honglouwawa

The Federal Reserve is ready to embark on a new rate-cutting cycle, one element that creates a favorable set-up for equities, but investors will still need to navigate through choppy markets, according to Goldman Sachs’ global head of hedge fund coverage.

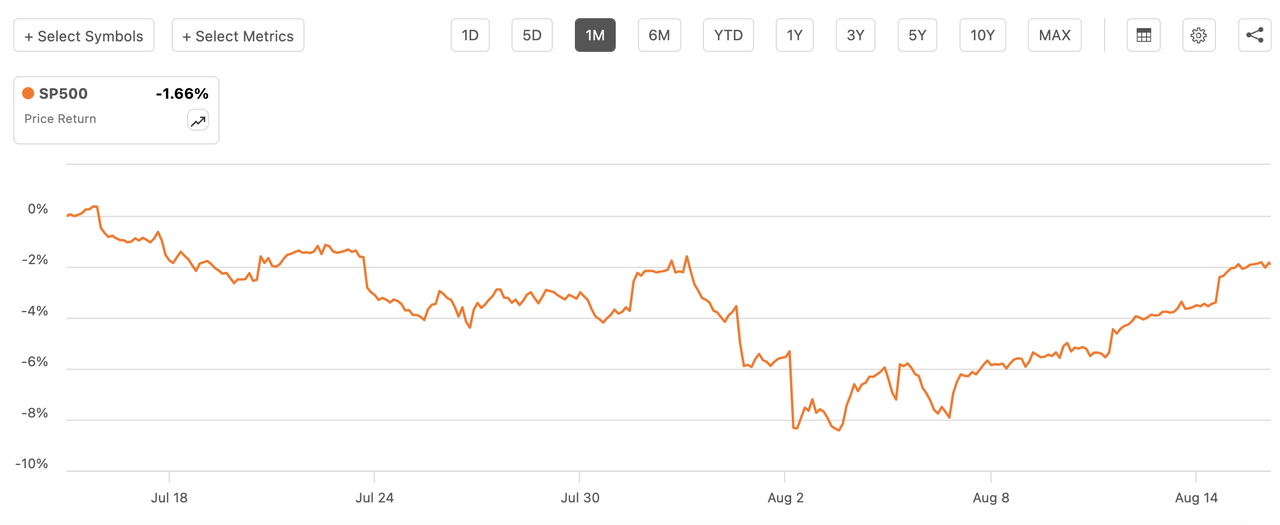

Tony Pasquariello, in a Friday note, assessed the risk/reward of the market following a “remarkable stabilization” in the S&P 500 (SP500) after U.S. recession fears early last week fired up Wall Street’s key volatility measure (VIX) to pandemic-era levels, above 65. They also drove a 12% plunge in Japan’s Nikkei 225 Index (NKY:IND). Since then, the S&P 500 (SP500), after dropping more than 8% from its all-time high, has narrowed the loss to ~2%, and marked a sixth consecutive gain on Thursday.

“The bottom line: as we move through an illiquid August and into an exceedingly busy fall, I expect that the trading environment will remain choppy, so I’d sit tight with a portfolio that’s reduced to the highest quality assets,” Pasquariello said.

The U.S. economy is “durable” and the Fed is set to deliver 200 basis points of interest rate cuts, which is a “healthy macro setting for risky assets,” he said.

“At the same time, however, I think the market will continue to sweat the trajectory of growth and the political/geopolitical news feed,” he said. “In addition, the narrative around AI is less one-sided than it was just a few months ago,” Pasquariello said.

Shares of Nvidia (NVDA) and other artificial intelligence plays have been pulled down from loftier levels during this summer’s selloff as investors weigh spending and demand prospects for that pocket of the tech industry. Nvidia (NVDA) will post Q2 financial results on Aug. 28.