anyaberkut

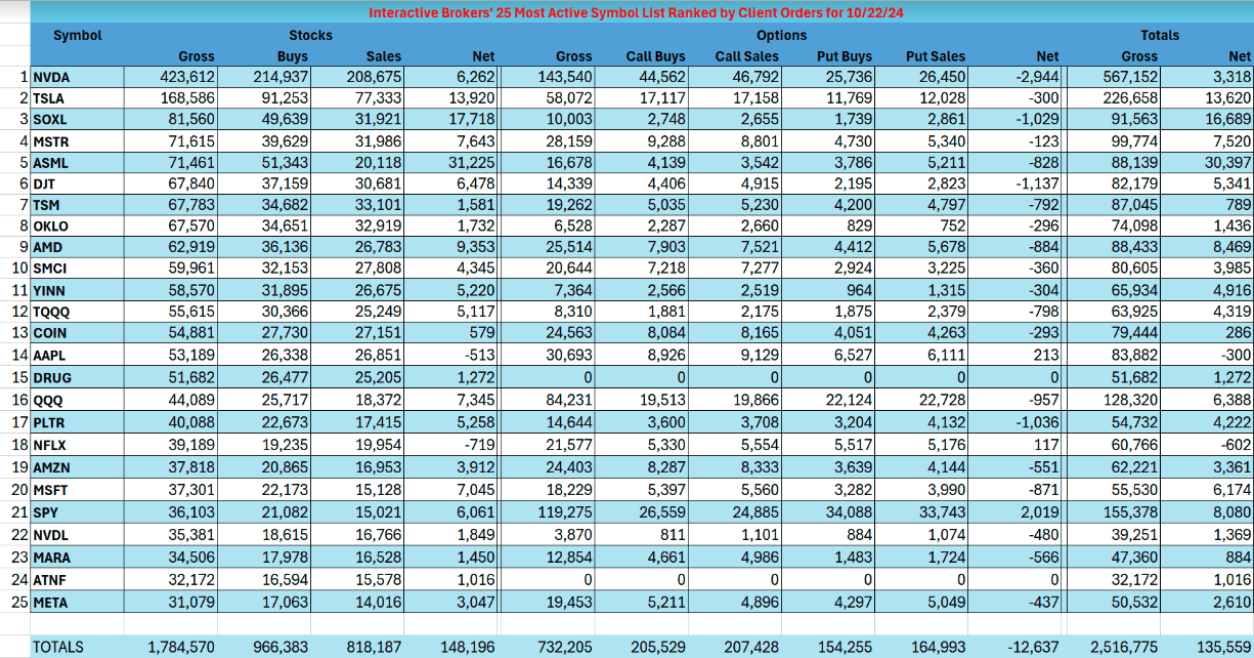

Nvidia (NVDA) remained as the most-active weekly name on Interactive Brokers’s (IBKR) trading platform, but a couple of stocks surging from $1 handles emerging on its list may indicate some froth in a stock market (SP500) trading around all-time highs.

IBKR’s Chief Strategist Steve Sosnick said Tuesday three names he was unfamiliar with – Oklo (OKLO), Bright Minds Biosciences (NASDAQ:DRUG), and 180 Life Sciences (NASDAQ:ATNF) – hopped onto its weekly tally of the 25 most-active stocks and options on its platform.

Oklo (OKLO) snagged the eighth spot on the list. Shares of the nuclear power startup supported by OpenAI CEO Sam Altman had rocketed up ~144% over the past week. The climb came as Google (GOOG) (GOOGL) and Amazon (AMZN) separately said they were investing in nuclear energy as power demand grows for data centers producing artificial intelligence technology.

“OKLO was clearly a beneficiary of the AI-fueled resurgence of nuclear power as this reactor company more than doubled last week,” Sosnick said. “Unlike the next two winners, there is an understandable reason for the enthusiasm,” he said, referring to Bright Minds Biosciences (DRUG) and 180 Life Sciences (ATNF), which captured the 15th and 24th places on IBKR’s list.

“I’ll leave it to you to decide whether we’re seeing a bit of froth right now,” Sosnick said.

Shares of the Bright Minds (DRUG) and 180 Life Sciences (ATNF) have been on wild rides lately. Psychedelic drug developer Bright Minds (DRUG) early last week shot up from $1.08 to $38.49 over two trading sessions.

A day after its shares leapt to +$38 from $2.49 in one session, Bright Minds (DRUG) said it was “unaware of any material changes” that would account for the recent increase in market activity. Then, the company’s private placement at $21.70 was followed by a stock surge to $79.02 on Friday before closing at $47.21 that day.

On Monday, Bright Minds (DRUG) rose much as 33% to +$62 after saying it’s partnering with Firefly Neuroscience (AIFF) for data analysis related to a drug-development study. The shares eventually settled up by 1.7%.

Meanwhile, 180 Life Sciences (ATNF) soared to a high of $17.75 last Tuesday from $1.52 last Monday after saying it was entering into the online gaming industry, initially focusing on business-to-consume online casinos. “The stock quickly gave back most of its immediate gains but remains about 4X above its prior levels,” he said. The shares closed at $4.69 on Tuesday.

Bank of America in its recent Global Fund Manager survey spotted “froth on the rise” in the stock market, fueled in part by the Federal Reserve’s new round of rate easing and soft-landing expectations. A net 31% of managers were overweight equities in October, up from net 11% last month. BofA’s Bull & Bear Indicator was up to 7.1, but hadn’t yet hit the “big sell signal” at the 8.0 level.

See below for the full data on IBKR’s 25 most-active list:

For investors wanting to monitor the market through ETFs, here are a few:

S&P ETFs: (SPY), (RSP), (SSO), (SH), (VOO) and (IVV). Nasdaq ETFs: (QQQ), (QLD) and (SQQQ).