Sundry Photography

Analysts and investors are increasing their interest in the home improvement sector after the Federal Reserve lowered benchmark interest rates for the first time in four years.

Lowe’s Companies (NYSE:LOW) tracked higher in early trading on Tuesday after Oppenheimer upgraded the home improvement retailer to an Outperform rating after having it set at Market Perform. The firm’s thesis is that lower interest rates following the FOMC action last week could help boost the stock.

Analyst Brian Nagel said the firm’s somewhat more constructive stance towards home improvement retail and shares of leading chains, Home Depot (NYSE:HD) and Lowe’s (LOW) is predicated on improved retail demand and compelling longer-term fundamentals. He also reminded investors that lower rates can help to drive up spending. “We undertook a proprietary analysis, studying prior Fed easing cycles, and impacts upon spending, particularly in home-related categories. Key takeaway: moderating rates tend to underpin stronger demand for home-related items, but often with a substantial lag,” he highlighted.

Oppenheimer assigned a price target of $305 to Lowe’s (LOW).

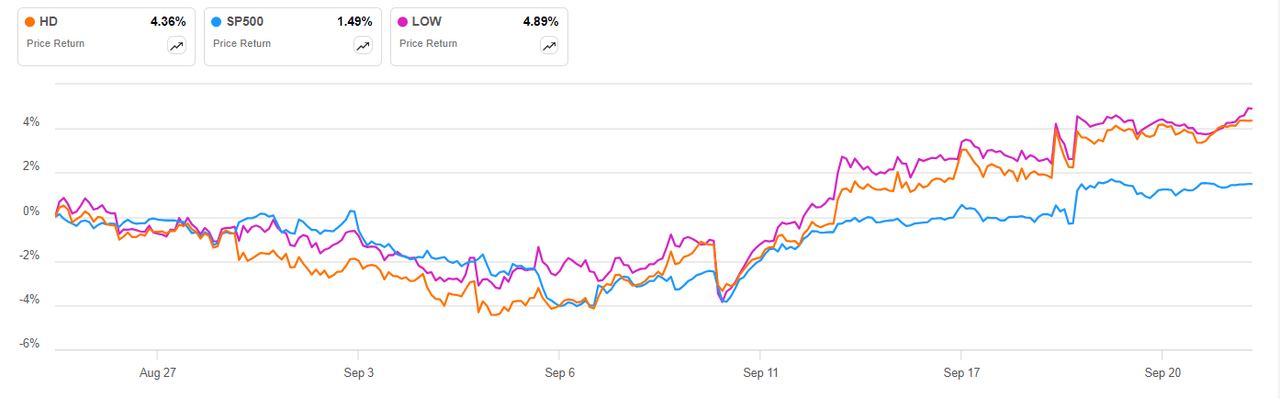

Last week, Wells Fargo analyst Christopher Harvey said home improvement stocks such as Home Depot (HD) and Lowe’s (LOW) are beginning to rally and noted it looks like the start of a bigger move for the group.

Over the last six weeks, Home Depot (HD) and Lowe’s (LOW) have outperformed the broad market.