anilbolukbas/iStock Editorial via Getty Images

Macquarie’s Equity Research on Tuesday initiated coverage on ride-hailing platform DiDi (OTCPK:DIDIY) at ‘outperform’, stating that the company is in a “unique position” to capture share in the $1.1tn mobility market amid favourable policy and digital adoption.

The brokerage expects DiDi’s market positioning and “superior execution quality” to continue drive improved economies of scale, thus supporting sustained margin expansion. And with DiDi Global (OTCPK:DIDIY) trading at a ~75% discount to Uber (UBER) despite its higher earnings CAGR, Macquarie believes rising LatAM adoption could emerge as positive optionality.

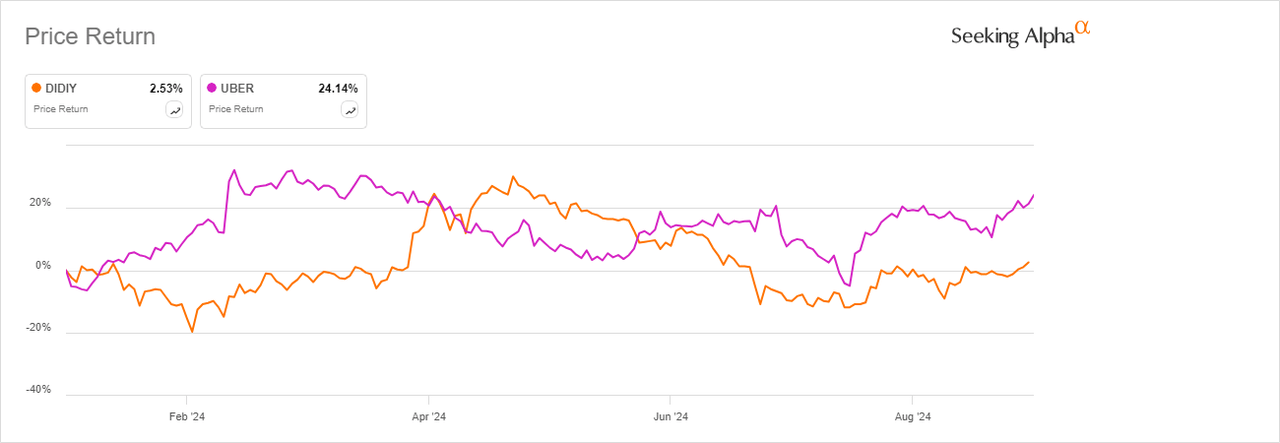

Didi vs UBER YTD price comparison:

The company’s shares, up 2.5% YTD, was up about 3% premarket.

Furthermore, while regulatory uncertainty is admittedly the largest risk, “despite a bumpy listing path, we believe the company is now finally out of the woods and entering a new phase of normalisation on an easing regulatory environment for the broader Internet sector.”

In terms of catalysts, the brokerage says, DiDi (OTCPK:DIDIY) is currently trading in the OTC market with valuation 72% below its NYSE IPO level, but with a 20% larger scale and a significant earnings turnaround. “Potential HK IPO could be the next key catalyst.”

In other news, DiDi Global (OTCPK:DIDIY) was reportedly in discussions to sell its smart driving and cockpit assets to AutoAi. The move is part of DIDIY’s plans to focus more on its core business.