iQoncept/iStock via Getty Images

Short interest for healthcare stocks in S&P 500 rose in November vs. October, while Moderna continued to be the most shorted stock of the month.

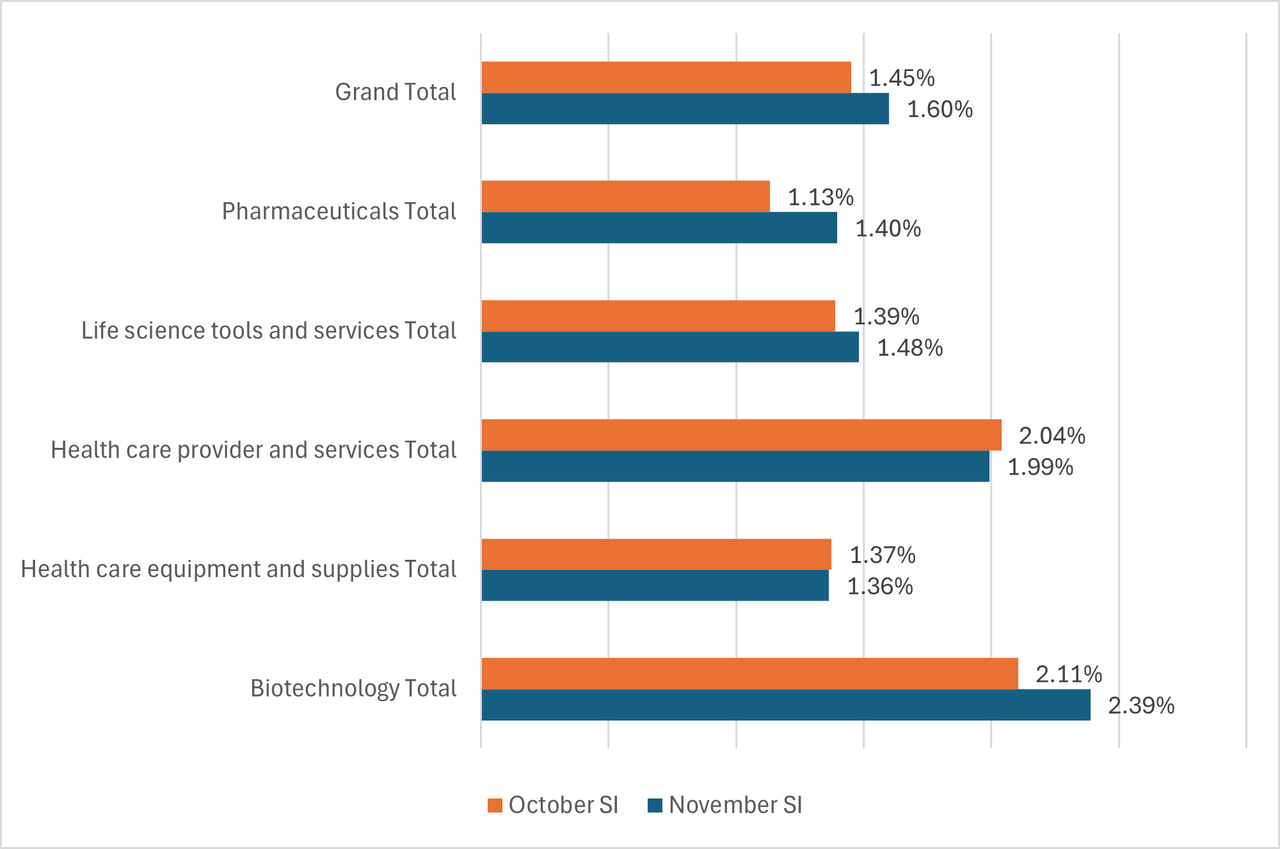

The average short interest for S&P 500 Health Care Index Sector (NYSEARCA:XLV) came at 1.60%, higher than 1.45% recorded last month.

XLV, which has a 12.12% weightage in the broader S&P 500 index, fell 4% in the last month, compared to S&P 500 index’s (SP500) gain of 1.10%.

Industry analysis:

Average short Interest as percentage of floating shares

Biotechnology was the most shorted industry in the healthcare index in November for the eighth time in a row. Short interest in this sub-sector rose to 2.39% from 2.11% in October.

Healthcare provider and services sector was in the second position with short interest at 1.99% in November end.

Healthcare equipment and supplies had the lowest short interest in the month of November, with a short percentage of 1.36%

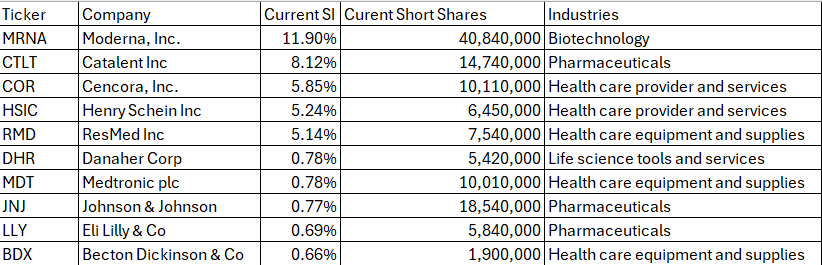

Stocks with highest and lowest short positions

Ranked by short interest as a percentage of shares float

Moderna (MRNA)—most shorted—saw short interest rise to 11.90% from 10.02% in October. Catalent (CTLT) came in second with a short interest of 8.12%, followed by Cencora (COR) with a short interest of 5.85%.

Becton Dickinson (BDX) was the least shorted stock in November again, with a short interest of 0.66%, followed by Eli Lilly (LLY) which came in a close second with a short percentage of 0.69%.

Johnson & Johnson (JNJ) was the third least shorted company in the month of November, with a short percentage of 0.77%.