Micron Technology’s (MU) record-setting first quarter fiscal 2026 results and outlook prompted semiconductor stocks across the supply chain to edge higher during Thursday market action.

While Micron shares had spiked more than 10%, the optimism spilled across the semiconductor sector, with Nvidia (NVDA) and AMD (AMD) each up about 2.5%.

Wells Fargo analysts pointed out that Nvidia likely accounted for 17% of Micron’s revenue during the first quarter.

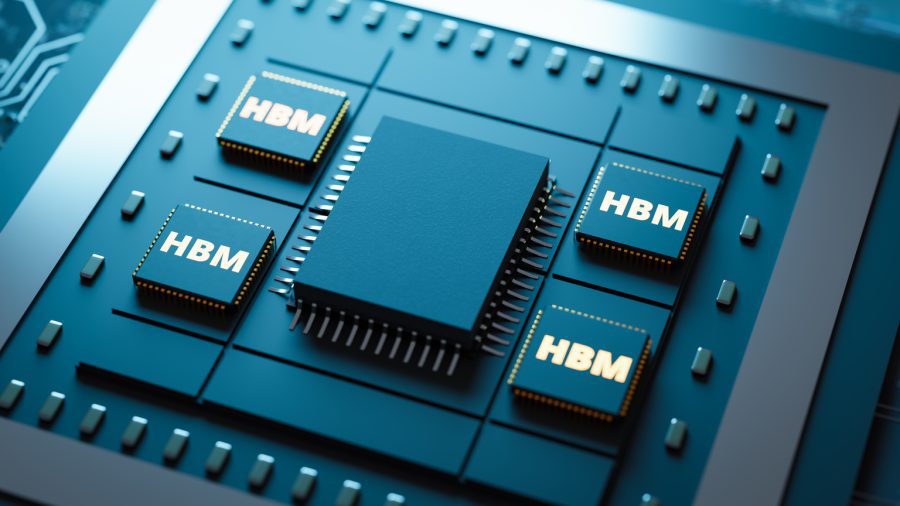

“This compares to a disclosed ~13% contribution in the year ago qtr and implied at ~19% of revenue in F4Q25,” said Wells Fargo analysts, led by Aaron Rakers, in a Thursday investor note. “This implies the unnamed customer at ~40%-45% of MU’s total CMBU segment revenue (~$2.3-$2.4B). As a reminder, in F4Q25 MU disclosed that it was shipping HBM to six customers.”

A minority of customers comprising a bulk of revenue is not uncommon in the semiconductor sector. For example, two Nvidia customers made up 37% of its revenue during the October quarter, according to its Form 10-Q filing. Customer A accounted for 22%, and Customer B was 15%. Customers C and D combined accounted for another 24%.

Taiwan Semiconductor Manufacturing (TSM) was up 4%, and Intel (INTC) had inched up 0.8%. Broadcom (AVGO) had edged up 0.3% and Qualcomm (QCOM) had increased 1.8%. Marvell (MRVL) had climbed 3%.

Firms related to memory and storage posted some of the most significant gains. Seagate Technology (STX) had gained 6%, Western Digital (WDC) had jumped 8%, Pure Storage (PSTG) had increased by 2% and Super Micro Computer had inched up 1.2%.

Semiconductor capital equipment companies were also trending higher. ASML Holding (ASML) and Applied Materials (AMAT) were both up 3%, and Lam Research (LRCX) had popped up 6%.