticals (REGN) (up ~34% YTD), which benefits from continued strong sales of its VEGF inhibitor Eylea and Eylea HD (aflibercept) and the allergic diseases biologic Dupixent (dupilumab), which is marketed with Sanofi (SNY).

The report also listed the therapeutic areas with the largest seven-year compound annual growth rates going forward. They are gastro-intestinal (16.6%), dermatology (13.5%), oncology (9.8%), and cardiovascular (9.4%)

More on Johnson & Johnson, Roche

- Roche: A Long-Term Bottom May Have Been Struck (Technical Analysis)

- Roche Holding AG 2024 Q2 – Results – Earnings Call Presentation

- Roche Holding AG (RHHBY) Q2 2024 Earnings Call Transcript

- J&J expected to declare voting support for talc bankruptcy plan as early as Friday

- J&J makes headway in settling talc baby powder litigation: reports